Trump’s threat of ‘regime change’ in Iran is being greeted with calm and enthusiasm by the markets

Investors are unconcerned about major oil disruptions, reasoning that Iran is unlikely to close the Strait of Hormuz and harm its own economy.

- Despite President Trump’s threat of “regime change” in Tehran following U.S. strikes on Iranian nuclear sites, the markets have reacted with calm and even optimism. Oil prices, after a brief spike, returned to pre-strike levels, and volatility indices dropped, while equities edged higher. Investors are unconcerned about major oil disruptions, reasoning that Iran is unlikely to close the Strait of Hormuz and harm its own economy.

You’d think the price of oil would be heading toward $100 per barrel right now—but it’s not.

Donald Trump threatened “regime change” in Iran early this morning and, counterintuitively, the price of oil declined back to roughly where it was ($76/barrel) prior to the U.S. bombing of Iran’s nuclear facilities. Sure, there was a brief spike in the price to $79. But the decline happened despite Iran’s threat to close the Strait of Hormuz, the shipping bottleneck in the Persian Gulf through which 20% of the world’s oil flows.

The VIX volatility index—the so-called “fear index”—was down 6% this morning and S&P 500 futures rose 0.22%.

Why are investors so calm in a world filled with war and chaos?

Because Iran’s options in terms of screwing up the oil market are actually quite limited.

First, if Iran closed the Strait, the country it would hurt the most would be itself. Iran needs oil revenues as much as the rest of the world needs Iranian oil. And the U.S. would barely feel the closure of the Strait because it buys very little oil from the Gulf region. The predominant buyer of Iranian oil is China, which is an ally of Tehran … so you can see why investors don’t think that Iran is going to shoot itself in that particular foot, and why Iran has not actually closed the Strait yet.

Historically, it would be extremely unlikely for Iran to actually block the shipping route. The Iranian regime has never done that in its five-decades of existence, according to Convera’s George Vessey. And if it did so, it would strengthen the U.S. dollar—which has been through a weak spot of late. (Oil contracts are settled in dollars so if the price rises the demand for dollars increases likewise.)

“In the lead-up to the strikes, markets were pricing in diplomatic progress: the euro strengthened, the dollar softened, safe havens were muted, and oil dropped nearly 3% on Friday — signaling a partial return to the pre-conflict playbook. But the U.S. intervention has now reversed that momentum. While the broader bias still leans toward structural dollar weakness, escalating Middle East tensions are injecting support for the greenback via the commodity channel. … As such, even the threat alone is enough to keep the dollar bid, with positioning set to adjust as investors begin to unwind their bearish USD bets,” Vessey told clients.

Elsewhere, investors are beginning to suspect that Saturday’s bombing looks more like the closure of a period of uncertainty rather than the beginning. The current situation is that Iran’s air capability is gone, its nuclear weapons program is at the very least heavily damaged, it has a limited ability to punish the world with higher oil prices, and its military retaliation against further bombing by Israel overnight consisted of just one—one!—missile.

“A weakened Iran with no nuclear capacity removes the biggest threat to the Middle East and Israel which will be viewed as a positive for the market and tech stocks in particular as investors digest this news,” Wedbush’s Daniel Ives and team told their clients this morning. “The market will view this Iran threat as now gone and that is a positive for growth in the broader Middle East and ultimately the tech sector. It will take some time for this conflict to settle, but the market will view the worst is now in the rearview mirror with investors looking forward.”

Nonetheless, if Iran did suppress the oil market, what might that look like?

There could be an “estimated geopolitical risk premium of $12” on each barrel, according to Goldman Sachs. “We consider [there might be] two types of oil disruption scenarios, not in our base case: 1) reductions in Iran supply only ($80 Brent), and 2) broader disruption of regional oil production or shipping ($110 Brent),” analysts Sahar Islam and Ayushi Mishra wrote in a note seen by Fortune.

Here’s a snapshot of the action prior to the opening bell in New York:

- The S&P 500 closed at 5,967.84 on Friday, it’s up 1.47% YTD.

- This morning, S&P futures were up 0.22% after the price of oil briefly spiked over $79 per barrel and then declined back to just over $76.

- The VIX volatility index was down 6% this morning.

- The Stoxx Europe 600 and the U.K.’s FTSE 100 were both flat in early trading.

