Will the Stock Market Crash as Tariffs Hit the Economy in 2025? History Offers an Important Clue.

The S&P 500 (SNPINDEX: ^GSPC) rocketed higher when Donald Trump won the presidential election in November. Investors assumed his administration would usher in a period of booming economic growth with tax cuts and deregulation. Instead, Trump has made changes to U.S. trade policy that numerous economists say will slow economic growth and raise prices.The S&P 500 began falling in February when Trump fired the first salvo in the trade war: He announced tariffs on goods from China, Canada, and Mexico, followed by duties on aluminum, steel, and auto imports. But the losses accelerated in April when the president unveiled more aggressive "Liberation Day" tariffs. The news erased over $6 trillion from the U.S. stock market in two trading days.Surprisingly, the S&P 500 has since staged one of its greatest comebacks in history. The index is actually up 2% year to date and currently sits within striking distance of its record high. Trump softening his stance on certain trade policies has been the primary reason for the recovery, but the most aggressive tariffs are merely paused and some Wall Street analysts think investors have been lulled into a false sense of security.Continue reading

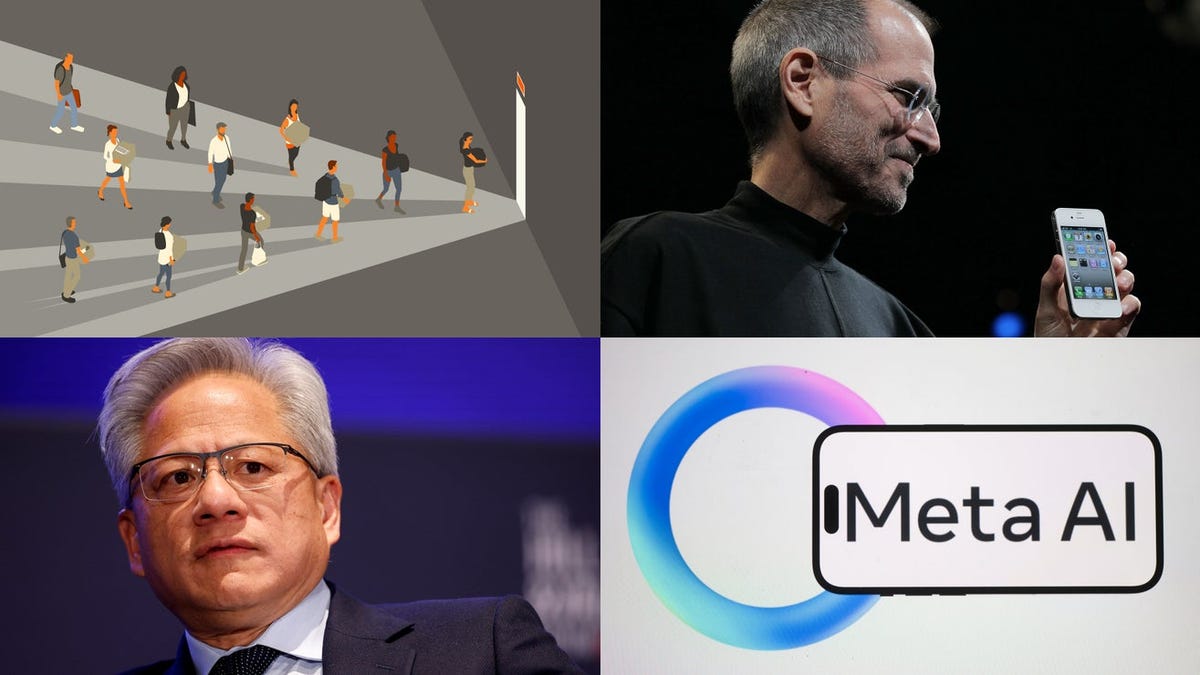

The S&P 500 (SNPINDEX: ^GSPC) rocketed higher when Donald Trump won the presidential election in November. Investors assumed his administration would usher in a period of booming economic growth with tax cuts and deregulation. Instead, Trump has made changes to U.S. trade policy that numerous economists say will slow economic growth and raise prices.

The S&P 500 began falling in February when Trump fired the first salvo in the trade war: He announced tariffs on goods from China, Canada, and Mexico, followed by duties on aluminum, steel, and auto imports. But the losses accelerated in April when the president unveiled more aggressive "Liberation Day" tariffs. The news erased over $6 trillion from the U.S. stock market in two trading days.

Surprisingly, the S&P 500 has since staged one of its greatest comebacks in history. The index is actually up 2% year to date and currently sits within striking distance of its record high. Trump softening his stance on certain trade policies has been the primary reason for the recovery, but the most aggressive tariffs are merely paused and some Wall Street analysts think investors have been lulled into a false sense of security.

.mp4)