KULR Technology Joins Bitcoin for Corporations, Increases Holdings to 920 BTC

Bitcoin Magazine KULR Technology Joins Bitcoin for Corporations, Increases Holdings to 920 BTC KULR Technology announced today that it has joined the Bitcoin for Corporations initiative and its recent purchase of $13 million more Bitcoin. This post KULR Technology Joins Bitcoin for Corporations, Increases Holdings to 920 BTC first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

Bitcoin Magazine

KULR Technology Joins Bitcoin for Corporations, Increases Holdings to 920 BTC

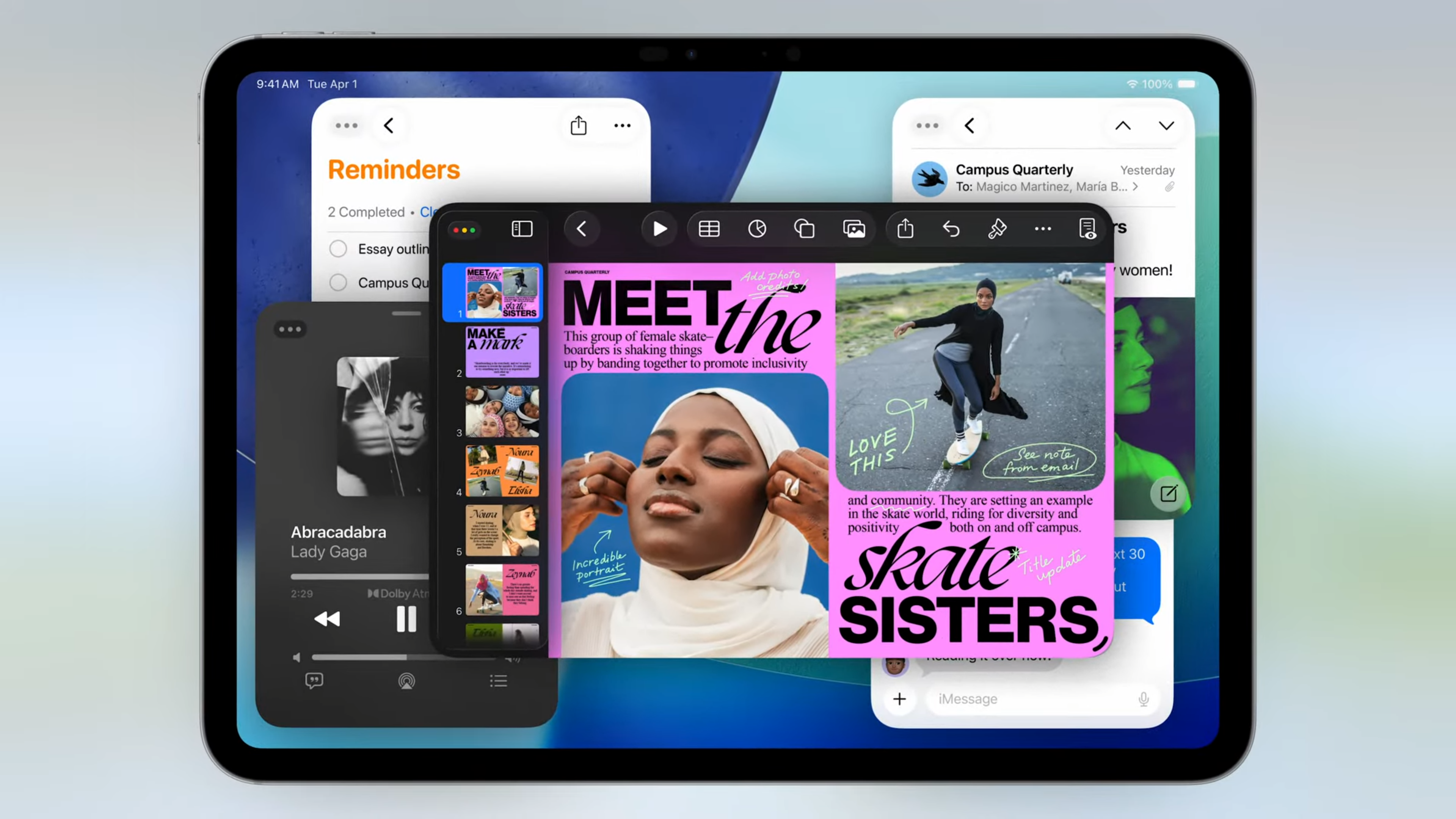

KULR Technology Group, Inc. (NYSE American: KULR), a Bitcoin First Company and global leader in sustainable energy management, announced that it has joined the Bitcoin for Corporations (BFC) initiative, an institutional platform by Strategy and Bitcoin Magazine to promote corporate Bitcoin adoption.

The initiative is made to support publicly traded companies in integrating Bitcoin into their corporate treasury strategies and balance sheets. Participating organizations gain access to institutional-grade tools, frameworks, and peer networks that support the responsible management and expansion of Bitcoin holdings. KULR’s role as an Executive Member of BFC aligns with its strategy to position Bitcoin as a long-term reserve asset.

“Our commitment to Bitcoin for Corporations reflects a strong conviction in Bitcoin’s long-term value as a monetary asset,” CEO of KULR Michael Mo, commented. “As KULR continues to scale its Bitcoin treasury, we welcome the chance to align with other institutions pioneering this shift in corporate treasury management.”

KULR also has increased its Bitcoin treasury by $13 million, bringing total holdings to 920 BTC, at an average acquisition price of $98,760 per bitcoin. The company’s total Bitcoin investment now stands at $91 million. The latest purchase was made at an average price of $107,861 per bitcoin. Year to date, KULR has delivered a 260% return on its Bitcoin holdings. They use a strategic mix of cash reserves and its At-The-Market (ATM) equity program to fund their acquisitions.

.jpg)