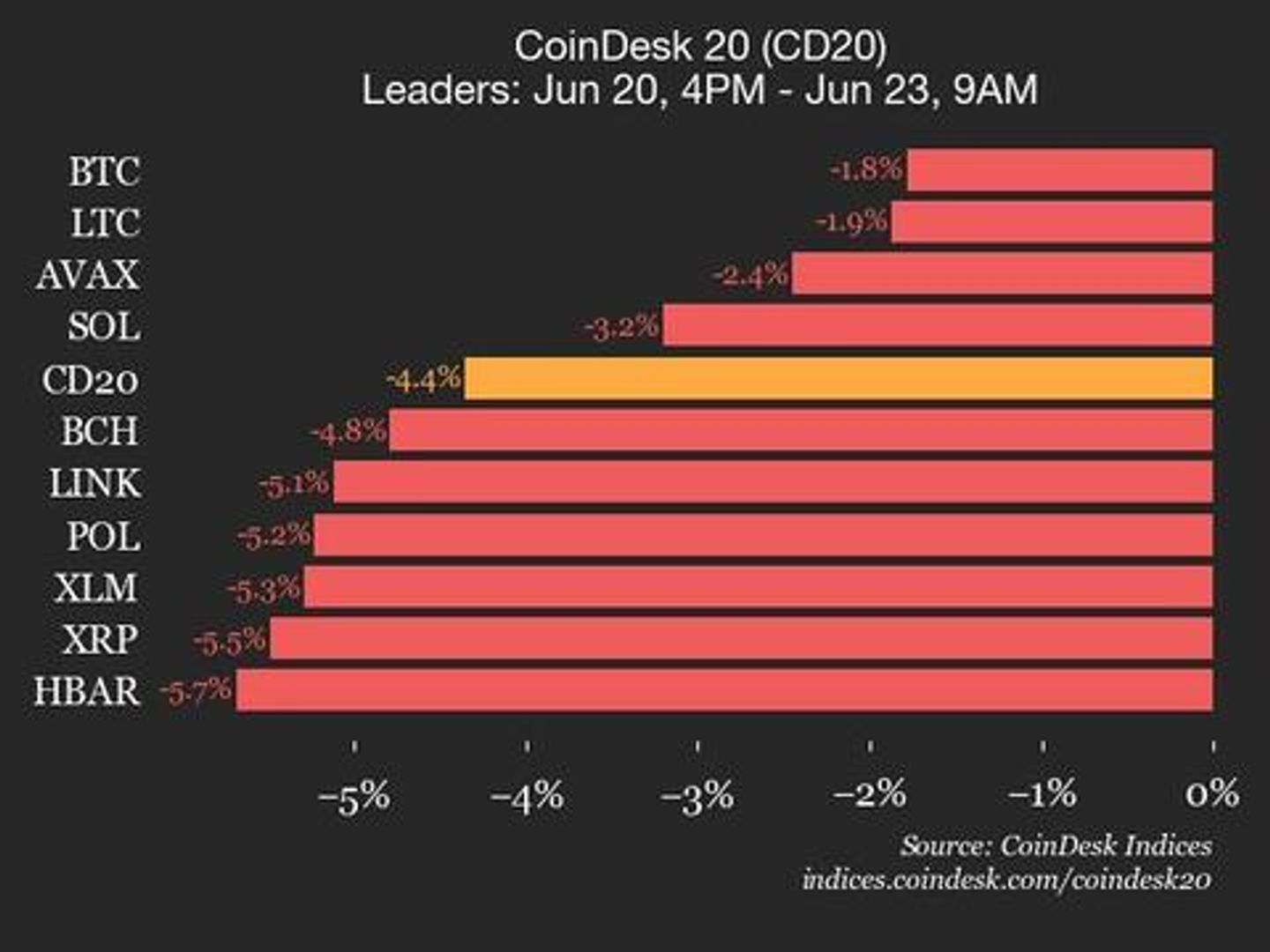

- Bitcoin is back over $101K after hitting a low around $98K.

- China and Hong Kong were broadly up this morning.

- Japan, South Korea, and India all saw declines.

This story was originally featured on Fortune.com

![Is ChatGPT Catching Google on Search Activity? [Infographic]](https://imgproxy.divecdn.com/RMnjJQs1A7VQFmqv9plBlcUp_5Xhm4P_hzsniPsfHiU/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9kYWlseV9zZWFyY2hlc19pbmZvZ3JhcGhpYzIucG5n.webp)