Up 55,810%, Is O'Reilly Automotive Stock Still a Buy?

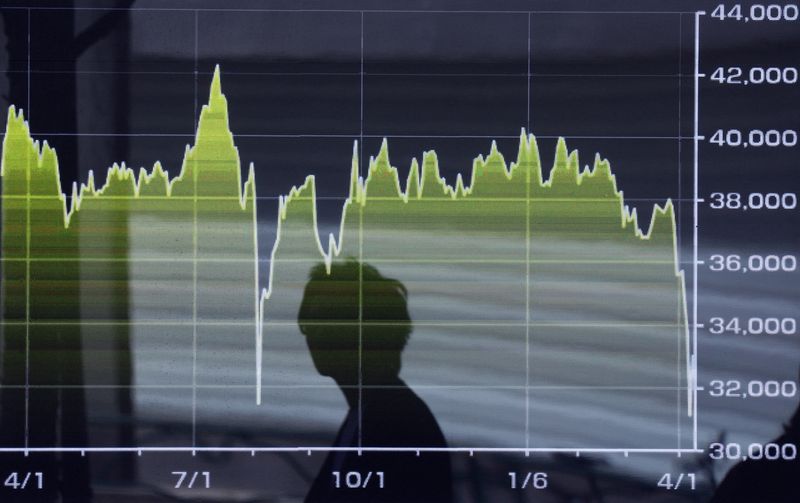

If you had invested $10,000 into O'Reilly Automotive (NASDAQ: ORLY) in 1993, you would have $5.59 million today. You read that correctly -- shares have risen by a jaw-dropping 55,810% in 30 years.Typically, investors associate this type of massive growth with disruptive technology companies pioneering brand-new industries. But O'Reilly shows that sometimes the most boring companies can deliver the best long-term results. Let's look at whether this automotive parts retailer has what it takes to maintain its market-beating bull run.The United States has many advantages over other countries, but one of the most important is scale. With 340 million of some of the world's wealthiest consumers, American businesses can unlock tremendous amounts of value by offering relatively mundane goods and services to a large number of people. The automotive aftermarket industry is an example of how this can create sustainable shareholder value.Continue reading

If you had invested $10,000 into O'Reilly Automotive (NASDAQ: ORLY) in 1993, you would have $5.59 million today. You read that correctly -- shares have risen by a jaw-dropping 55,810% in 30 years.

Typically, investors associate this type of massive growth with disruptive technology companies pioneering brand-new industries. But O'Reilly shows that sometimes the most boring companies can deliver the best long-term results. Let's look at whether this automotive parts retailer has what it takes to maintain its market-beating bull run.

The United States has many advantages over other countries, but one of the most important is scale. With 340 million of some of the world's wealthiest consumers, American businesses can unlock tremendous amounts of value by offering relatively mundane goods and services to a large number of people. The automotive aftermarket industry is an example of how this can create sustainable shareholder value.

![How Google’s AI Mode Compares to Traditional Search and Other LLMs [AI Mode Study]](https://static.semrush.com/blog/uploads/media/86/bc/86bc4d96d5a34c3f6b460a21004c39e2/f673b8608d38f1e4be0316c4621f2df0/how-google-s-ai-mode-compares-to-traditional-search-and-other-llms-ai-mode-study-sm.png)