Asia Morning Briefing: BTC Stalls at 105K as Analyst Says Market Looks 'Overheated'

Bitcoin still looks bullish, but some metrics are pointing to an overheated market, says CryptoQuant

Good Morning, Asia. Here's what's making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.

Bitcoin BTC is trading above $105K as Asia begins its business week. The world's largest digital asset remained relatively stable over the weekend, with a 0.4% movement, and trading volume was compressed.

While overall market conditions remain bullish, a new report from CryptoQuant suggests that certain metrics indicate the BTC market is “overheating.”

The report shows bitcoin demand has climbed to 229,000 BTC over the past 30 days, approaching the December 2024 peak of 279,000 BTC. At the same time, whale-held balances have risen by 2.8 percent, a pace that often signals slowing accumulation.

These indicators suggest the current rally, which pushed prices to a record $112,000, may be nearing a short-term top.

The report highlights $120,000 as the next major resistance level, tied to the upper band of the Traders’ On-chain Realized Price, where unrealized profits would hit 40 percent, a threshold that has historically marked local tops.

While CryptoQuant’s "Bull Score Index" remains strong at 80, signaling continued bullish momentum, rising profit margins, and peaking demand growth suggest traders may face a period of consolidation before the next leg higher.

News Roundup:

James Wynn Gets Liquidated, But Says He'll 'Run it All Back'

James Wynn, a trader renowned for his aggressive, high-leverage bets on Hyperliquid, has been fully liquidated, leaving him with just $23 in his account after sustaining losses totaling more than $17 million, CoinDesk previously reported.

Wynn, who attracted significant attention with trades involving bitcoin, memecoins like PEPE, and even obscure tokens such as FARTCOIN, first faced steep declines from a massive $1.25 billion long position on BTC, resulting in a loss exceeding $37 million after prices dipped below $105,000 amid geopolitical turmoil.

Throughout the volatile month, Wynn rapidly cycled through trades, briefly netting an unrealized gain of $85 million before market swings wiped him out completely. An account associated with Wynn downplayed the dramatic liquidation, defiantly stating on X: "I'll run it back, I always do. And I'll enjoy doing it. I like playing the game. I took a large and calculated bet at making billions."

Brazil's Méliuz Shares Sink 8% After Announcing $78M Equity Raise to Buy Bitcoin

Brazilian fintech Méliuz plans to raise up to $78 million through a public equity offering, intending to allocate all proceeds to purchasing Bitcoin and positioning the cryptocurrency as a primary strategic asset in its treasury, CoinDesk previously reported.

However, Méliuz’s strategy hasn't impressed the market yet, as shares dropped more than 8% following the announcement. The initial offering includes 17 million common shares, with the potential to expand up to 51 million, and investors will receive subscription warrants allowing future stock purchases at set prices.

Known for its cashback and financial services platform serving over 30 million users, Méliuz currently holds 320.2 BTC, having previously committed 10% of its cash reserves to Bitcoin in March. Trading for the subscription warrants is expected to commence on June 16, with share settlement and warrant issuance finalized by June 18.

NYC Comptroller Rejects Mayor Adams' 'BitBond', Warns Deviating from Dollar Could Undermine City's Credit Reputation

New York City's Comptroller Brad Lander sharply criticized Mayor Eric Adams' plan to issue municipal bonds backed by bitcoin, labeling the proposed "BitBond" as "legally dubious and fiscally irresponsible," CoinDesk previously reported.

Lander rejected the idea just days after Adams introduced it at a bitcoin conference in Las Vegas, emphasizing that cryptocurrency's instability makes it unsuitable to reliably fund critical city projects such as infrastructure and affordable housing.

Mayor Adams has actively promoted cryptocurrency initiatives since entering office, including converting his own paychecks into digital assets and establishing a digital asset advisory council.

However, Comptroller Lander highlighted serious practical concerns with the BitBond proposal, noting federal tax laws and city financial regulations would make the proposal unworkable, and warned that deviating from the dollar-based municipal borrowing system could undermine investor confidence and New York City's credit reputation.

