This 77-year-old Indian IT training co raised crores just to buy bitcoins

JetKing Infotrain Ltd., a 77-year-old Indian IT training company, has raised Rs 6.1 crore through a share sale to purchase Bitcoin—making it the first Indian company to officially adopt the Bitcoin standard. The Mumbai-based firm increased its Bitcoin holdings from 15.02 coins at the end of March

JetKing Infotrain, a 77-year-old Indian IT training company, has raised Rs 6.1 crore through a share sale to purchase bitcoins—making it the first Indian company to officially adopt the bitcoin standard.

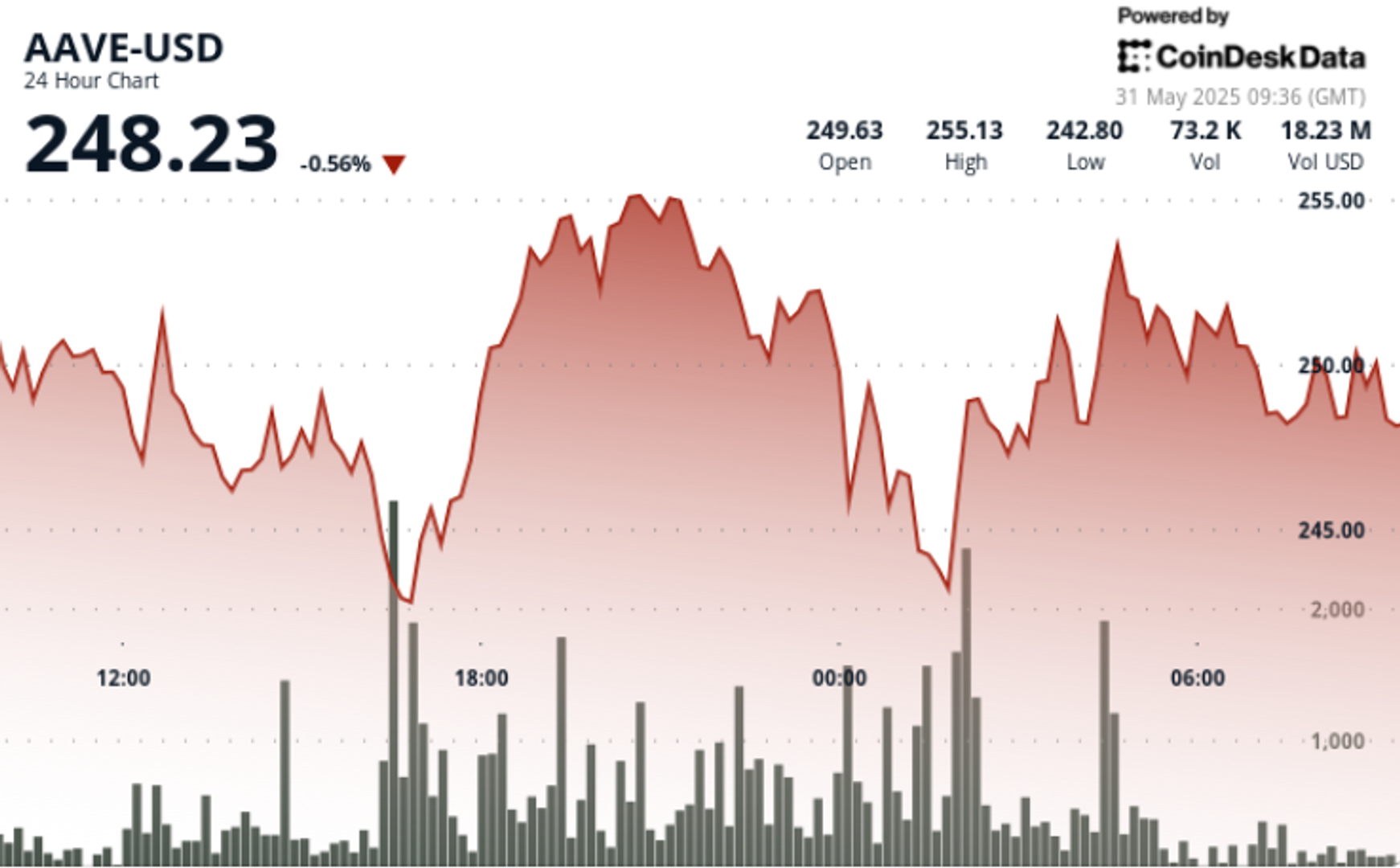

The Mumbai-based firm increased its bitcoin holdings from 15.02 coins at the end of March to 21 coins as of May 28. The latest acquisitions were made at an average price of Rs 64.65 lakh per bitcoin, as disclosed in a recent stock exchange filing.

“We just orange-pilled into the Bombay Stock Exchange with our business at JetKing,” wrote Siddarth Bharwani, Joint MD and CFO of JetKing Infotrain, on X.

“‘Buy and HODL Bitcoin forever’ is unimaginable in India. But we’ve become the first Indian company to adopt the Bitcoin standard—and we did it.”

The term "orange pill" is inspired by the movie The Matrix and the Bitcoin logo's orange colour. "Orange-pilling" involves educating someone about bitcoins and their underlying principles, potentially showing them the flaws in traditional financial systems and the potential benefits of the decentralized bitcoin system and monetary sovereignty.

JetKing formally designated Bitcoin as its primary treasury reserve asset in December 2024. According to the company’s treasury policy, bitcoin is now preferred over traditional cash holdings as a long-term store of value.

“The Company's Treasury Reserve Assets [are] with the objective of holding a majority of the Treasury Reserve Assets in BTC, which has been designated to be the Company's primary Treasury Reserve Asset,” the policy stated.

The Rs 6.1 crore capital raise represents nearly 30% of JetKing’s annual revenue of Rs 21 crore, underscoring the company's aggressive commitment to Bitcoin accumulation. With a market capitalisation of Rs 78.92 crore, JetKing’s Bitcoin holdings now make up a significant portion of shareholder value.

