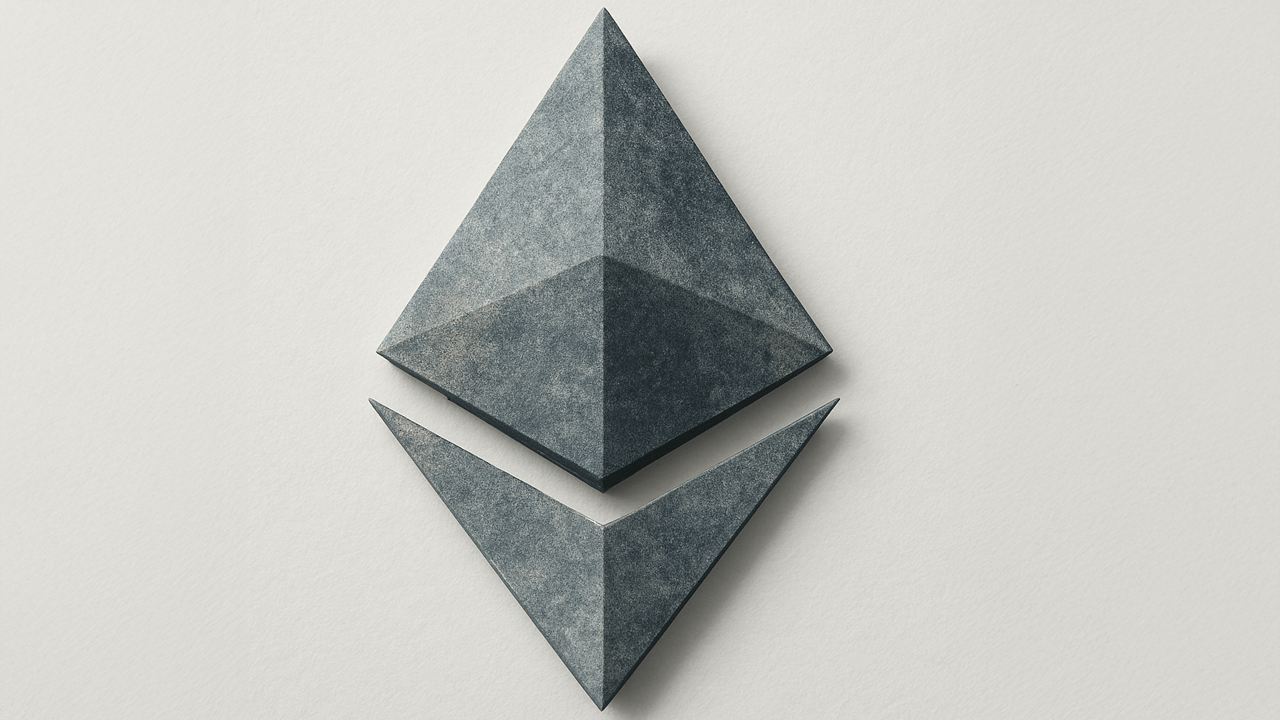

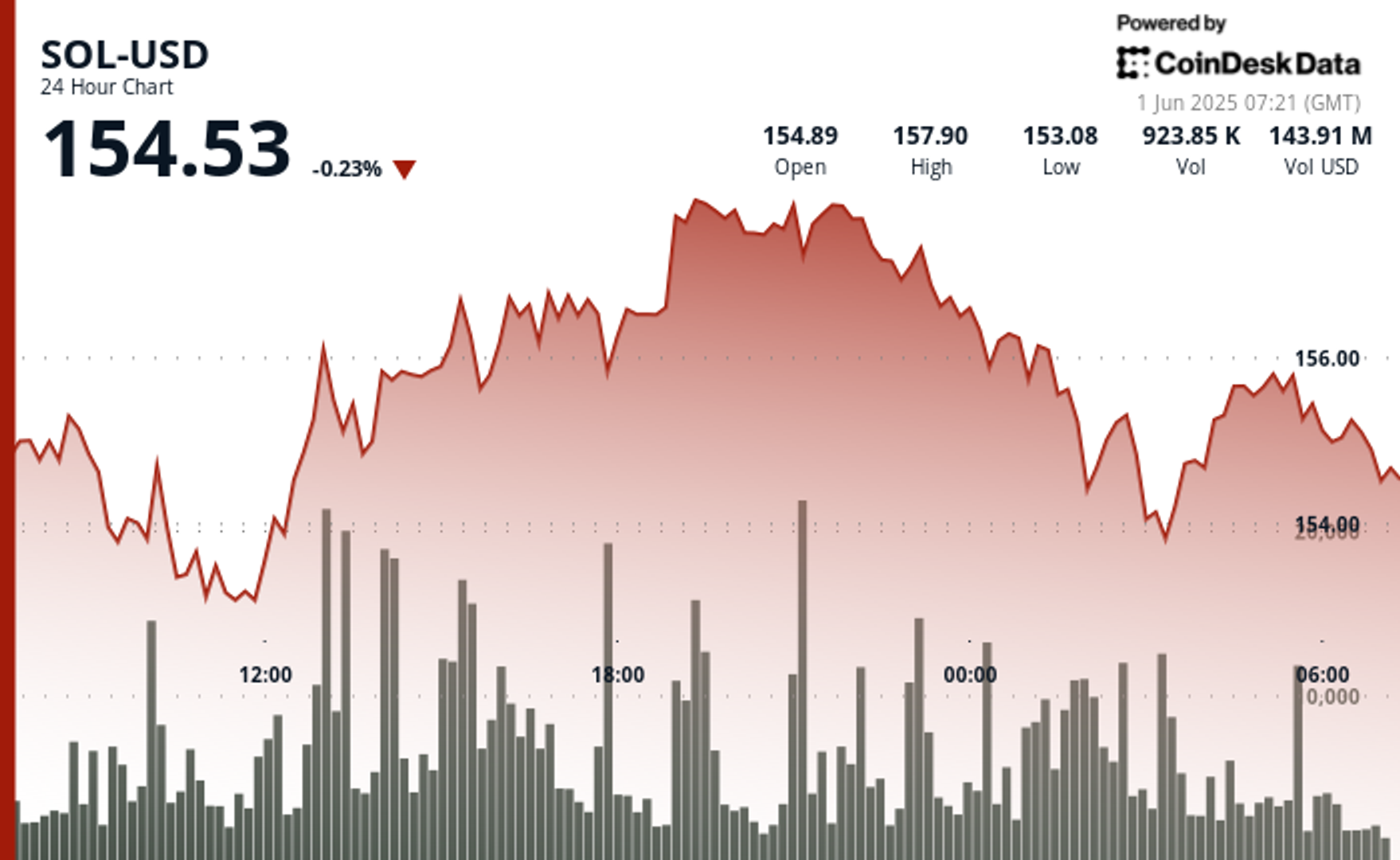

Solana Holds Near $154 After Losing Support as Tariff Fears Rattle Markets

SOL trades sideways after slipping below its mid-April trendline, with short-term sentiment shaky despite ongoing growth in stablecoin activity and validator interest.

Solana (SOL) remains under pressure as macroeconomic headwinds—particularly renewed tariff concerns — rattle investor confidence.

