Crypto stocks soar after Senate passes stablecoin bill, Circle up over 50%

The GENIUS bill would establish a regulatory framework for the stablecoin industry.

Shares of the first publicly-traded stablecoin company Circle continued to surge on Friday after the Senate passed legislation that would establish a regulatory framework for stablecoins, a type of cryptocurrency designed to maintain a value in line with the U.S. dollar, earlier this week.

Shares of Circle are up 53%, soaring from $148 to $227, since the market opened on Wednesday after the legislation passed in the Senate on Tuesday night. Shares of other crypto-related companies increased on the news with Coinbase, the leading crypto exchange in the U.S., gaining 20% since Wednesday.

The legislation, known as the GENIUS act, is a first-of-its-kind bill that would establish regulations and consumer protections for stablecoin companies, including full reserve backing, monthly audits, and anti-money laundering compliance. After passing in the Senate, it will be sent to the House of Representatives for a vote and potential revisions.

Circle issues USDC, the second-largest stablecoin by market cap behind Tether’s USDT. Circle CEO Jeremy Allaire expressed his support for the bill in a post on X after the Senate vote on Tuesday night.

“History is being made, as the US Senate passes the GENIUS Act, taking us one step closer to breakthrough legislation being signed into law that will drive U.S. economic and national competitiveness for decades to come,” he wrote.

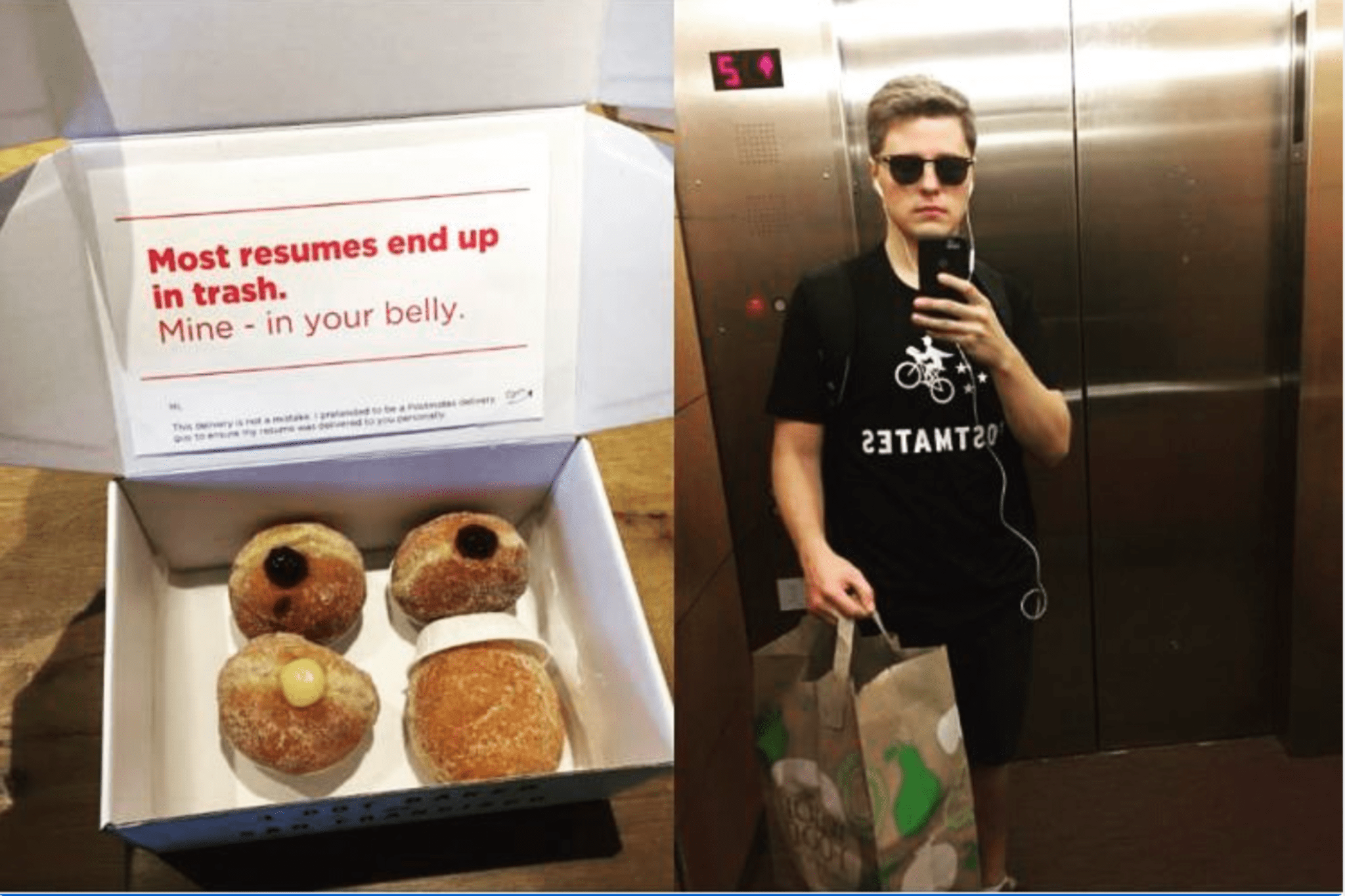

The surge in Circle’s stock price comes weeks after the company’s debut on the stock market under the ticker CRCL. After pricing its shares at $31, CRCL opened on the New York Stock Exchange at $69. Within its first day on the market, the company’s shares soared to a high of $103.75 before closing at $82.23, showcasing strong retail demand for access to the stablecoin industry.

