London seeks more Chinese listings as city battles IPO drought

Beijing and London vowed early this year to deepen economic and financial ties, promising efforts to boost the China-U.K. stock connect.

London is seeking to attract more Chinese firms to list on its stock exchange as the city struggles with a shrinking equity market and a deal drought across Europe.

“We need to get more IPOs happening in London,” Chris Hayward, policy chairman of the City of London Corp., said in an interview from Shanghai. “We don’t want to lose business across the Atlantic.”

The authority for London’s Square Mile financial district can provide opportunities for Chinese firms to secure customers and funding in the UK and drive them to list in the city via its connect scheme with Shanghai, Hayward said. The city can also encourage UK firms to raise capital and list on the Shanghai Stock Exchange, he said.

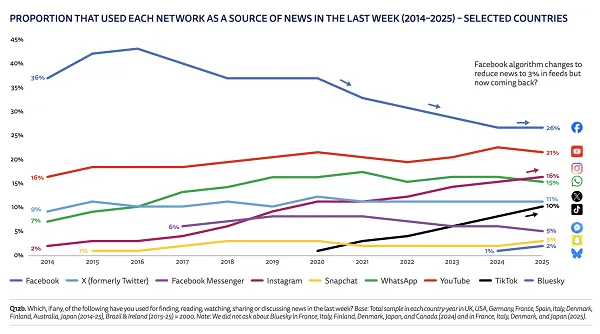

China introduced its stock connect program with the UK in 2019, allowing listed companies to issue depository receipts on each other’s exchanges. It later expanded the program to include Switzerland and Germany. Six years later, only a handful of Chinese firms, including Huatai Securities Co., have listed in London, raising a total $6.6 billion, and trading has been muted.

Beijing and London vowed early this year to deepen economic and financial ties, promising efforts to boost the China-UK stock connect.

“You’ve got to proactively go out there and encourage listings on your exchange,” said Hayward, drawing lessons from Hong Kong’s success in igniting a boom in initial public offerings in the first half of this year. Hayward, who was in Shanghai this week for China’s annual financial Lujiazui forum, is traveling to Hong Kong later in the week for IPO discussions.

Hong Kong’s share-sale bonanza this year saw new listings and additional offerings fetch more than $27 billion as of early June. That eclipsed annual totals in the last three years, and is the most since records were reached in 2021, according to data compiled by Bloomberg. The London bourse, on the other hand, has had just four pending or trading IPOs this year, as its valuation discount to the rest of the world discourages firms.

London, as a key offshore yuan center, has also worked with China’s central bank to help promote the internationalization of its currency.

London established a working group with the People’s Bank of China in 2018 to monitor the yuan market in the UK capital. The authority has been pushing global asset managers in the city to issue new products in yuan to facilitate greater use of the currency, said Hayward.

He downplayed the potential impact that UK’s recent tax for wealthy non-domiciled residents and its immigration crackdown could have on London’s appeal as a global financial center, while urging efforts to resolve the non-dom issue.

“I would encourage the government to continue to review this matter,” he said. “It’s important to us to try and keep wealth creators in this country.”

This story was originally featured on Fortune.com