Fear of Trump’s tariffs sparked a rush on used cars—now prices are easing

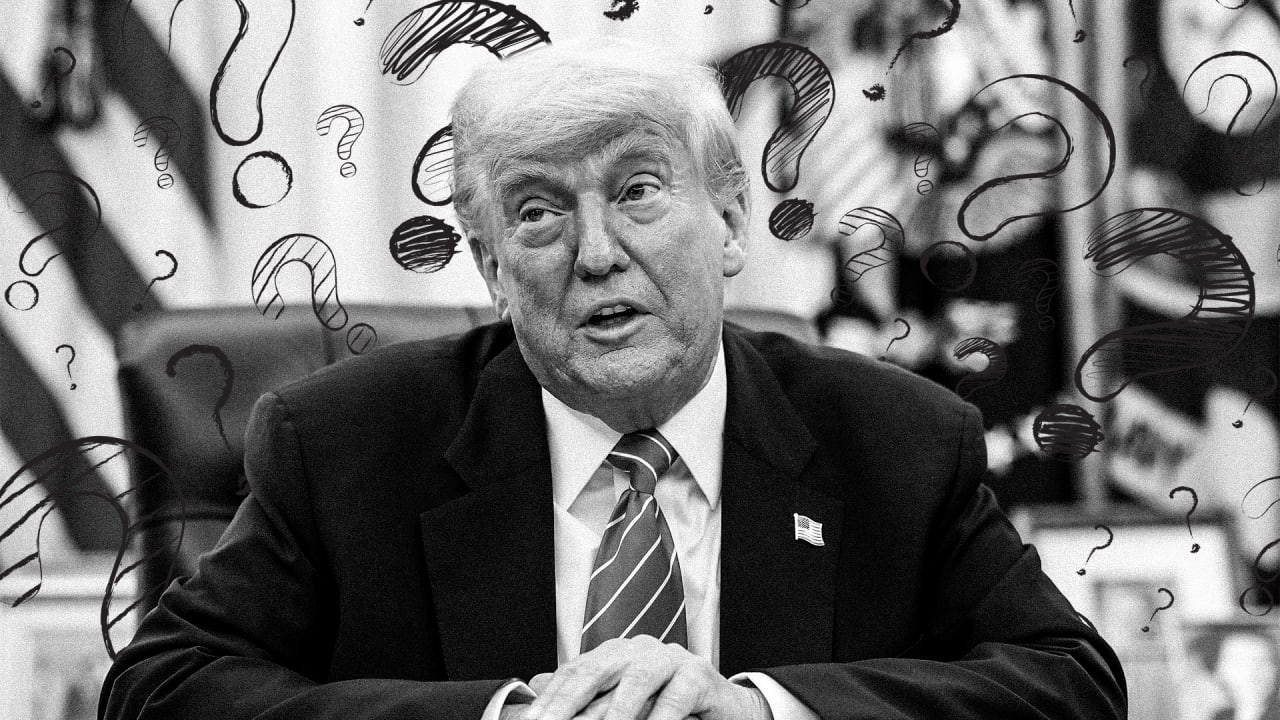

Used car prices ticked down slightly last month in spite of uncertainty around tariffs, but buying a new old whip still costs more than it used to. In April, the average cost for a used vehicle shot up as consumers raced to lock in purchases ahead of potential price hikes driven by Trump’s ongoing trade wars. The Manheim Used Vehicle Value Index from Cox Automotive, which tracks used car sales in the U.S., showed a 1.4% drop in prices last month, but prices are still up 4% compared to the same time last year. In April, used car prices saw their biggest spike since October 2023. “While the market continues to digest the impact of tariffs, we could see a bit higher levels of wholesale depreciation over the summer,” Cox Automotive Senior Director of Economic and Industry Insights Jeremy Robb said in the report, while noting that low inventory could act as a counterbalance, driving prices back up. Compared to a year ago, luxury cars saw the biggest price increase at 6.5%, with SUVs close behind with a 5.2% year-over-year increase. Electric vehicle prices were up 3.1% compared to the same time last May. Used car prices in the U.S. have been a telling indicator of market forces in recent years. In the pandemic’s early days, supply chain issues constricted the availability of new cars, driving more buyers to the used market. That demand sent used car prices up, and they mostly stayed that way. In March, President Trump announced a 25% tariff on imported cars and car parts, sowing fresh inflation concerns and sending supply chains into chaos again. Trump later eased tariffs for vehicles assembled in the U.S. using foreign parts – a reprieve intended to give U.S. automakers a break while they scramble to determine the feasibility of building domestic supply chains to replace parts sourcing abroad.

Used car prices ticked down slightly last month in spite of uncertainty around tariffs, but buying a new old whip still costs more than it used to.

In April, the average cost for a used vehicle shot up as consumers raced to lock in purchases ahead of potential price hikes driven by Trump’s ongoing trade wars. The Manheim Used Vehicle Value Index from Cox Automotive, which tracks used car sales in the U.S., showed a 1.4% drop in prices last month, but prices are still up 4% compared to the same time last year. In April, used car prices saw their biggest spike since October 2023.

“While the market continues to digest the impact of tariffs, we could see a bit higher levels of wholesale depreciation over the summer,” Cox Automotive Senior Director of Economic and Industry Insights Jeremy Robb said in the report, while noting that low inventory could act as a counterbalance, driving prices back up.

Compared to a year ago, luxury cars saw the biggest price increase at 6.5%, with SUVs close behind with a 5.2% year-over-year increase. Electric vehicle prices were up 3.1% compared to the same time last May.

Used car prices in the U.S. have been a telling indicator of market forces in recent years. In the pandemic’s early days, supply chain issues constricted the availability of new cars, driving more buyers to the used market. That demand sent used car prices up, and they mostly stayed that way.

In March, President Trump announced a 25% tariff on imported cars and car parts, sowing fresh inflation concerns and sending supply chains into chaos again. Trump later eased tariffs for vehicles assembled in the U.S. using foreign parts – a reprieve intended to give U.S. automakers a break while they scramble to determine the feasibility of building domestic supply chains to replace parts sourcing abroad.

.mp4)