Housing market weakness triggers Lennar to offer biggest incentives since 2009

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. There is a consensus among major publicly traded homebuilders that the spring 2025 housing market—especially in many parts of the Sun Belt, where inventory has climbed above pre-pandemic 2019 levels—was softer than they expected. While some builders have started focusing more on maintaining margins—and some have slowed their housing starts—Lennar has continued to push forward. Instead of defending short-term profitability, Lennar—America’s second-largest homebuilder—is using this period of housing market softness as an opportunity to capture market share and maintain sales pace through bigger affordability adjustments. The ResiClub team reviewed Lennar’s Monday earnings report and listened in on its Tuesday earnings call. Here are our top nine takeaways: 1. Lennar: “All of the markets we operate in experienced some level of softening” According to Lennar, it has observed at least some “softening” across all its markets this spring. Even its “strongest” markets have lost some momentum. This aligns with ResiClub’s reporting. “All of the markets we operate in experienced some level of softening [this quarter],” Lennar co-CEO John Jaffe said on the company’s June 17 earnings call. “Even in our strongest performing markets, buyers needed the assistance of incentives. Incentives will vary across the different markets, but primarily in the form of assistance with mortgage rate buy downs.” Jaffe added: “The markets that experienced more challenging conditions during the quarter were the Pacific Northwest markets of Seattle and Portland, the Northern California markets of the Bay Area and Sacramento, the Southwestern markets of Phoenix, Las Vegas, and Colorado, and some Eastern markets such as Raleigh, Atlanta, and Jacksonville.” 2. Lennar is deploying bigger sales incentives Lennar’s average sales price came in at $389,000 in Q2 2025—that’s down 8.7% from $426,000 in Q2 2024. And oh, boy, is Lennar spending a lot on incentives. In Q2 2025, Lennar spent an average of 13.3% of the final sales price on sales incentives, such as mortgage-rate buydowns. At that incentive rate, a home with a $450,000 sticker price would come with nearly $60,000 in incentives. According to John Burns Research and Consulting [see its historical chart here], that’s the highest incentive level Lennar has offered since 2009—and it’s significantly higher than Lennar’s cycle low in Q2 2022, when it spent 1.5% of the final sales price on sales incentives. Earlier this year, Lennar co-CEO Stuart Miller noted: “These are outsized [incentives] for the moment and normalized incentives should be around 5% to 6%.” Pretty much: Where and when needed—especially in pockets of Florida, Arizona, Colorado, and Texas, where active inventory has bounced back and buyers have gained leverage—Lennar is cutting net effective prices through larger incentives to find the market and keep sales rolling. 3. Average price net of incentives is down across Lennar’s divisions—even more so in Florida The biggest net price cuts occurred in Lennar’s East division—which, while it includes Florida, New Jersey, and Pennsylvania, is dominated by operations in the Sunshine State—the epicenter of housing market weakness over the past year. 4. Additional margin compression During the pandemic housing boom, many publicly traded homebuilders achieved record profit margins as home prices soared and buyer demand ran red hot. Once the national housing demand boom fizzled out in the summer of 2022, many large homebuilders made affordability adjustments where and when needed to maintain their sales pace. Despite some profit margin compression, almost every major homebuilder entered 2024 with gross margins still above pre-pandemic 2019 levels. However, in recent quarters, margin compression has returned—especially for Lennar. During the company’s December 2024 earnings call, Lennar CFO Diane Bessette stated that the company anticipates further margin compression, with gross margins expected to range between 19.0% and 19.25% for Q1 2025. Lennar’s Q1 2025 gross margin ended up being 18.7%, and its Q2 2025 gross margin on home sales came in on June 16 at 17.8%. On the June 17 earnings call, Miller said he expects Lennar’s gross margin to be 18.0% in Q3 2025. 5. Lennar: Sales pace > margin As highlighted above, amid the softening market, Lennar has chosen to maintain sales pace over margin. Among the big builders, it has been the most aggressive on that front. It’s now spending 13.3% of final sales price on incentives—and doing some of the biggest net effective price cuts in the Sun Belt—in order to keep sales up. “We are not there yet, but we are certain that we are finding a floor with margin and getting close to building it back even in a softer housing market environment,” M