Since 2021, stablecoins have become increasingly popular outside of the U.S. as a means to settle cross-border transfers and protect assets against inflation. Crypto firms, however, have long complained that the U.S. stablecoin industry has been hindered by a lack of clear regulations, especially under Biden-era Securities and Exchange Commission (SEC) chair Gary Gensler who initiated dozens of investigations and enforcement actions against crypto companies.

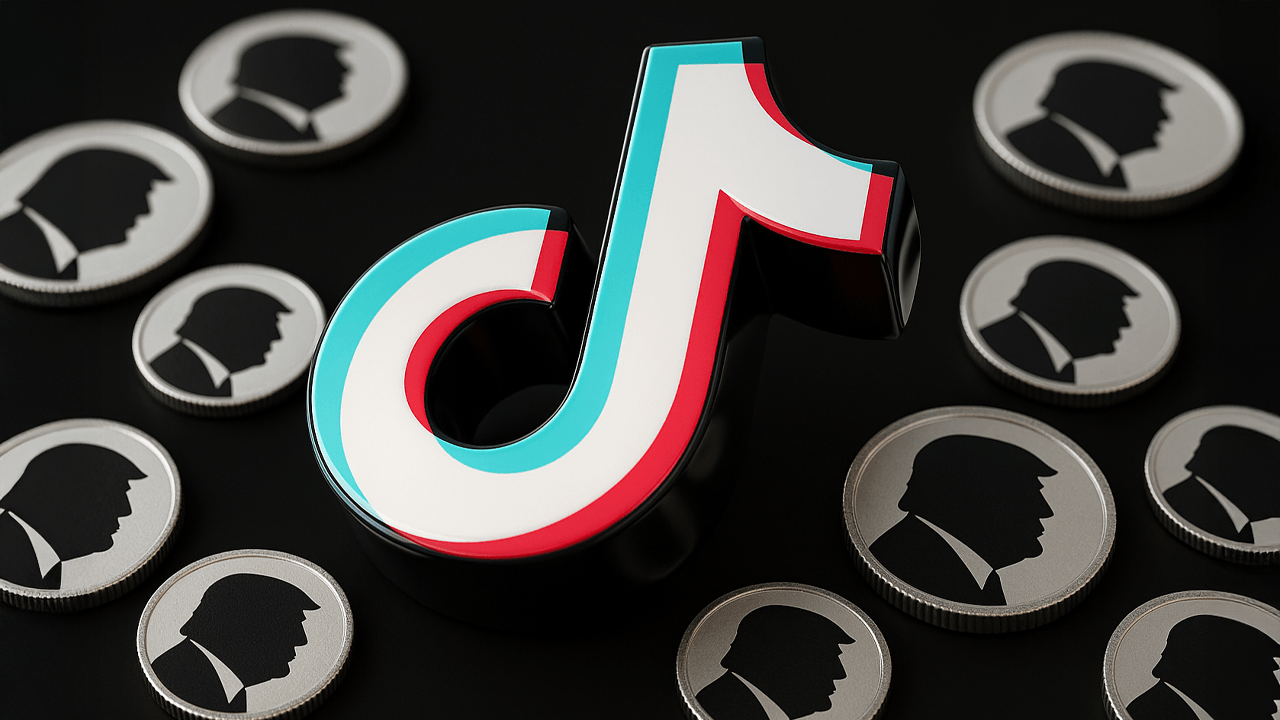

The Senate’s passage of the GENIUS act was aided by President Donald Trump’s vocal support of the broader crypto industry. In addition to pushing for Congress to pass the stablecoin bill, Trump has established a national Bitcoin reserve, pardoned crypto criminal Ross Ulbricht and appointed SEC officials that have ended a number of lawsuits against crypto companies.

With support from the U.S. president and increasing regulatory clarity, mainstream corporations are considering implementing them into their payment structures, including Meta, Google, AirBnB and X.

This story was originally featured on Fortune.com

![The Largest Communities on Reddit [Infographic]](https://imgproxy.divecdn.com/vfTS-YsC_ZrqM6F4tAXJgV6qj3gCHSsf2dvHufDbrrQ/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9sYXJnZXN0X3JlZGRpdF9jb21tdW5pdGllczIucG5n.webp)

![[Weekly funding roundup June 14-20] VC inflow crashes to second lowest level for the year](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)