Bharwani had earlier said that the company would look at raising funds through compulsorily convertible preference shares (CCPS) in a couple of rounds, and then explore raising money via debt to acquire more bitcoins, according to an interview he gave to crypto influencer Kashif Raza on a MoneyFest podcast.

In India’s traditionally conservative regulatory climate, this move stands out. Bharwani commented:

“If you are in bitcoin, it might seem obvious. But India and its regulatory environment have been slow to adopt blockchain as a technology. When we adopt, though, we’ll eat this stuff up. T-minus… Stay tuned.”

India currently imposes a 30% tax on cryptocurrency gains and a 1% tax deducted at source (TDS) on crypto transactions, reflecting its cautious approach toward the sector.

JetKing’s strategy closely mirrors that of Strategy Corp. (formerly MicroStrategy), the US-based software firm that reinvented itself as a Bitcoin holding company. Led by founder and executive chairman Michael Saylor, Strategy has aggressively raised capital through share issuance and debt to purchase bitcoin—regardless of market volatility.

As of now, Strategy holds 553,555 bitcoins, valued at over $53 billion. The company raised $21 billion in October 2024 specifically for Bitcoin purchases and has already deployed that capital. It has since raised an additional $21 billion for further acquisitions. The firm's average acquisition price stands at $68,459 per coin, giving it control of approximately 2.64% of the total bitcoin supply.

Saylor’s approach—often described as a “capital-markets hack”—funnels traditional financial market liquidity into bitcoins. Strategy’s stock (MSTR) has effectively become a proxy for Bitcoin, frequently outperforming the cryptocurrency itself during bull markets.

JetKing Infotrain's share price saw a sharp reaction following its Bitcoin treasury announcement. On December 9, when the company revealed its adoption of Bitcoin as a primary treasury asset, the stock jumped from Rs 64.92 to Rs 156.80. It later corrected to Rs 67.12 but has since shown a steady recovery, trading at Rs 133.60 as of today.

Edited by Kanishk Singh

![[Weekly funding roundup May 24-30] Capital inflow continues to remain steady](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)