Bakkt makes moves to issue $1 billion worth of securities and could potentially use the money to create a crypto treasury

A growing number of companies are adding crypto to their corporate treasuries.

Crypto infrastructure company Bakkt is looking to raise $1 billion from investors in a bid to add digital assets to its corporate assets, becoming the latest company to make moves towards creating a crypto treasury.

Bakkt, which trades on the New York Stock Exchange under the ticker BKKT, filed a form with the SEC on Thursday to issue up to $1 billion worth of securities, including common stock and preferred stock, in a Securities and Exchange Commission (SEC) filing on Thursday. Bakkt did not explicitly say that the $1 billion will be used to buy crypto, but the filing noted that the company has recently updated its investment policy to allow for the acquisition of Bitcoin and other cryptocurrencies as part of its treasury strategy.

“We may acquire Bitcoin or other digital assets using excess cash, proceeds from future equity or debt financings, or other capital sources, subject to the limitation set forth in our Investment Policy,” the filing says. “The timing and magnitude of any such transactions will depend on market conditions, capital market receptivity, business performance and other strategic considerations.”

Bakkt did not immediately respond to a request for comment from Fortune.

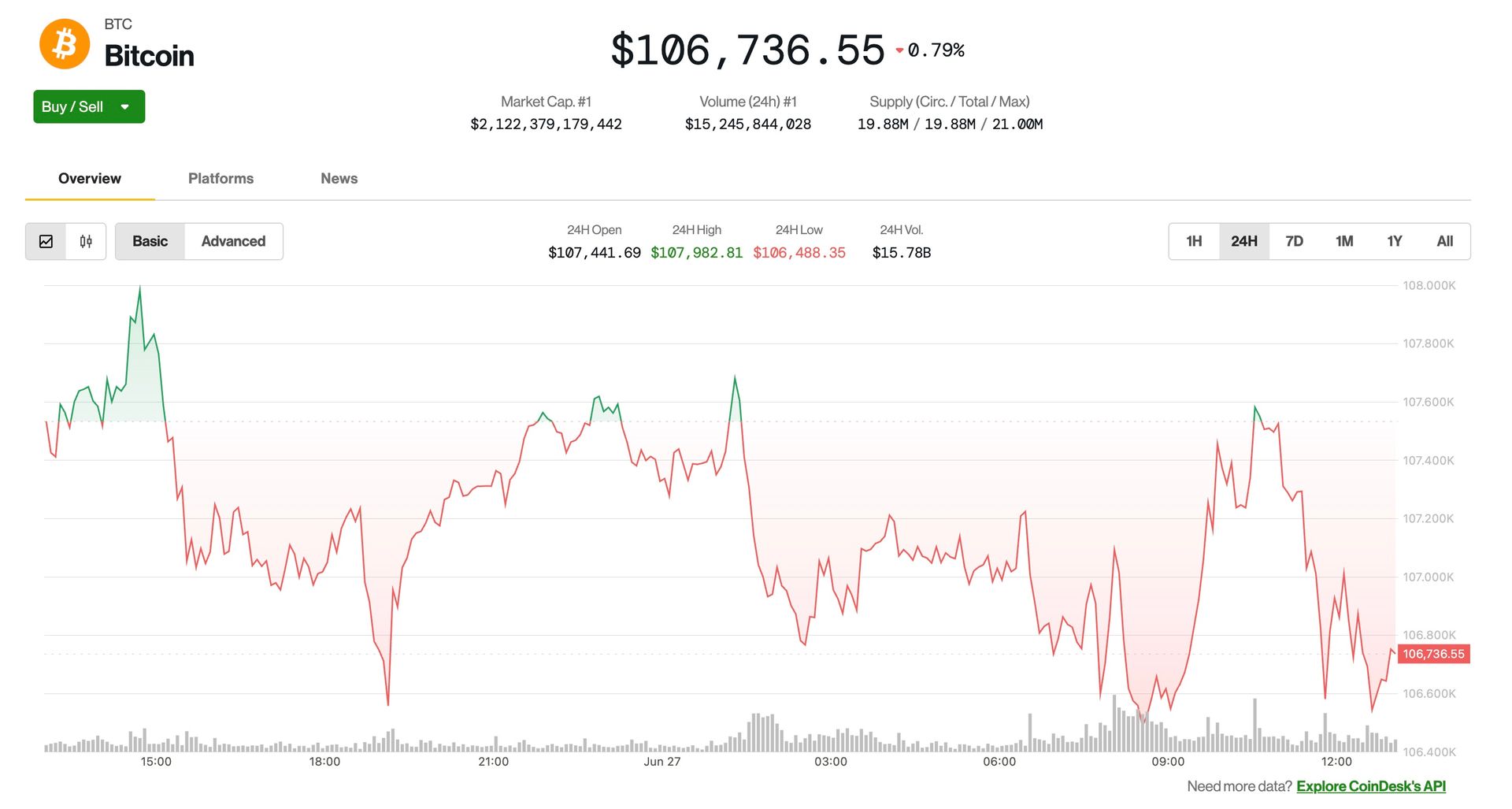

While adopting a crypto treasury strategy has been a boon for some companies, Bakkt’s SEC filing acknowledged several risk factors associated with their updated investment policy that could impact the company’s overall performance. Among 12 different risk factors listed, the filing says that Bakkt’s financial results and the market price of its securities “are expected to be affected by fluctuations in the price of digital assets we may acquire…which are highly volatile assets.”

Bakkt’s updated investment policy comes as a growing number of companies begin to establish their own crypto treasuries to diversify their balance sheets. Michael Saylor’s software company Strategy, formerly known as Microstrategy, has been accumulating Bitcoin since 2020. Strategy has stockpiled nearly 600,000 Bitcoins, worth over $60 billion at its current price, and has seen its stock price skyrocket over 3,000% in the past five years as the value of Bitcoin increases.

It became a more popular move after President Donald Trump signed an executive order to establish a national Bitcoin reserve and separate stockpile of other digital assets like Ethereum and XRP. And in recent months, a flurry of both crypto and non-crypto companies have jumped on the trend.

In March, GameStop, the embattled video game retailer, announced that it would begin buying Bitcoin. The company now has a stockpile of more than $500 million worth of Bitcoin. In April, consumer products company Upexi announced that it would raise $100 million as part of a pivot to begin accumulating Solana, the sixth-largest cryptocurrency by market cap. And Trump Media and Technology Group, the Trump family-backed company behind Truth Social, announced in May that it would raise $2.5 billion to establish a Bitcoin treasury.

This story was originally featured on Fortune.com

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)

![[Weekly funding roundup June 21-27] A sharp rise in VC inflow](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)