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

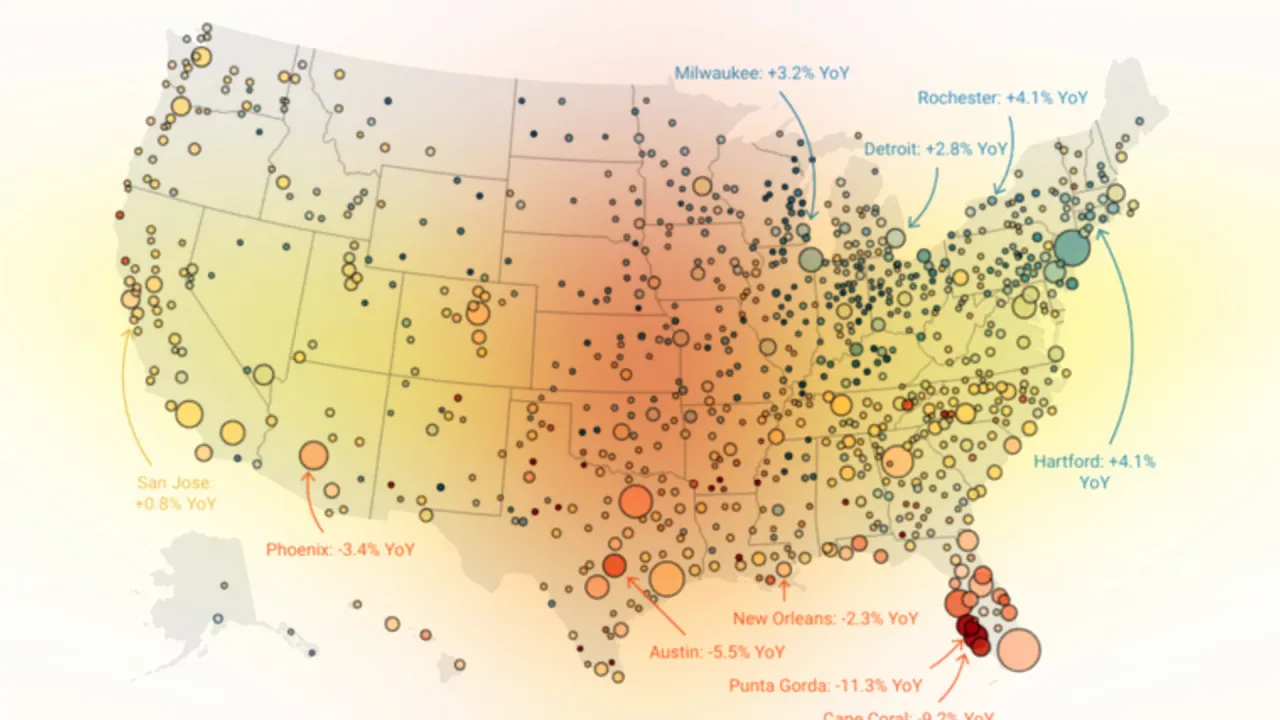

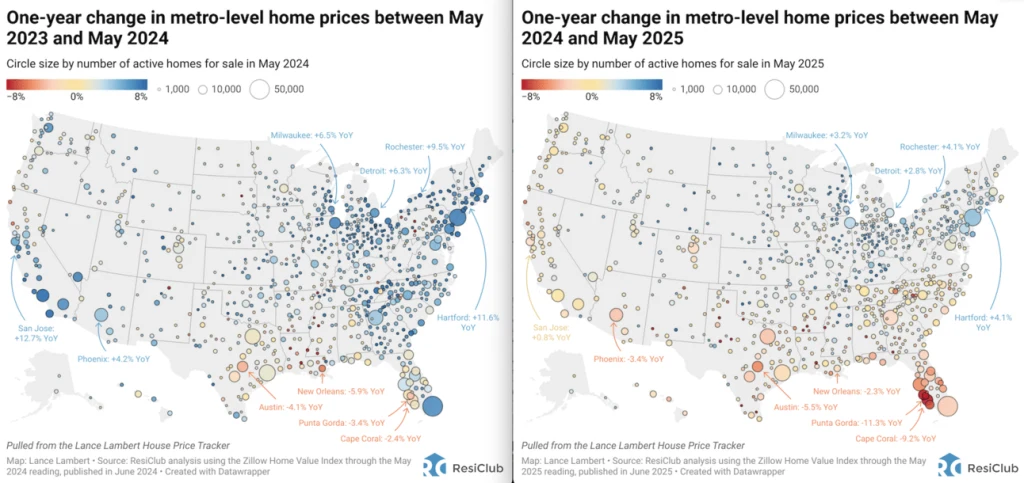

There is a consensus among major publicly traded homebuilders that the spring 2025 housing market—especially in many parts of the Sun Belt, where inventory has climbed above pre-pandemic 2019 levels—was softer than they expected.

While some builders have started focusing more on maintaining margins—and some have slowed their housing starts—Lennar has continued to push forward.

Instead of defending short-term profitability, Lennar—America’s second-largest homebuilder—is using this period of housing market softness as an opportunity to capture market share and maintain sales pace through bigger affordability adjustments.

The ResiClub team reviewed Lennar’s Monday earnings report and listened in on its Tuesday earnings call.

Here are our top nine takeaways:

1. Lennar: “All of the markets we operate in experienced some level of softening”

According to Lennar, it has observed at least some “softening” across all its markets this spring. Even its “strongest” markets have lost some momentum. This aligns with ResiClub’s reporting.

“All of the markets we operate in experienced some level of softening [this quarter],” Lennar co-CEO John Jaffe said on the company’s June 17 earnings call. “Even in our strongest performing markets, buyers needed the assistance of incentives. Incentives will vary across the different markets, but primarily in the form of assistance with mortgage rate buy downs.”

Jaffe added: “The markets that experienced more challenging conditions during the quarter were the Pacific Northwest markets of Seattle and Portland, the Northern California markets of the Bay Area and Sacramento, the Southwestern markets of Phoenix, Las Vegas, and Colorado, and some Eastern markets such as Raleigh, Atlanta, and Jacksonville.”

