This startup wants to give you money to buy a house

Potential buyers in California have seen the daunting challenge of owning a home become even more difficult. Due to higher mortgage rates and increased home values, a recent report from the California Association of Realtors found that buyers needed an income of $218,000 to afford a median home, a figure that’s jumped 82% since 2019. A Canadian startup seeks to make those figures a little more favorable, especially for working class and first-time buyers. Zown, which opened for operations in California in the fall, offers buyers what it calls down payment assistance. The model works like this: By using automation and salaried showing agents to help facilitate deals, it can reduce commissions that usually account for 2.5% or more of a home’s purchase price to about 1%, offering the difference as a rebate to buyers to use toward a down payment or to cover closing costs. Zown was launched by Canadian entrepreneur Rishard Rameez, who documented his own struggles with housing affordability on a viral Reddit thread. He found the process laborious and expensive and, in 2021, started working on a way to simplify the transaction. He developed a model that uses automation and a team of salaried brokers to cut commission fees and pass those savings along to buyers. He said Zown is able to give back roughly $10,000 to $15,000 per buyer for down payment assistance, an amount that equaled what an average person could save in a year or two. Since launching the product in Toronto in 2024, Zown has helped more than 250 buyers purchase homes, and offered more than $3 million toward down payments. That assistance can often mean the difference between potential buyers who can comfortably make a purchase or ones who are stretching substantially to buy their home. Michelle Boyd is chief strategy officer for the Terner Center at the University of California, Berkeley, and studies housing startups and fintech innovations. She says the Zown model makes sense for first-time buyers and those doing more straightforward deals. (But those buying older homes or fixer-uppers would perhaps benefit from an experienced agent’s help.) “I think there is a real opportunity to take some of that value that real estate agent is providing and give that back to the home, or that person who’s trying to purchase it,” she said. “It’s maybe not going to totally change someone’s ability to buy a home, but it’s not nothing.” Downpayment assistance programs, many run by cities and localities to help buyers in their area achieve homeownership, have been rising sharply in recent years due to the nation’s worsening housing crisis. Down Payment Resources, a group tracking this trend, found that more than 2,500 such programs exist across the country, providing an average of $18,000 in benefits to buyers. The number of programs has increased 55% year over year. Zown’s salary model can also offer more stability in a profession that depends on irregular sales and commissions. The national average take-home pay for a realtor is just under $59,000, according to the Bureau of Labor Statistics. The buyer-first model Lisa Touney has been running the California expansion of Zown in 2024, and has closed three deals in Corona and Newport Beach; one deal saved a buyer $30,000. A broker-owner with three decades of experience, Touney worked with one of the Zown co-owners and decided to help them launch in California. Touney has a license to work in multiple states, and the Golden State offers a great proving ground, due to its significant affordability crisis. Touney likes the salary-based model of Zown, which takes away the pressure of making sales, and offers an “attractive, innovative” way to help lower the cost of housing. Currently, Touney is working with two other agents, and says they can expect to make “over a six-figure income” with the Zown model. (The firm said “a full-time Zown agent in California can expect to earn solid mid-to-high five figures annually under Zown’s productivity-based pay model.”) Rameez hopes Zown can facilitate 1,000 sales in its first full year in California. Diana Zaya, an expert on real estate brokerage models, says she doesn’t find the Zown model as innovative as is being touted: realtors have long sacrificed some of their commission to make a deal pencil out. In this case, it’s more systematized. She believes the push to lower costs is good and can really make a difference for buyers, but also worries, long-term, that taking away commissions could lead to a devaluing of realtor pay and a reduction in quality, since she believes the model relies on low margins. Rameez added that, “This isn’t a race to the bottom; it’s a modern, trust‑first model where real value is measured by service and lasting relationships, not by a flat percentage.” Zown is the latest in a number of startups seeking to make homebuying more accessible. Boyd said a number of such startups have gone under in recent years

Potential buyers in California have seen the daunting challenge of owning a home become even more difficult. Due to higher mortgage rates and increased home values, a recent report from the California Association of Realtors found that buyers needed an income of $218,000 to afford a median home, a figure that’s jumped 82% since 2019.

A Canadian startup seeks to make those figures a little more favorable, especially for working class and first-time buyers.

Zown, which opened for operations in California in the fall, offers buyers what it calls down payment assistance. The model works like this: By using automation and salaried showing agents to help facilitate deals, it can reduce commissions that usually account for 2.5% or more of a home’s purchase price to about 1%, offering the difference as a rebate to buyers to use toward a down payment or to cover closing costs.

Zown was launched by Canadian entrepreneur Rishard Rameez, who documented his own struggles with housing affordability on a viral Reddit thread. He found the process laborious and expensive and, in 2021, started working on a way to simplify the transaction. He developed a model that uses automation and a team of salaried brokers to cut commission fees and pass those savings along to buyers. He said Zown is able to give back roughly $10,000 to $15,000 per buyer for down payment assistance, an amount that equaled what an average person could save in a year or two.

Since launching the product in Toronto in 2024, Zown has helped more than 250 buyers purchase homes, and offered more than $3 million toward down payments. That assistance can often mean the difference between potential buyers who can comfortably make a purchase or ones who are stretching substantially to buy their home.

Michelle Boyd is chief strategy officer for the Terner Center at the University of California, Berkeley, and studies housing startups and fintech innovations. She says the Zown model makes sense for first-time buyers and those doing more straightforward deals. (But those buying older homes or fixer-uppers would perhaps benefit from an experienced agent’s help.)

