Are Prosus’ bets paying off?; Inside PayU India’s mixed results

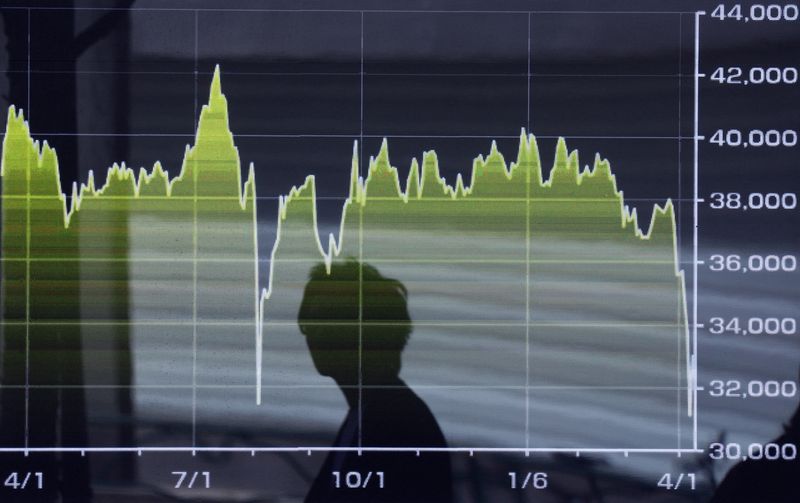

Consumer internet company Prosus reported a 47% rise in core headline earnings during the year ended March 31, 2025. PayU India, the fintech arm of Dutch technology investor Prosus, delivered a mixed performance in FY25 as it navigated a challenging regulatory environment.

Hello,

It’s raining IPOs, yet again.

Social commerce marketplace Meesho is finally back home in India after concluding its reverse flip process, and it’s wasting no time in filing the draft prospectus for its initial public offering in the next few weeks.

Walmart-backed PhonePe is also following close on Meesho’s heels, as it prepares to file preliminary documents for an IPO that may raise as much as $1.5 billion. PhonePe’s draft prospectus could be in as early as August.

There’s more on the finance and banking front: Warburg Pincus is pulling back from State Bank of India’s general insurance unit, and is in talks with Premji Invest and SBI to divest its 10% stake.

On the other hand, global trading giants such as Citadel Securities and Millennium are doubling down on India’s derivatives markets.

From ratcheting up hiring plans to pushing for exchanges to adopt better technologies, their plans hinge on expectations that large domestic consumer and investor bases will help shield India from the global fallout from US President Donald Trump’s trade policies.

India’s trajectory of economic growth is being acknowledged on a global scale. Join us at MSME Sparks 2025 by YourStory’s SMBStory, where we’re celebrating the building blocks driving this growth—medium, small and micro enterprises.

And, just in case you missed it, here’s everything that went down at the YourStory GCC Summit 2025.

In today’s newsletter, we will talk about

- How Prosus’ portfolio fared in FY25

- Inside PayU India’s mixed results

- Optimising construction with 3D printing

Here’s your trivia for today: What art movement literally means the style of “the wild beasts”?

Investor

How Prosus’ portfolio fared in FY25

Consumer internet company Prosus reported a 47% rise in core headline earnings during the year ended March 31, 2025.

The company, which has invested in Indian foodtech major Swiggy and online payment solutions firm PayU India, reported core headline earnings of $7.4 billion compared to $5 billion in FY24.

Key takeaways:

- According to the firm’s investor presentation, its bet on Swiggy has yielded an internal rate of return of 23% in FY25. Meesho and Eruditus churned out an IRR of 20% and 15%, respectively, while the firm’s investment in consumer healthcare startup PharmEasy saw a negative IRR of 29%.

- Prosus values omnichannel brand BlueStone at around $950 million, slightly below the unicorn tag. It sees the fair value of its stake in Bluestone as $42 million.

- The investment firm, one of Urban Company’s biggest shareholders, has pegged the fair value of the IPO-bound firm at about $2.4 billion. Urban Company was last valued at about $2.8 billion, according to media reports.

Funding Alert

Startup: EKA Mobility

Amount: Rs 200 Cr

Round: Equity

Startup: Rabitat

Amount: Rs 40 Cr

Round: Series A

Startup: Utopia Therapeutics

Amount: $1.5M

Round: Seed

Fintech

Inside PayU India’s mixed results

PayU India, the fintech arm of Dutch technology investor Prosus, delivered a mixed performance in FY25 as it navigated a challenging regulatory environment amid heightened competition.

PayU India saw its aEBIT (actual consolidated earnings before taxes) loss increase from $32 million in 2024 to $44 million in 2025. Revenue, however, increased 21.41%—from $551 million in FY24 to $669 million.

Earnings:

- The payments business posted a 12.16% year-on-year revenue growth to $498 million from $444 million, aided by deeper penetration among existing merchants and expansion in value-added services, Prosus said.

- PayU’s India credit business also saw its aEBIT loss grow from $20 million in FY24 to $32 million in FY25. Consolidated revenue of the vertical increased by 59.81% from $107 million to $171 million.

- “We’ve taken decisive steps to strengthen our risk practices, and the improvement in recent loan cohorts demonstrates early traction,” the company said in its annual report.

Startup

Optimising construction with 3D printing

MiCoB came into being to mitigate the operational mayhem in the construction industry using 3D concrete printing (3DCP).

Co-founder Ankita Sinha believes 3DCP can finish a project far quicker than traditional construction. “All our completed projects have been delivered in less than half the time it would have taken using conventional methods.”

MiCoB is also focused on sustainability, and the founders say the startup’s carbon footprint is lower compared to traditional construction.

News & updates

- Robotaxi launch: Tesla shares jumped 10% on Monday, as the automaker deployed a small fleet of self-driving taxis in Austin, Texas, on Sunday, marking the first time its cars have carried paying passengers without human drivers. The rides were being offered for a flat fee of $4.20 in a limited zone.

- Leadership reshuffle: Stellantis NV is reorganising its top management ranks as new CEO Antonio Filosa begins his push to turn around the struggling automaker. This includes new appointments such as Monica Genovese, who takes over the head of purchasing role from Maxime Picat.

- IP dispute: Marketing materials and a video that announced OpenAI’s $6.5 billion acquisition of Jony Ive’s secretive AI hardware startup IO Products were removed from the web due to a trademark dispute, prompting speculation about a hiccup in the agreement.

What art movement literally means the style of “the wild beasts”?

Answer: Fauvism. The movement emphasised vivid expressionism and unnatural use of colour over representational or realistic values.

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail nslfeedback@yourstory.com.

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.

![How Social Platforms Measure Video Views [Infographic]](https://imgproxy.divecdn.com/AncxHXS242CT-kDlEkGZi7uQ2k70-ebTAh7Lm14QKb8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9ob3dfcGxhdGZvcm1zX21lYXN1cmVfdmlld3MucG5n.webp)