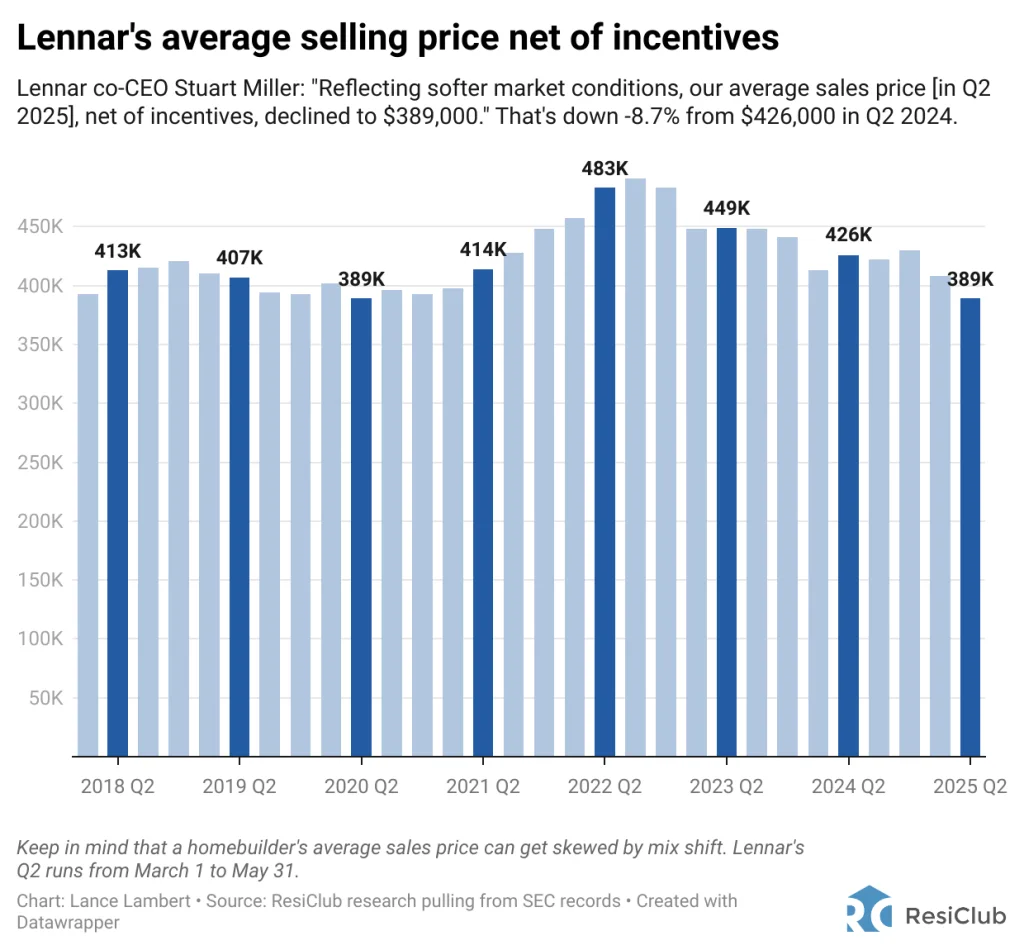

2. Lennar is deploying bigger sales incentives

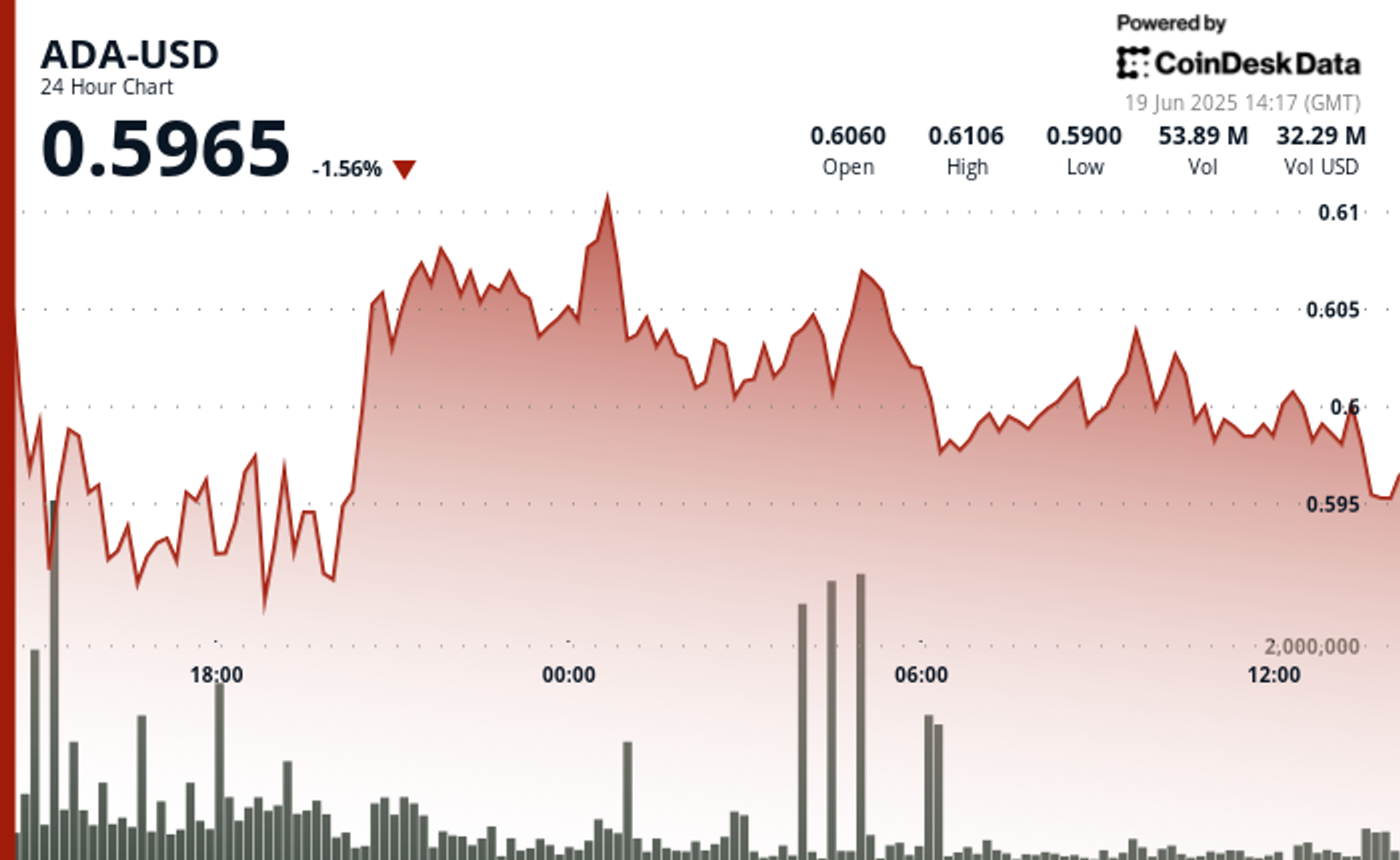

Lennar’s average sales price came in at $389,000 in Q2 2025—that’s down 8.7% from $426,000 in Q2 2024.

And oh, boy, is Lennar spending a lot on incentives.

In Q2 2025, Lennar spent an average of 13.3% of the final sales price on sales incentives, such as mortgage-rate buydowns. At that incentive rate, a home with a $450,000 sticker price would come with nearly $60,000 in incentives.

According to John Burns Research and Consulting [see its historical chart here], that’s the highest incentive level Lennar has offered since 2009—and it’s significantly higher than Lennar’s cycle low in Q2 2022, when it spent 1.5% of the final sales price on sales incentives.

Earlier this year, Lennar co-CEO Stuart Miller noted: “These are outsized [incentives] for the moment and normalized incentives should be around 5% to 6%.”

Pretty much: Where and when needed—especially in pockets of Florida, Arizona, Colorado, and Texas, where active inventory has bounced back and buyers have gained leverage—Lennar is cutting net effective prices through larger incentives to find the market and keep sales rolling.

