NVIDIA clocks $44B in Q1 revenue fuelled by data-centre biz

Revenue from the data-centre segment, which includes AI chips and networking products, soared 73% year-on-year.

US chipmaker giant has posted a stronger-than-expected revenue of $44.1 billion in the first quarter of the current fiscal, up 69% from a year ago, fuelled by surging demand for its data centre business.

Revenue from the data centre segment, which includes AI chips and networking products, soared 73% year-on-year to $39.1 billion, representing over 88% of the company’s total sales.

In April, the firm was notified by the US government that its H20 AI-accelerator products would require an export licence for shipment to China. In response to the resulting softening in demand, the company said it incurred a $4.5-billion charge in the quarter to write down the excess H20 inventory and cover purchase commitments.

Despite the curbs, NVIDIA recorded $4.6 billion in H20 product sales in the first quarter of fiscal 2026, before the export licensing rules came into effect. However, it was unable to ship an additional $2.5 billion worth of H20 products during the same period.

“Our breakthrough Blackwell NVL72 AI supercomputer—a ‘thinking machine’ designed for reasoning—is now in full-scale production across system makers and cloud service providers,” said Jensen Huang, founder and CEO of NVIDIA.

“Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate. Countries around the world are recognising AI as essential infrastructure—just like electricity and the internet—and NVIDIA stands at the centre of this profound transformation,” he added.

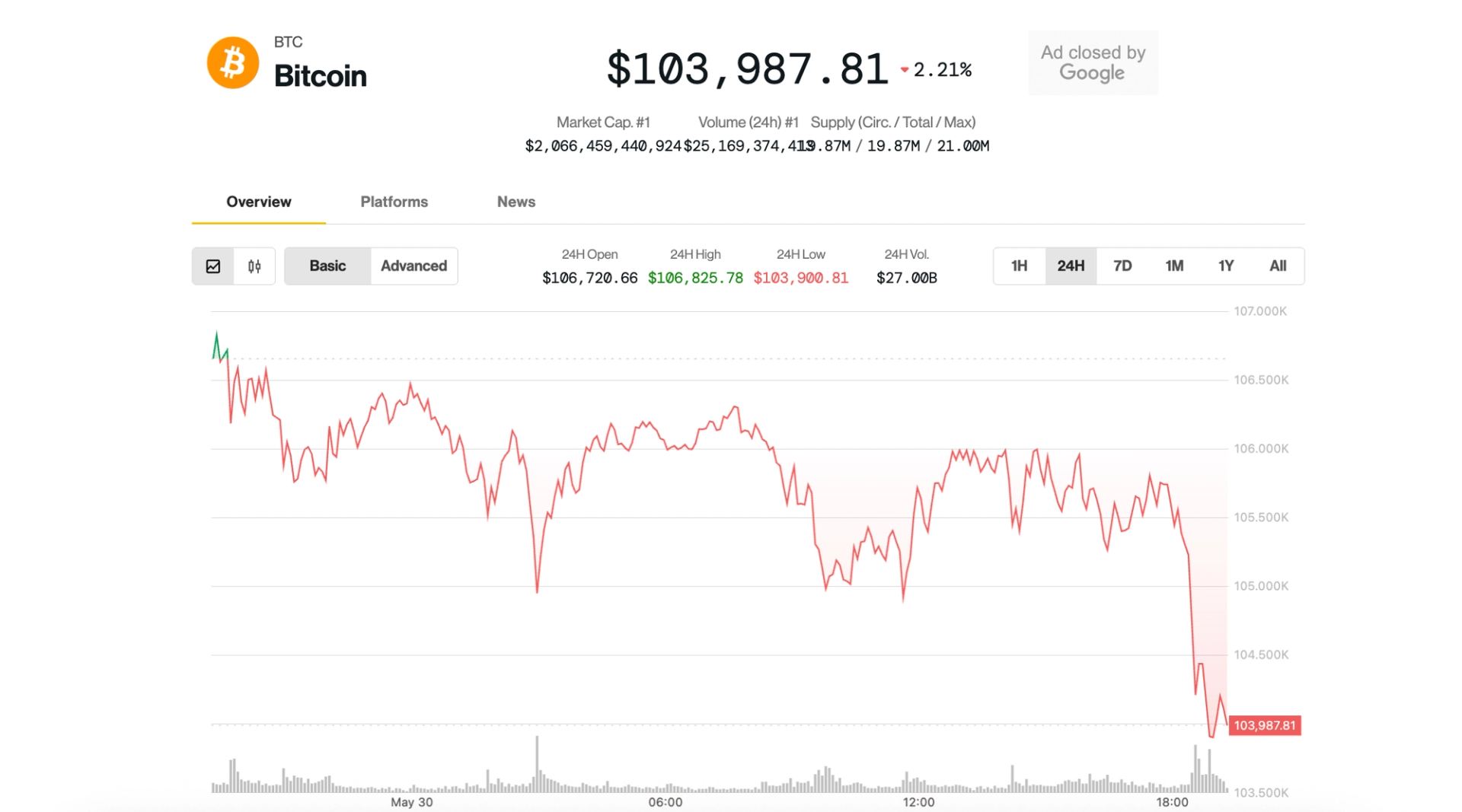

Nvidia’s share price jumped as much as 6% to $142.22 in after-hours Nasdaq trading.

The company’s net income jumped 26% year-over-year to $18.8 billion, up from $14.9 billion a year earlier. In the first quarter, gaming revenue reached a record $3.8 billion, up 42% year-over-year. Meanwhile, the automotive and robotics division reported sales growth of 72% to $567 million.

Diluted earnings per share stood at $0.76 on a GAAP basis and $0.81 on a non-GAAP basis.

NVIDIA is expanding its manufacturing footprint by building factories in the United States and collaborating with partners to produce NVIDIA AI supercomputers domestically. The company rolled out two new AI platforms, Blackwell Ultra and Dynamo, to scale reasoning models.

Outside the US, NVIDIA has partnered with HUMAIN to establish AI factories in Saudi Arabia. In Abu Dhabi, it has joined forces with G42, OpenAI, Oracle, SoftBank Group, and Cisco to launch Stargate UAE, a next-generation AI infrastructure cluster. It has also announced plans with Foxconn and the Taiwanese government to build an AI-factory supercomputer.

Edited by Swetha Kannan