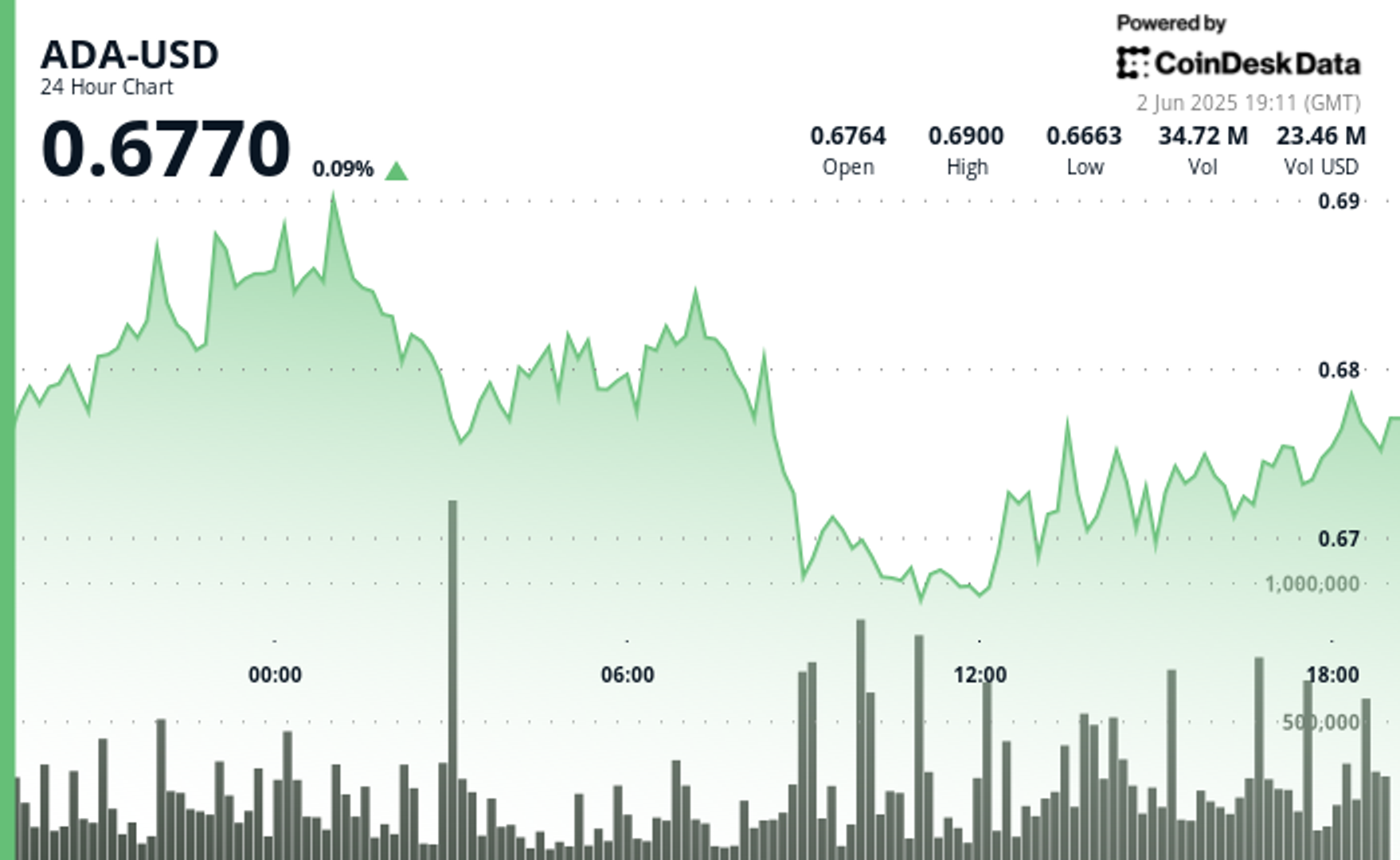

The token is now hovering around $154.50 after establishing a tight trading range between $152.33 and $158.06, reflecting a 3.76% swing in the past 24 hours, according to CoinDesk Research's technical analysis data model.

Although higher lows had previously suggested resilience, SOL slipped from $156.74 to $154.86 in a single hour, breaking beneath its mid-April uptrend channel.

Derivatives data reflects bearish sentiment: open interest in SOL futures is down 2.47% to $7.19 billion, while long liquidations surged to $30.97 million, indicating pressure on leveraged positions. Short liquidations remain minimal, reinforcing the downside bias.

Still, institutional interest remains evident. Circle’s recent $250 million USDC mint on Solana has added liquidity and cemented the chain’s stablecoin leadership, with 34% of all stablecoin volume now routed through the network. Additionally, SOL Strategies’ $1 billion validator fund signals sustained long-term confidence in the protocol’s scalability, even as short-term price action falters.

Technical Analysis Highlights

- SOL established a 5.73-point range ($152.33–$158.06), indicating a 3.76% intraday swing.

- Earlier price action traced a clear ascending channel with solid support near $152.80, supported by heavy accumulation.SOL hit a session high of $158.06 during the 19:00 hour on strong volume, signaling earlier bullish momentum.

- A reversal unfolded in the early morning hours, with SOL falling from $156.74 to $154.86 on increased selling.Selling pressure peaked between 01:53–01:54, with over 74,000 units traded in a sharp burst.

- Short-term momentum turned bearish as lower highs and weaker volume defined the final trading stretch.As of writing, SOL is consolidating near $154.50, suggesting price stability but with downside risk if volume doesn’t improve.