“I think there is a real opportunity to take some of that value that real estate agent is providing and give that back to the home, or that person who’s trying to purchase it,” she said. “It’s maybe not going to totally change someone’s ability to buy a home, but it’s not nothing.”

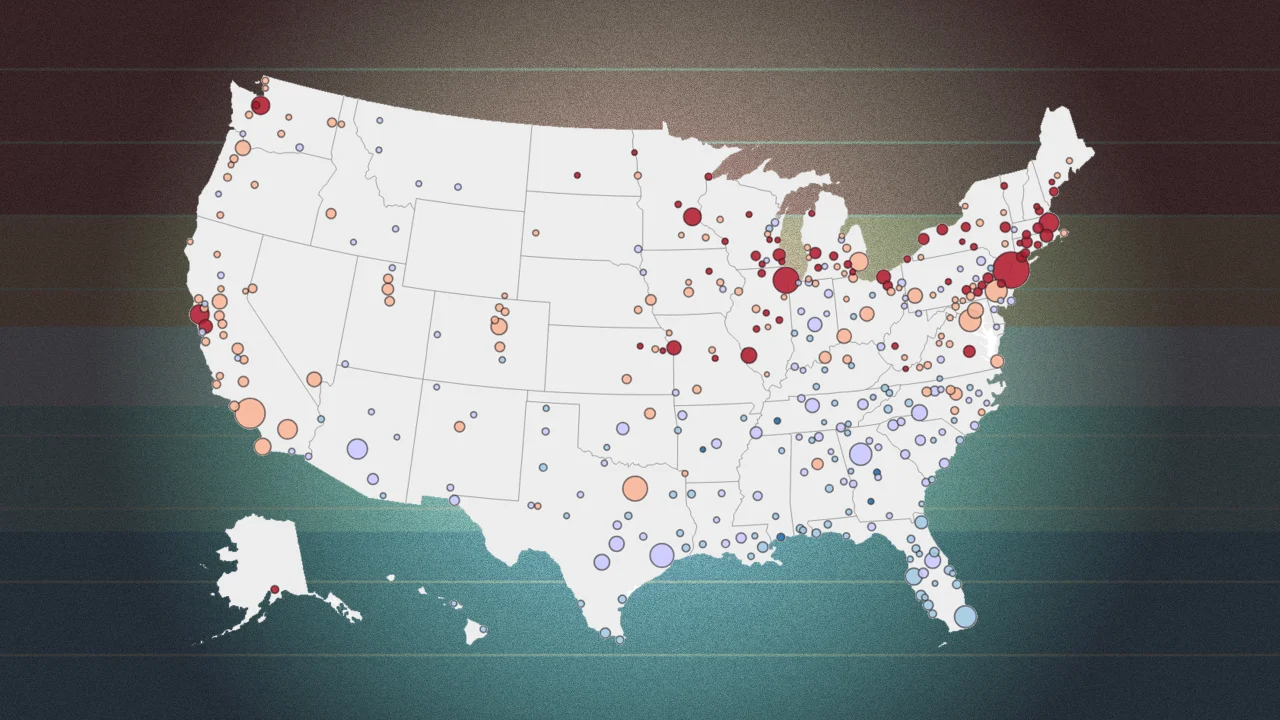

Downpayment assistance programs, many run by cities and localities to help buyers in their area achieve homeownership, have been rising sharply in recent years due to the nation’s worsening housing crisis. Down Payment Resources, a group tracking this trend, found that more than 2,500 such programs exist across the country, providing an average of $18,000 in benefits to buyers. The number of programs has increased 55% year over year.

Zown’s salary model can also offer more stability in a profession that depends on irregular sales and commissions. The national average take-home pay for a realtor is just under $59,000, according to the Bureau of Labor Statistics.

The buyer-first model

Lisa Touney has been running the California expansion of Zown in 2024, and has closed three deals in Corona and Newport Beach; one deal saved a buyer $30,000. A broker-owner with three decades of experience, Touney worked with one of the Zown co-owners and decided to help them launch in California. Touney has a license to work in multiple states, and the Golden State offers a great proving ground, due to its significant affordability crisis.

Touney likes the salary-based model of Zown, which takes away the pressure of making sales, and offers an “attractive, innovative” way to help lower the cost of housing. Currently, Touney is working with two other agents, and says they can expect to make “over a six-figure income” with the Zown model. (The firm said “a full-time Zown agent in California can expect to earn solid mid-to-high five figures annually under Zown’s productivity-based pay model.”) Rameez hopes Zown can facilitate 1,000 sales in its first full year in California.

Diana Zaya, an expert on real estate brokerage models, says she doesn’t find the Zown model as innovative as is being touted: realtors have long sacrificed some of their commission to make a deal pencil out. In this case, it’s more systematized. She believes the push to lower costs is good and can really make a difference for buyers, but also worries, long-term, that taking away commissions could lead to a devaluing of realtor pay and a reduction in quality, since she believes the model relies on low margins.

Rameez added that, “This isn’t a race to the bottom; it’s a modern, trust‑first model where real value is measured by service and lasting relationships, not by a flat percentage.”

Zown is the latest in a number of startups seeking to make homebuying more accessible. Boyd said a number of such startups have gone under in recent years, as the combination of lower price appreciation and a higher interest rate spike hurt their plan to profit off of rising values.

![[Weekly funding roundup May 24-30] Capital inflow continues to remain steady](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)