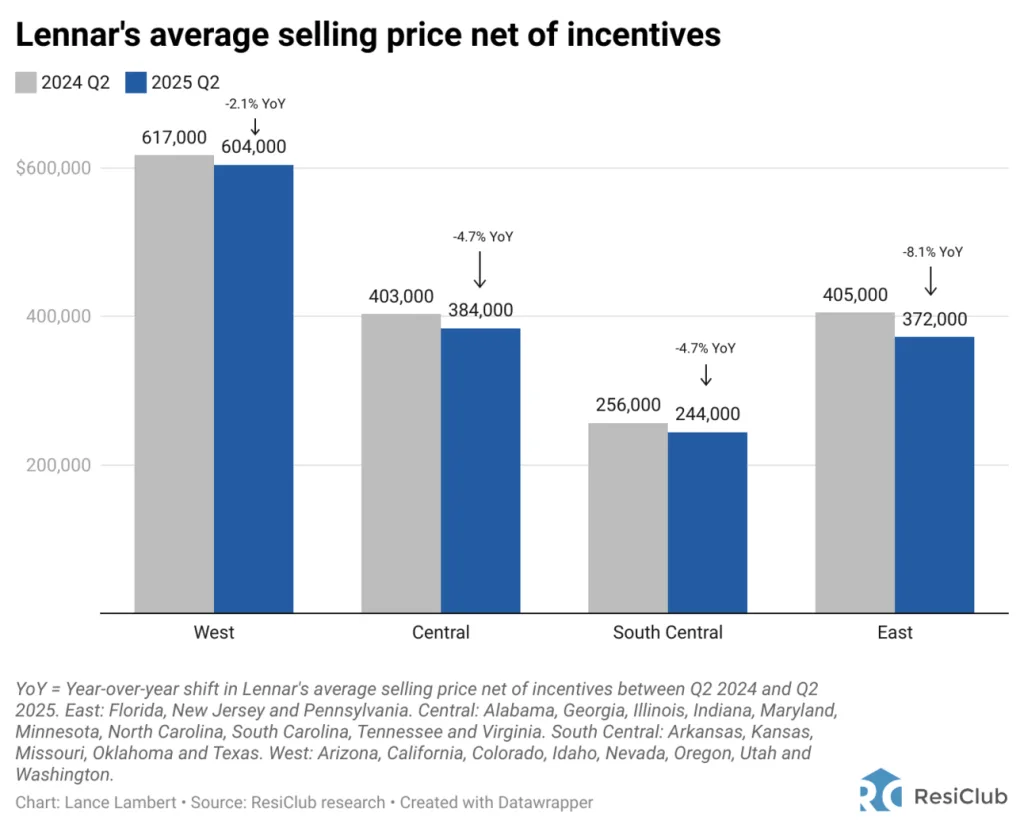

3. Average price net of incentives is down across Lennar’s divisions—even more so in Florida

The biggest net price cuts occurred in Lennar’s East division—which, while it includes Florida, New Jersey, and Pennsylvania, is dominated by operations in the Sunshine State—the epicenter of housing market weakness over the past year.

