Looking for a Blend of Growth and Dividend Stocks Amid Market Uncertainty? Consider This Low-Cost Vanguard ETF.

This year has been nothing like 2023 and 2024. In those two years, the S&P 500 (SNPINDEX: ^GSPC) shot up a whopping 53.2%.In 2025, the S&P 500 made new all-time highs in February, then went down over 15% year to date (YTD) at one point in April, and is now down a little over 1% YTD at the time of this writing.When markets are this volatile, it can be challenging to filter out noise and decide which companies or exchange-traded funds (ETFs) to put your hard-earned savings into. Allocate too much into growth stocks, and you may take on more risk than intended. Put too much into value and dividend stocks, and you could miss out on themes like cloud computing, artificial intelligence, and more.Continue reading

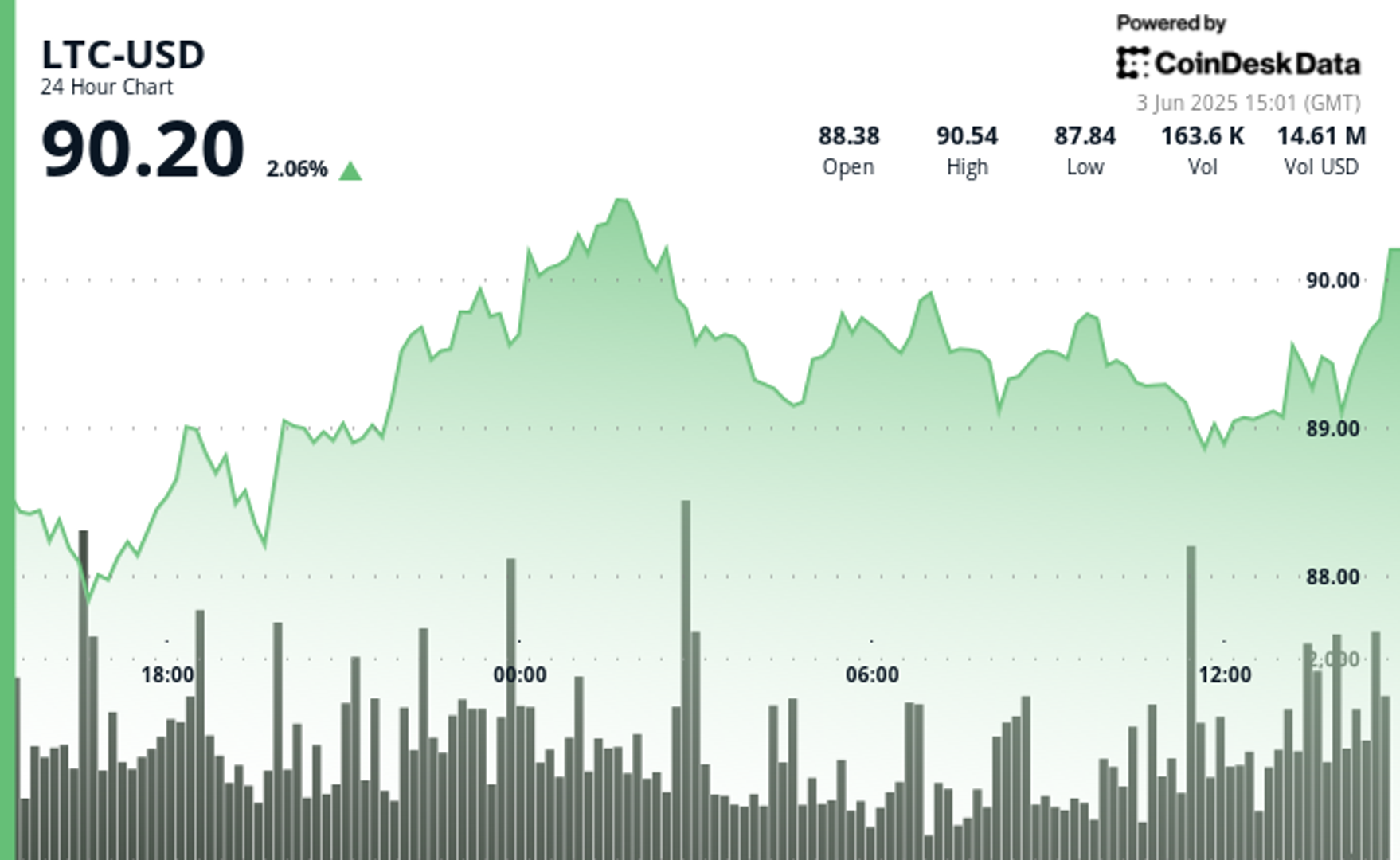

This year has been nothing like 2023 and 2024. In those two years, the S&P 500 (SNPINDEX: ^GSPC) shot up a whopping 53.2%.

In 2025, the S&P 500 made new all-time highs in February, then went down over 15% year to date (YTD) at one point in April, and is now down a little over 1% YTD at the time of this writing.

When markets are this volatile, it can be challenging to filter out noise and decide which companies or exchange-traded funds (ETFs) to put your hard-earned savings into. Allocate too much into growth stocks, and you may take on more risk than intended. Put too much into value and dividend stocks, and you could miss out on themes like cloud computing, artificial intelligence, and more.