1 Amazing Artificial Intelligence (AI) Stock Down 88% You'll Wish You'd Bought on the Dip in 2025

Upstart Holdings (NASDAQ: UPST) developed an artificial intelligence (AI) algorithm to originate loans on behalf of banks and financial institutions, and it appears to be far more effective at determining the creditworthiness of potential borrowers than traditional assessment methods.Upstart stock has nearly doubled over the past year, but it remains 88% below its all-time high, which was set during the tech frenzy in 2021. Demand for loans plummeted when interest rates soared in 2022 and 2023, which dealt a blow to the company's financial performance.But earlier this month, Upstart reported its financial results for the first quarter of 2025 (ended March 31), and they revealed extremely strong -- and accelerating -- revenue growth. Its stock is starting to look like a bargain, so here's why investors might wish they had bought the dip when they look back on this moment in the future.Continue reading

Upstart Holdings (NASDAQ: UPST) developed an artificial intelligence (AI) algorithm to originate loans on behalf of banks and financial institutions, and it appears to be far more effective at determining the creditworthiness of potential borrowers than traditional assessment methods.

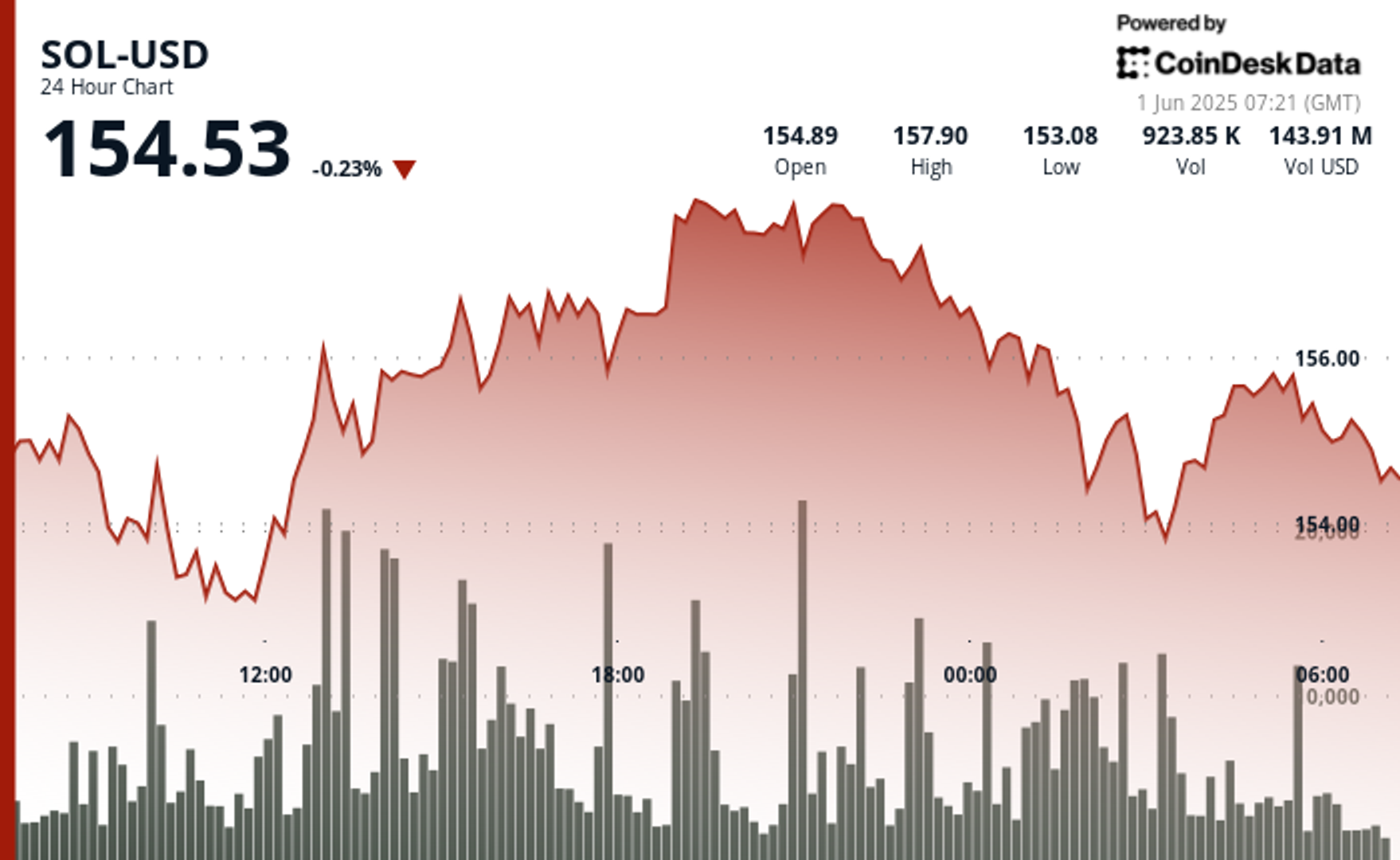

Upstart stock has nearly doubled over the past year, but it remains 88% below its all-time high, which was set during the tech frenzy in 2021. Demand for loans plummeted when interest rates soared in 2022 and 2023, which dealt a blow to the company's financial performance.

But earlier this month, Upstart reported its financial results for the first quarter of 2025 (ended March 31), and they revealed extremely strong -- and accelerating -- revenue growth. Its stock is starting to look like a bargain, so here's why investors might wish they had bought the dip when they look back on this moment in the future.