Government game theory activated: Pakistan edition

Pakistan has announced their own bitcoin strategic reserve, along with a new bitcoin mining initiative. This is a subtle update from their previous stance of "it will never be legal in this country ever". Gradually, then suddenly. On the eve of another game theory domino falling, I thought I'd take a minute to remind those newer to the space or more naive about finance about the connection between bitcoin and the dollar, and connect the dots on some of the macroeconomic events going on. Use these as jumping off points to decide for yourself. See the big picture, don't panic during dips. Brief history of the dollar. Post WW2 wtf are we gonna do to reconstruct the world. World powers decide to make the relatively unharmed US back the new global reserve currency of the dollar. Dollar will be redeemable for gold. US will run trade deficits to get the needed dollars into the world, world will rebuild their infrastructure and invest in US treasuries. US asset prices get a huge bid from this global demand, at the cost of outsourcing industry abroad and racking up debt. Doubt arises whether the US has been cheating by printing dollars that aren't backed by gold. Rather than prove this wrong and returning the promised gold for dollars, Nixon "suspends" redeemability and the unbacked fiat global reserve currency era begins. The world doesn't collapse because as bitcoiners know, money doesn't need to be redeemable, it's a game theory / network effect phenomenon where societies gravitate towards a single winner. Current status of the fiat dollar reserve currency experiment. I'll speed this up. US in debt very much. Never recession always print. Other govs notice. Treasuries expire very soon. New "fiscally responsible" admin proposes bill to expand debt further. Interest rates high and climbing. Gold exploding in price. Trade war threatens unwinding of dollar reserve system. Price action crazy. Stocks down bonds down treasuires down dollar down. Wealth panics. Where to put money? Bitcoin chillin', acts as amazing low correlation buying power protection and growth asset during the panic. Def not like a 2x levered risk asset. Wealth continues gradually-then-suddenly noticing. States establishing bitcoin reserves. Countries establishing bitcoin reserves. US president tells treasury to buy, family goes very long bitcoin including buying a miner. Corporate speculative attack on the dollar picking up steam. Bitcoin market cap: $2T, wealth that needs it right now: $400T+. US bill to buy 5% of the bitcoin supply is on the table. Boomers passing on wealth to kids, younger generations dramatically more favorable to bitcoin. What do you think? Is demand headed up or down over the next ten years? edit: trivial grammar corrections submitted by /u/BitcoinBaller420 [link] [comments]

Pakistan has announced their own bitcoin strategic reserve, along with a new bitcoin mining initiative. This is a subtle update from their previous stance of "it will never be legal in this country ever". Gradually, then suddenly.

On the eve of another game theory domino falling, I thought I'd take a minute to remind those newer to the space or more naive about finance about the connection between bitcoin and the dollar, and connect the dots on some of the macroeconomic events going on. Use these as jumping off points to decide for yourself. See the big picture, don't panic during dips.

Brief history of the dollar.

Post WW2 wtf are we gonna do to reconstruct the world. World powers decide to make the relatively unharmed US back the new global reserve currency of the dollar. Dollar will be redeemable for gold. US will run trade deficits to get the needed dollars into the world, world will rebuild their infrastructure and invest in US treasuries. US asset prices get a huge bid from this global demand, at the cost of outsourcing industry abroad and racking up debt.

Doubt arises whether the US has been cheating by printing dollars that aren't backed by gold. Rather than prove this wrong and returning the promised gold for dollars, Nixon "suspends" redeemability and the unbacked fiat global reserve currency era begins. The world doesn't collapse because as bitcoiners know, money doesn't need to be redeemable, it's a game theory / network effect phenomenon where societies gravitate towards a single winner.

Current status of the fiat dollar reserve currency experiment.

