Hong Kong Set to Allow Crypto Derivatives Trading

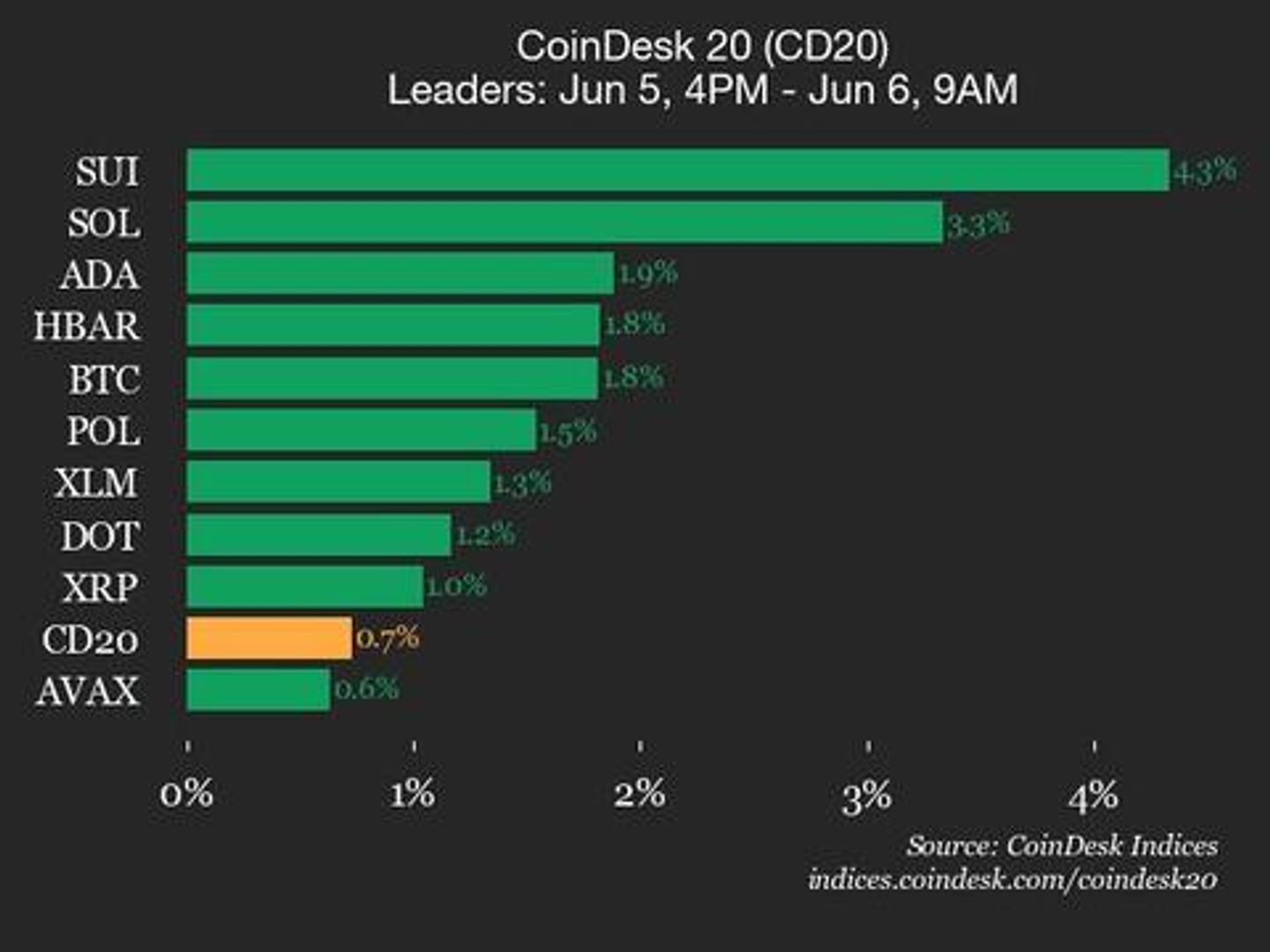

Crypto derivatives are a much larger market than spot trading.

The Securities and Futures Commission, Hong Kong’s securities regulator, is planning to allow professional investors to trade crypto derivatives, marking a significant expansion of the territory’s virtual asset market offerings, according to a report from China Daily.

Crypto derivatives are a considerably larger market than spot trading. Data from TokenInsight shows that the crypto derivatives market pushed through $21 trillion in volume for the first quarter of the year, compared to $4.6 trillion in spot volume.

Stakeholders in the industry have long called for Hong Kong to license crypto derivatives trading.

Speaking to the South China Morning Post earlier this year, Jean-David Péquignot, chief commercial officer of Deribit, one of the largest derivatives exchanges, said crypto derivatives rules were a missing piece of legislation for Hong Kong.

Hong Kong's legislative council, its parliamentary body, recently passed a bill that would allow for the licensing of stablecoins in the city.

_.png)