Techfino raises Rs 65 Cr from Stellaris Venture Partners and Saison Capital

Techfino, a Bengaluru-based non-banking financial company (NBFC), has secured Rs 65 crore in funding from Stellaris Venture Partners and Saison Capital to ramp up its secured lending operations for underserved micro, small and medium enterprises (MSMEs) in India. The fresh capital will be used to

Techfino, a Bengaluru-based non-banking financial company (NBFC), has secured Rs 65 crore in funding from Stellaris Venture Partners and Saison Capital to ramp up its secured lending operations for underserved micro, small and medium enterprises (MSMEs) in India.

The startup will use the fresh capital to expand its branch network, strengthen its proprietary technology stack, and increase loan disbursements in Tier II and III cities, according to a statement on Wednesday.

Techfino, which offers loans against property (LAP) to MSMEs and education loans through a B2B2C model, says it has disbursed over 100,000 loans since its inception and currently manages over Rs 200 crore in assets under management (AUM). The company operates in Karnataka, Gujarat, Madhya Pradesh, and Andhra Pradesh and has been profitable since launch.

Rajesh Panda, Co-founder at Techfino, highlighted the vast gap in MSME credit coverage. “Out of the 640 million registered MSMEs in India, 390 million are not part of the formal credit economy,” Panda said. “This segment, especially in rural and semi-urban markets, generates an estimated quarterly demand of Rs 200,000 crore.”

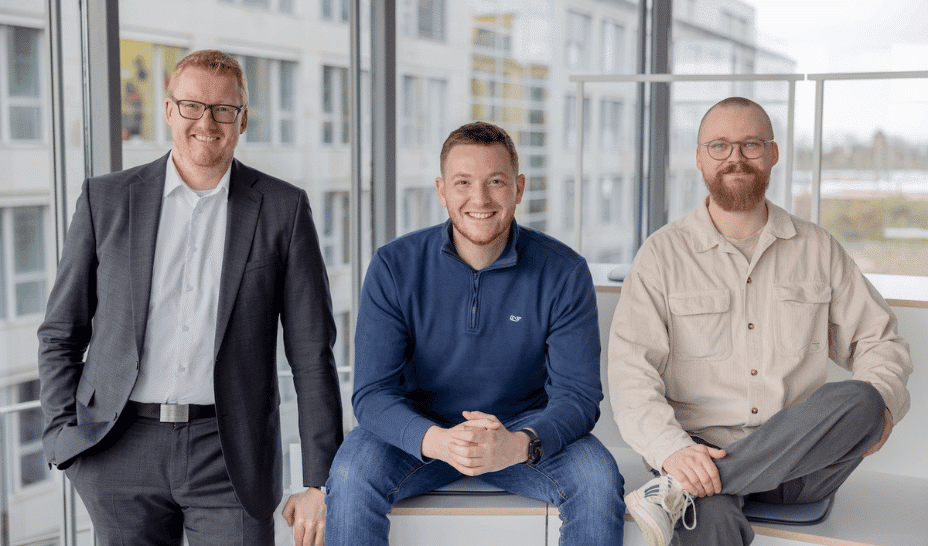

Founded in 2019 by former senior bankers Rajesh Panda (ex-Standard Chartered), Jayaprakash Patra (ex-ICICI Bank, ING), and Ratikant Satapathy (ex-Bajaj Finance), Techfino positions itself as a tech-first, risk-aware alternative to traditional lenders.

“At Techfino, we leverage a robust technology platform which we have internally developed from scratch,” said Satapathy. “This platform integrates multiple external APIs to obtain and verify data critical for underwriting. This technology has resulted in higher efficiency, better data-driven risk assessment and lower TAT (turnaround time).”

Investors see a long runway in India’s fragmented MSME lending ecosystem, particularly for lenders with strong tech and credit capabilities.

“The credit gap in the MSME sector is a massive opportunity,” said Ritesh Banglani, Partner at Stellaris Venture Partners. “Techfino has demonstrated that it is possible to build a high-quality, profitable lending business in this otherwise risky segment with strong underwriting and collections, and tech-enablement of the entire lending lifecycle.”

Saison Capital, the venture arm of Tokyo-listed Credit Saison, also participated in the round, continuing its focus on backing fintechs targeting the informal economy across Asia.

With this fundraising, Techfino plans to double its branch footprint, scale its secured disbursements, and solidify its position in rural lending over the next three to five years.

Edited by Affirunisa Kankudti