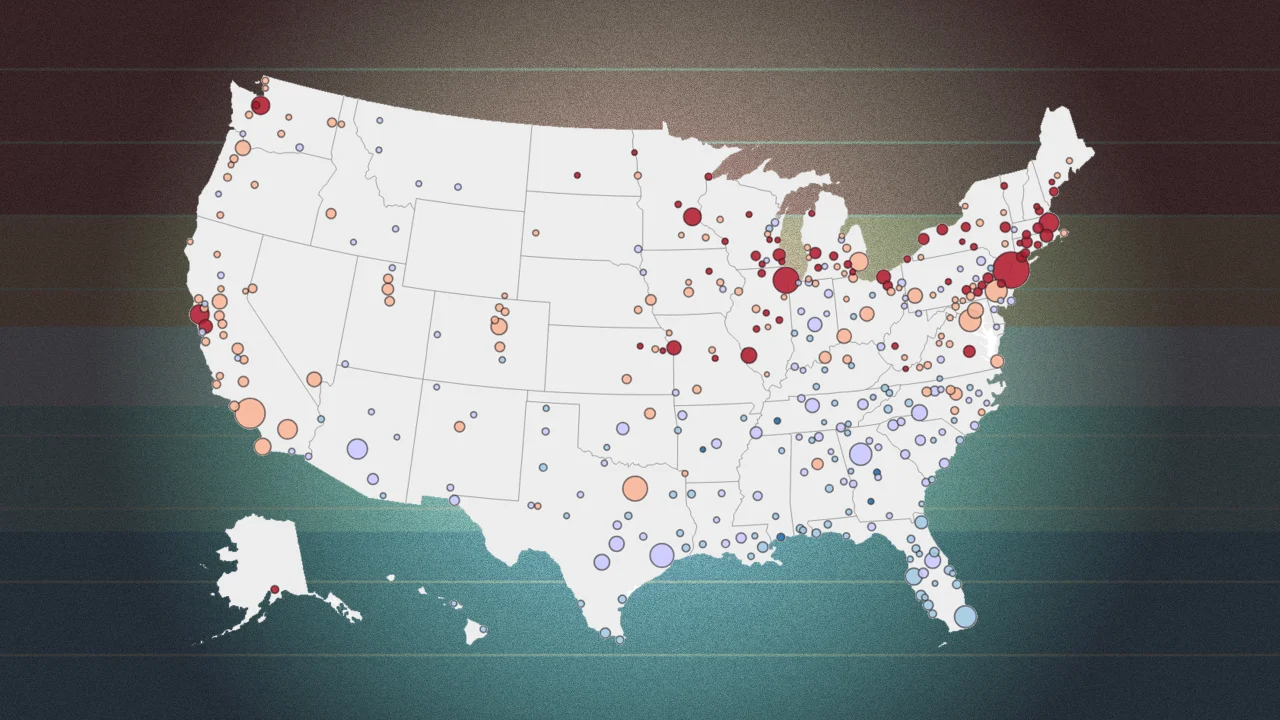

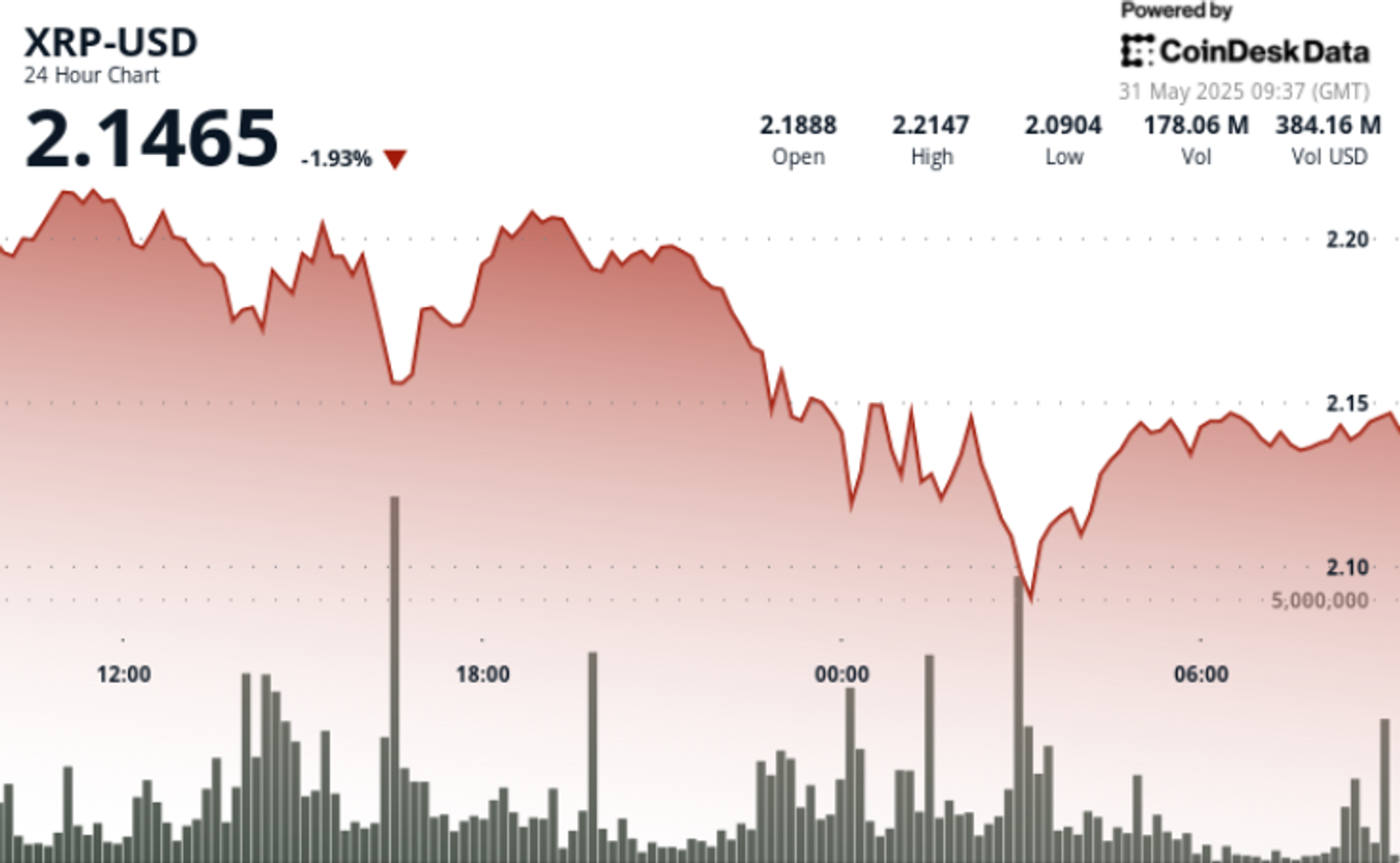

I'll speed this up. US in debt very much. Never recession always print. Other govs notice. Treasuries expire very soon. New "fiscally responsible" admin proposes bill to expand debt further. Interest rates high and climbing. Gold exploding in price. Trade war threatens unwinding of dollar reserve system. Price action crazy. Stocks down bonds down treasuires down dollar down. Wealth panics. Where to put money? Bitcoin chillin', acts as amazing low correlation buying power protection and growth asset during the panic. Def not like a 2x levered risk asset. Wealth continues gradually-then-suddenly noticing.

States establishing bitcoin reserves. Countries establishing bitcoin reserves. US president tells treasury to buy, family goes very long bitcoin including buying a miner. Corporate speculative attack on the dollar picking up steam. Bitcoin market cap: $2T, wealth that needs it right now: $400T+. US bill to buy 5% of the bitcoin supply is on the table. Boomers passing on wealth to kids, younger generations dramatically more favorable to bitcoin. What do you think? Is demand headed up or down over the next ten years?

edit: trivial grammar corrections

[link] [comments]

![[Weekly funding roundup May 24-30] Capital inflow continues to remain steady](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)