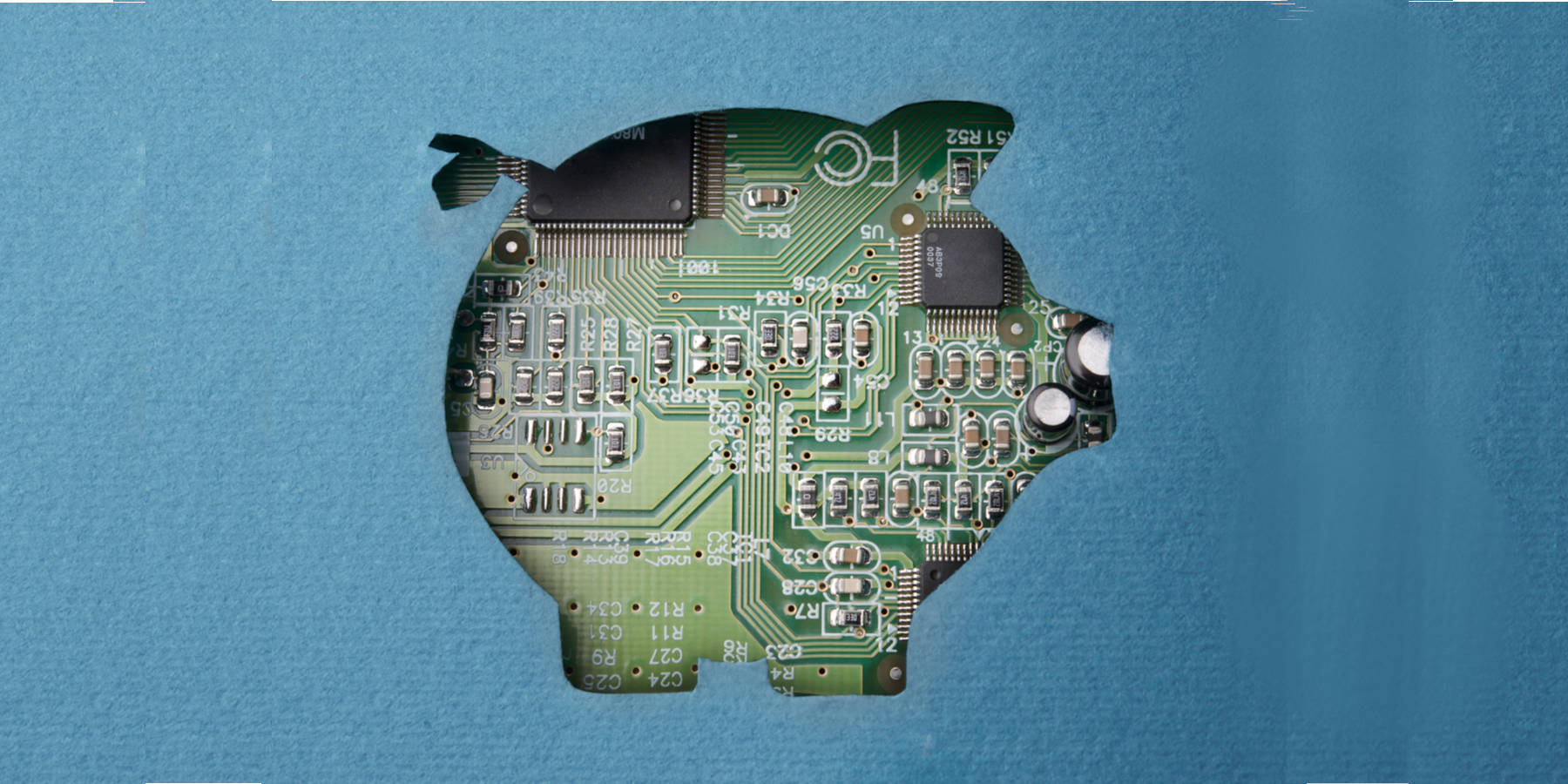

Prediction: Lyft Stock Could Double in the Next 3 Years

Lyft (NASDAQ: LYFT) has had a tough time on the public markets. Share prices of the ridesharing company, which has long been in the shadow of the larger Uber Technologies (NYSE: UBER), are down 77% since its IPO in 2019. Both ridesharing stocks were overpriced when they went public, and both tumbled when the pandemic started, but since then, their performances have diverged.Uber stock has soared as the company has brought costs under control and delivered steady growth, reinforcing its competitive advantages. Based on its weak stock performance, you might expect to hear that Lyft lagged behind Uber in growth, but that isn't the case. Its revenue growth has been faster than Uber's over the last year. Lyft has now reported 16 straight quarters of double-digit percentage gross bookings growth. It made strides on the bottom line as well. Last year, it reported a generally accepted accounting principles (GAAP) profit for the first time. In 2025's first quarter, Lyft reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $106.5 million, which was nearly double what it booked a year before. Lyft also reported free cash flow over the last four quarters of $919.9 million due in part to a large increase in insurance reserves. With Lyft's market cap at less than $7 billion, the stock trades for less than 8 times trailing free cash flow.Continue reading

Lyft (NASDAQ: LYFT) has had a tough time on the public markets. Share prices of the ridesharing company, which has long been in the shadow of the larger Uber Technologies (NYSE: UBER), are down 77% since its IPO in 2019. Both ridesharing stocks were overpriced when they went public, and both tumbled when the pandemic started, but since then, their performances have diverged.

Uber stock has soared as the company has brought costs under control and delivered steady growth, reinforcing its competitive advantages. Based on its weak stock performance, you might expect to hear that Lyft lagged behind Uber in growth, but that isn't the case. Its revenue growth has been faster than Uber's over the last year. Lyft has now reported 16 straight quarters of double-digit percentage gross bookings growth.

It made strides on the bottom line as well. Last year, it reported a generally accepted accounting principles (GAAP) profit for the first time. In 2025's first quarter, Lyft reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $106.5 million, which was nearly double what it booked a year before. Lyft also reported free cash flow over the last four quarters of $919.9 million due in part to a large increase in insurance reserves. With Lyft's market cap at less than $7 billion, the stock trades for less than 8 times trailing free cash flow.