Market Movements:

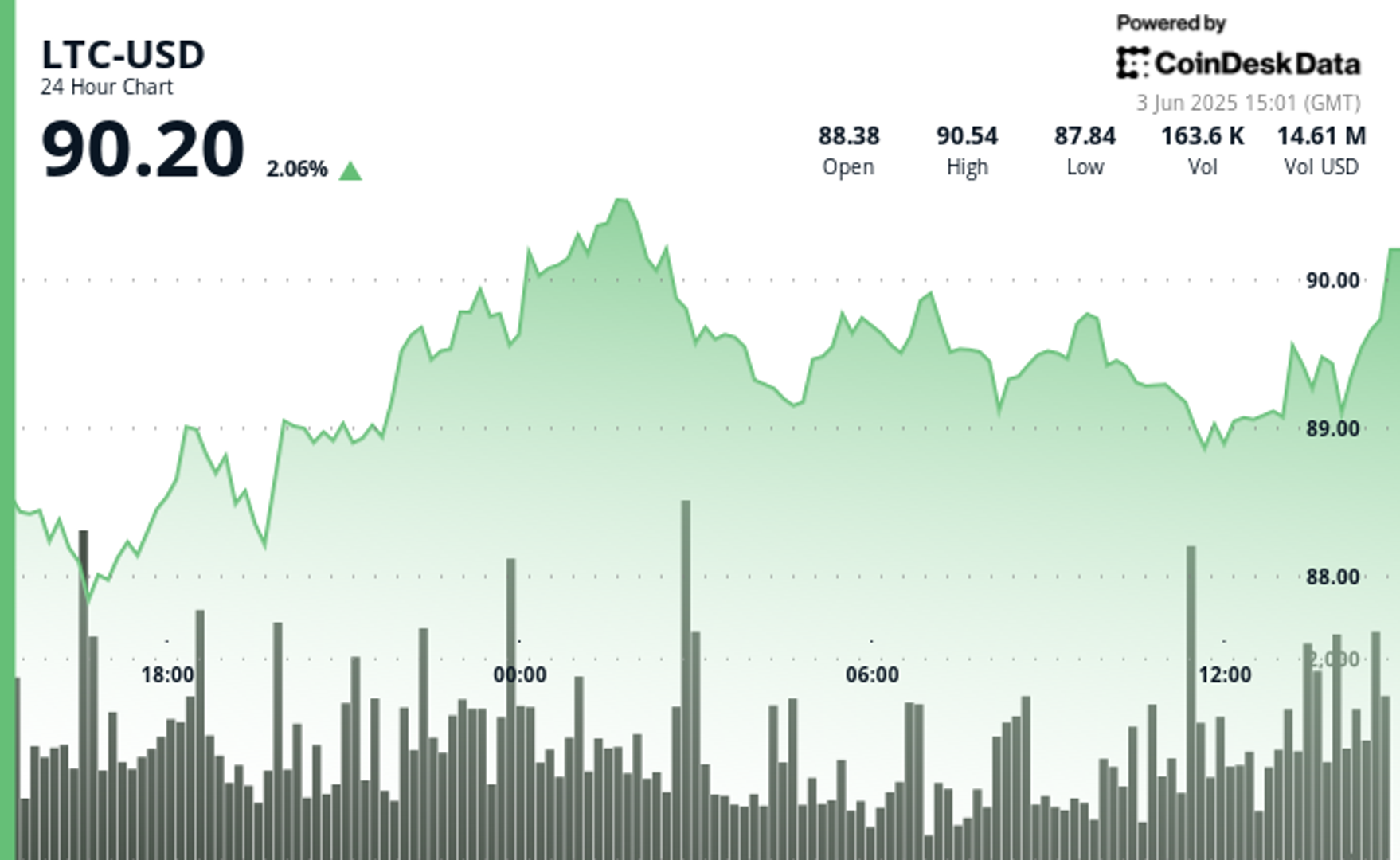

- BTC: Bitcoin showed resilience, staging a V-shaped recovery between $103,813.37 and $105,305.75 amid notable volume spikes.

- ETH: Ethereum formed a bullish reversal pattern, rebounding from strong support at $2,472.84 to $2,527.53 amid high-volume buying momentum, according to CoinDesk's Market Insight Bot.

- Gold: Gold climbed 0.6% to $3,311.66, as traders weighed its recent retreat from record highs against ongoing investor and central bank appetite driven by uncertainty over US tariffs and broader economic risks.

- Nikkei 225: Japan's Nikkei 225 dropped 0.89% as Asia-Pacific markets traded mixed following Trump's announcement of increased steel tariffs.

- S&P 500 Futures: Stock futures dipped Sunday to start June after the S&P 500's strongest month since November 2023, amid uncertainty over President Trump's tariffs following recent contradictory court rulings.

Elsewhere in Crypto:

- Wintermute warns Pectra upgrade leaves Ethereum users at risk of automated attacks (The Block)

- Here's What's at Stake for Crypto in South Korea's Upcoming Election (Decrypt)

- JPMorgan's Jamie Dimon Says U.S. Should Stockpile Missiles, Not Bitcoin (CoinDesk)

- IMF Raised Concerns Over Pakistan’s Plan to Allocate 2,000MW of Electricity for Bitcoin Mining (Local Report)