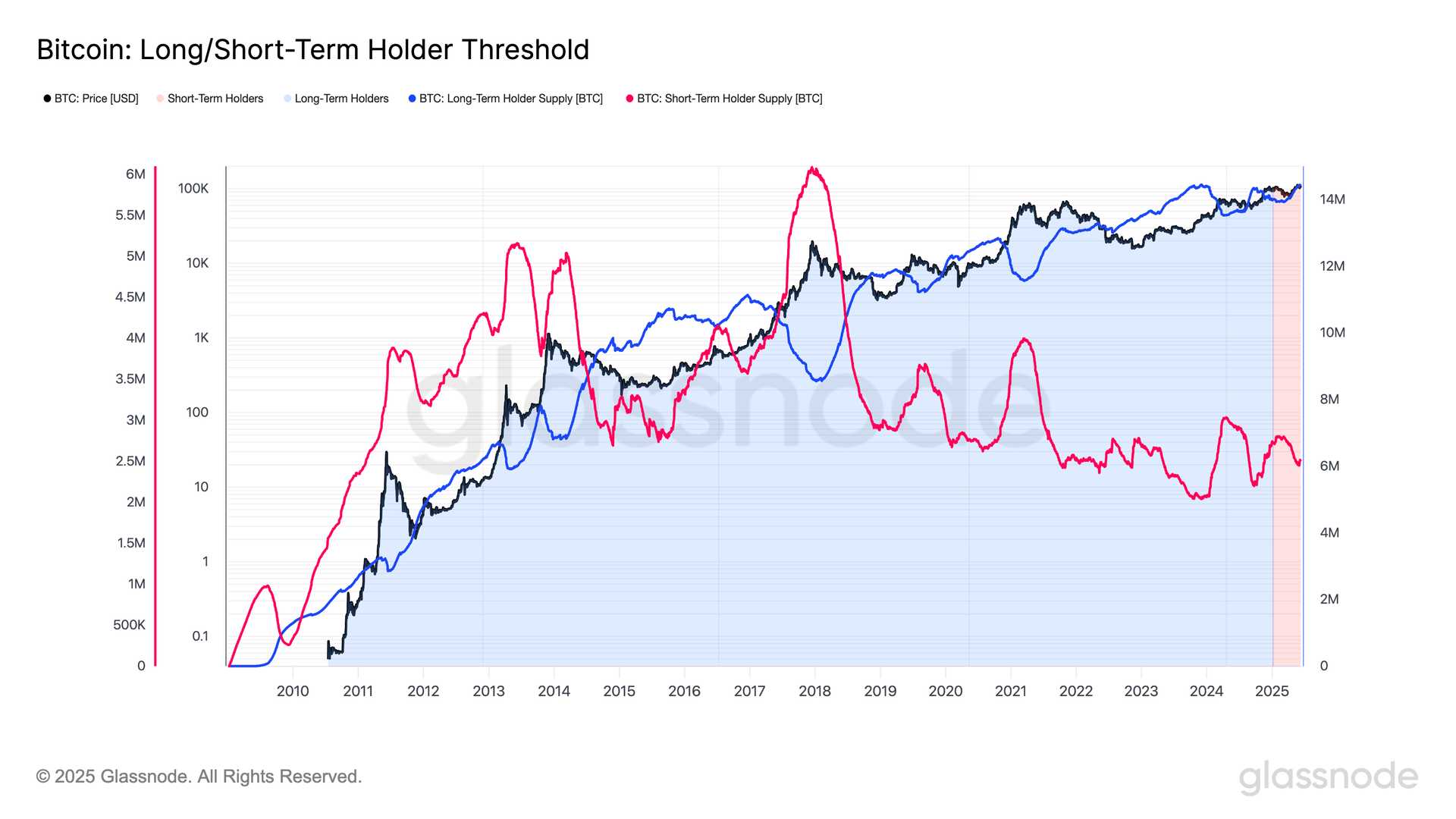

Growing Stacks of Bitcoin Long-Term Holders Signals Bullish Outlook

As the bitcoin counts of long-term holders has increased, that of short-term holders has fallen.

Long-term holder (LTH) bitcoin supply, as tracked by Glassnode, has surged to a record 14.46 million BTC, signaling confidence that price gains are in store.

LTHs, defined as investors holding bitcoin BTC for at least 155 days, are often seen as "smart money," strategically buying during price dips and selling during bull market peaks. This all-time high in LTH supply suggests that seasoned investors anticipate higher prices, a pattern historically associated with significant price rallies.

From March to June, LTH supply increased by approximately 500,000 BTC, while short-term holders (STHs) sold around 350,000 BTC

Many investors now classified as LTH entered the market amid the euphoria of January's Trump inauguration and $109,000 record. Five months later, having endured a 30% correction and now the bounce back to a record, these LTH's are demonstrating resilience.

LTHs currently represent about 73% of bitcoin’s circulating supply of 19.88 million BTC, underscoring their dominance in the market. This concentration of bitcoin in long-term hands, suggests potential for further price upside.