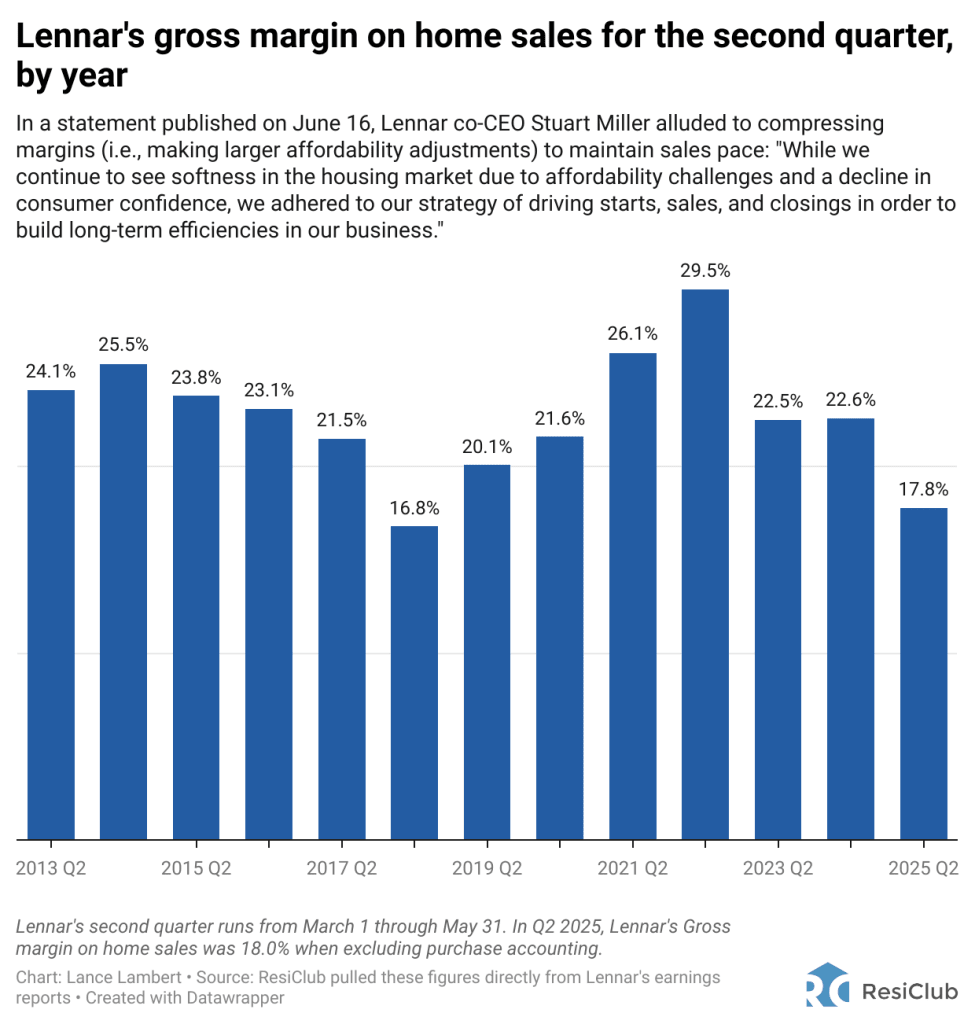

4. Additional margin compression

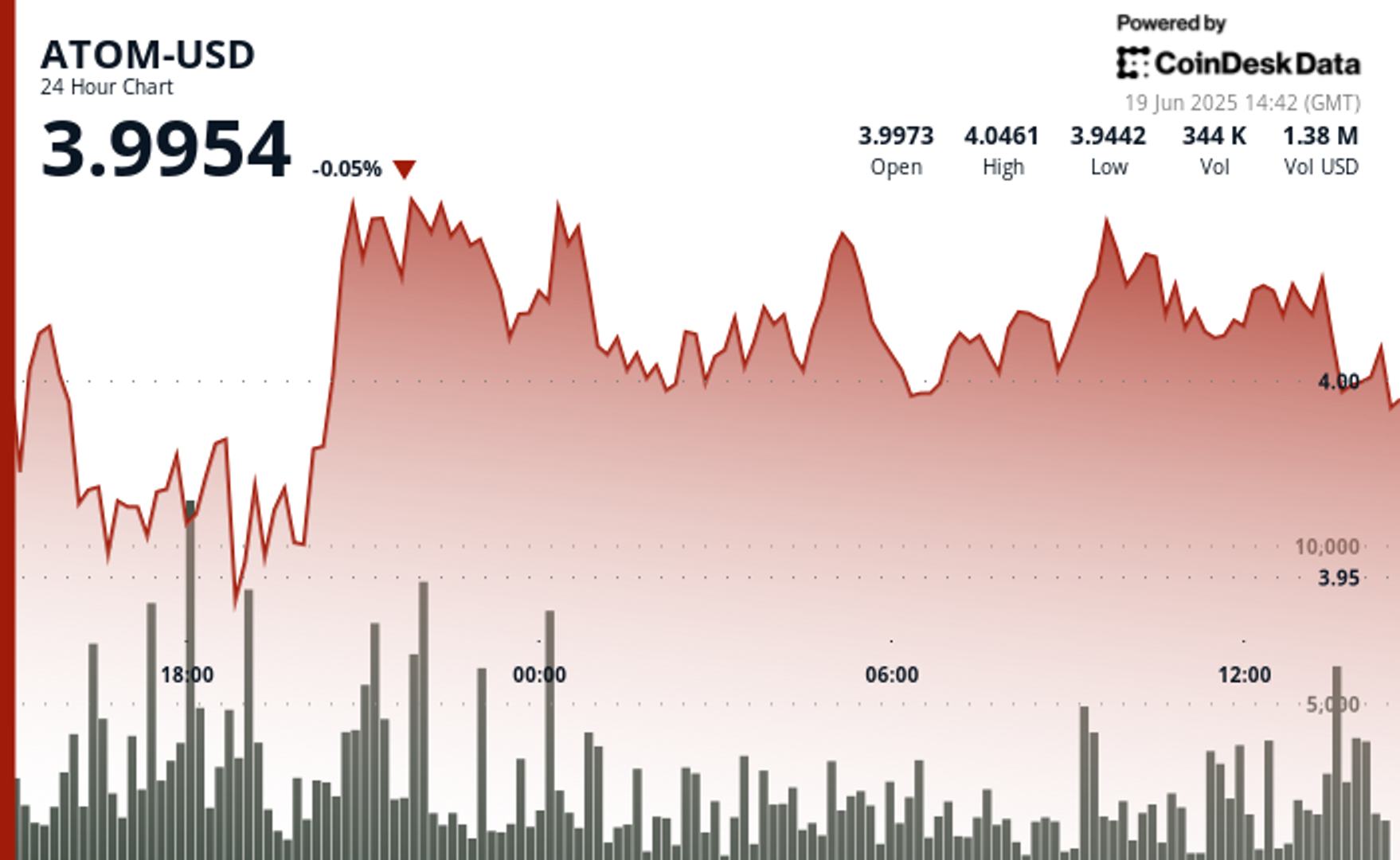

During the pandemic housing boom, many publicly traded homebuilders achieved record profit margins as home prices soared and buyer demand ran red hot. Once the national housing demand boom fizzled out in the summer of 2022, many large homebuilders made affordability adjustments where and when needed to maintain their sales pace. Despite some profit margin compression, almost every major homebuilder entered 2024 with gross margins still above pre-pandemic 2019 levels.

However, in recent quarters, margin compression has returned—especially for Lennar.

During the company’s December 2024 earnings call, Lennar CFO Diane Bessette stated that the company anticipates further margin compression, with gross margins expected to range between 19.0% and 19.25% for Q1 2025.

Lennar’s Q1 2025 gross margin ended up being 18.7%, and its Q2 2025 gross margin on home sales came in on June 16 at 17.8%.

On the June 17 earnings call, Miller said he expects Lennar’s gross margin to be 18.0% in Q3 2025.

5. Lennar: Sales pace > margin

As highlighted above, amid the softening market, Lennar has chosen to maintain sales pace over margin. Among the big builders, it has been the most aggressive on that front. It’s now spending 13.3% of final sales price on incentives—and doing some of the biggest net effective price cuts in the Sun Belt—in order to keep sales up.

“We are not there yet, but we are certain that we are finding a floor with margin and getting close to building it back even in a softer housing market environment,” Miller said on the June 17 call. “As the current market softness unfolded, we focused on consistent [sales] volume by matching our production pace with our sales pace.”

Miller added: “Although some have questioned why we have maintained volume rather than protect our margin, we are very clear and steadfast on our strategy. Historically, we protected margin as market conditions stalled, and we generally led the way in protecting short-term profitability. But we learned through those times that once we step backwards and lose momentum, it becomes increasingly more and more difficult to restart and recapture volume. The machine slows and does not restart easily. We have concluded that by maintaining volume, we can create new efficiencies and new solutions that are durable for the future and will result in meaningful long-term efficiencies in our cost structure.”

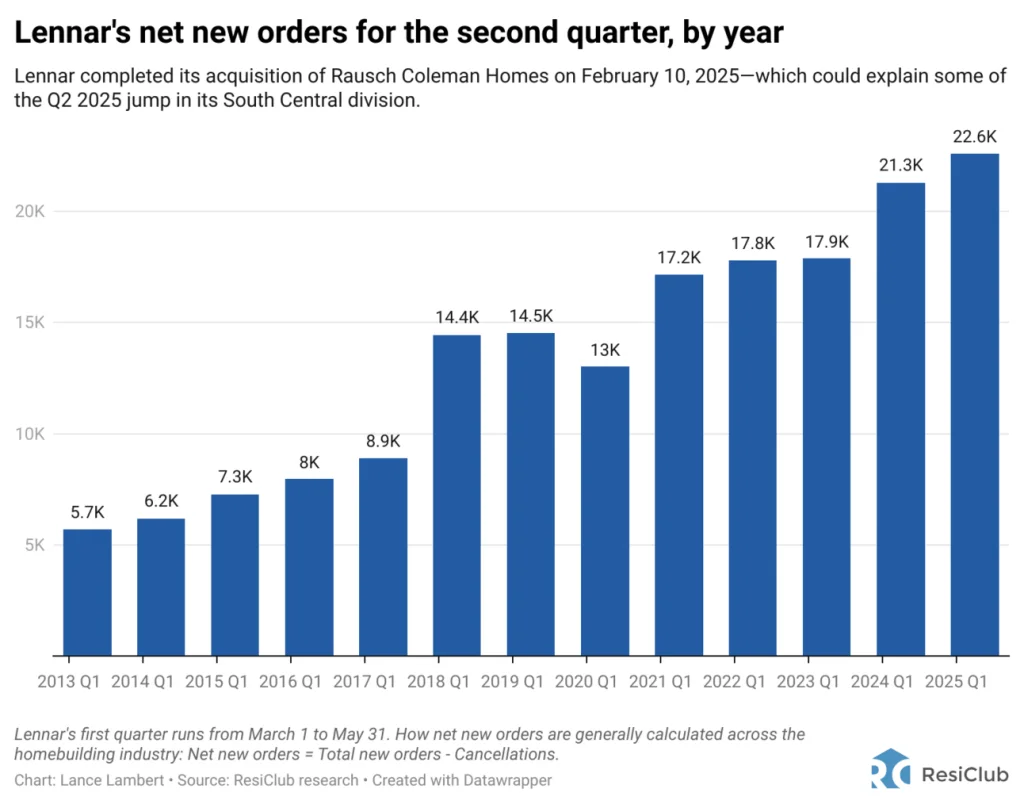

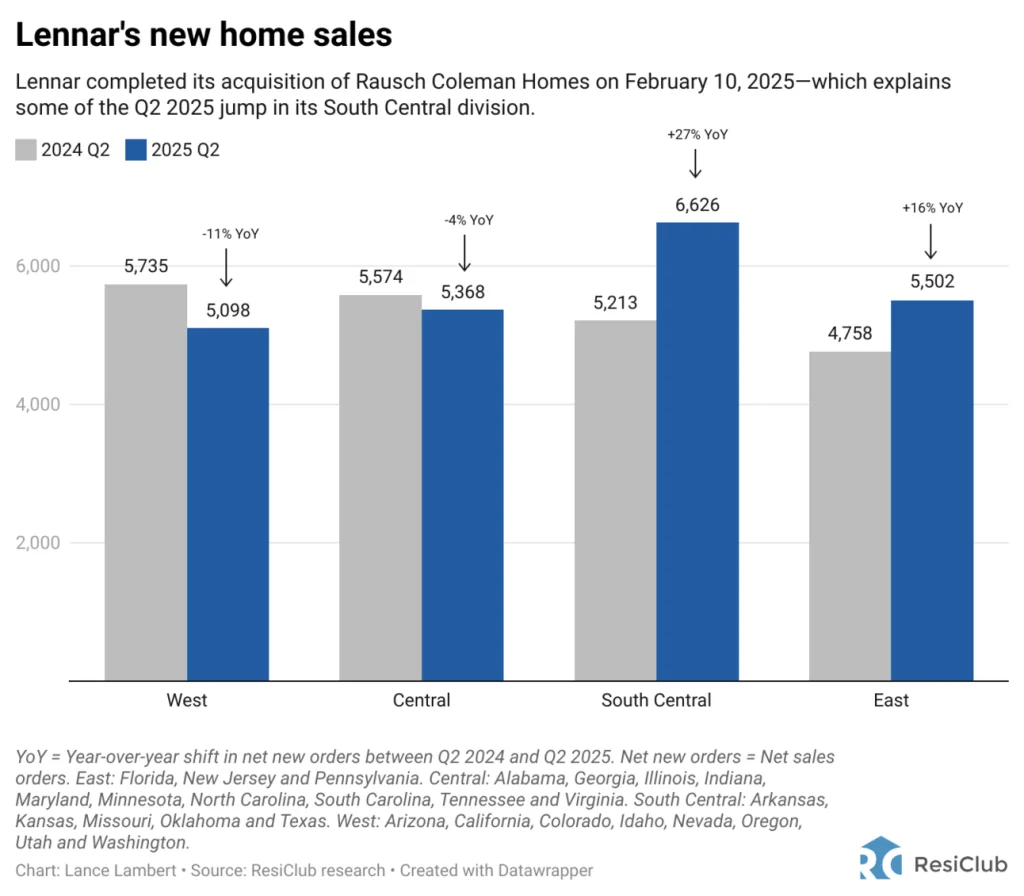

6. Sales steady-ish across markets

Lennar’s Q2 2025 division-level performance was relatively steady once you account for its February 10 acquisition of Rausch Coleman Homes, which largely explains the sharp year-over-year jump in the South Central division.

The Western division was a bit softer, reflecting broader cooling trends across many Western housing markets over the past six months. In contrast, Lennar saw a bit more growth in its Eastern division, particularly in Florida. Why? It’s likely that Lennar’s earlier and more aggressive discounting in Florida is now paying off, attracting buyers who are still encountering resale sellers resisting the shifted pricing environment in their local neighborhoods.

7. Lennar: No impact from tariffs—yet

“With respect to the question regarding tariffs, consistent with our commentary last quarter, we have had no impact to date on our costs from tariffs,” Lennar’s Jaffe said on the earnings call. “We work closely with the supply chain to prepare for alternative sourcing if it becomes necessary as well as the expectation that our trade partners will work with us to mitigate and offset cost impacts should they present themselves.”

8. Lennar: “There’s little evidence to support expectations of materially lower” mortgage rates this year

“Initially, many in the housing market held on to the hope that higher interest rates were temporary, expecting inflation to subside and rates to drift back to lower levels. However, this expectation has not materialized,” Miller said on the June 17 call. “Looking ahead, there’s little evidence to support expectations of materially lower interest rates in the near term. As a result, elevated interest rates have solidified as the new normal. The environment is about recognizing that short supply is keeping prices higher and that only lower prices enabled by lower cost structures will define affordability.”

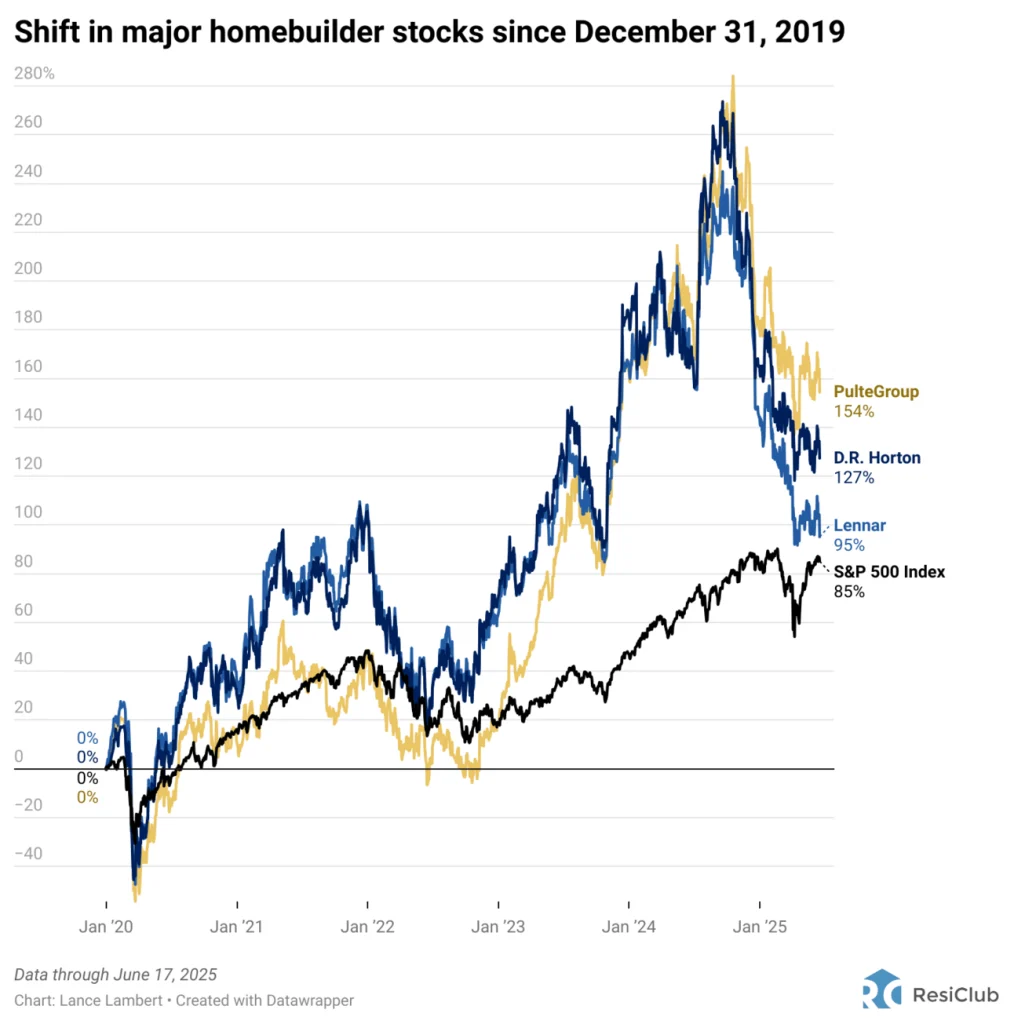

9. Homebuilder stocks remain in purgatory following Wall Street’s pullback late last year