Trump’s ‘One Big Beautiful Bill’ is one big betrayal of American energy progress

Now in the Senate, the bill guts a tax incentive that dramatically reduces the cost for installing solar energy projects.

The budget negotiations in Congress could dramatically reshape the energy industry—not by advancing it, but by dragging it backward. The “One Big Beautiful Bill” (OBBB), recently revised by the Senate Finance Committee, is branded as sweeping reform. But in reality, it weakens domestic energy output just as the country faces surging demand—weakening our energy resilience and adding at least $2.8 trillion to our national debt.

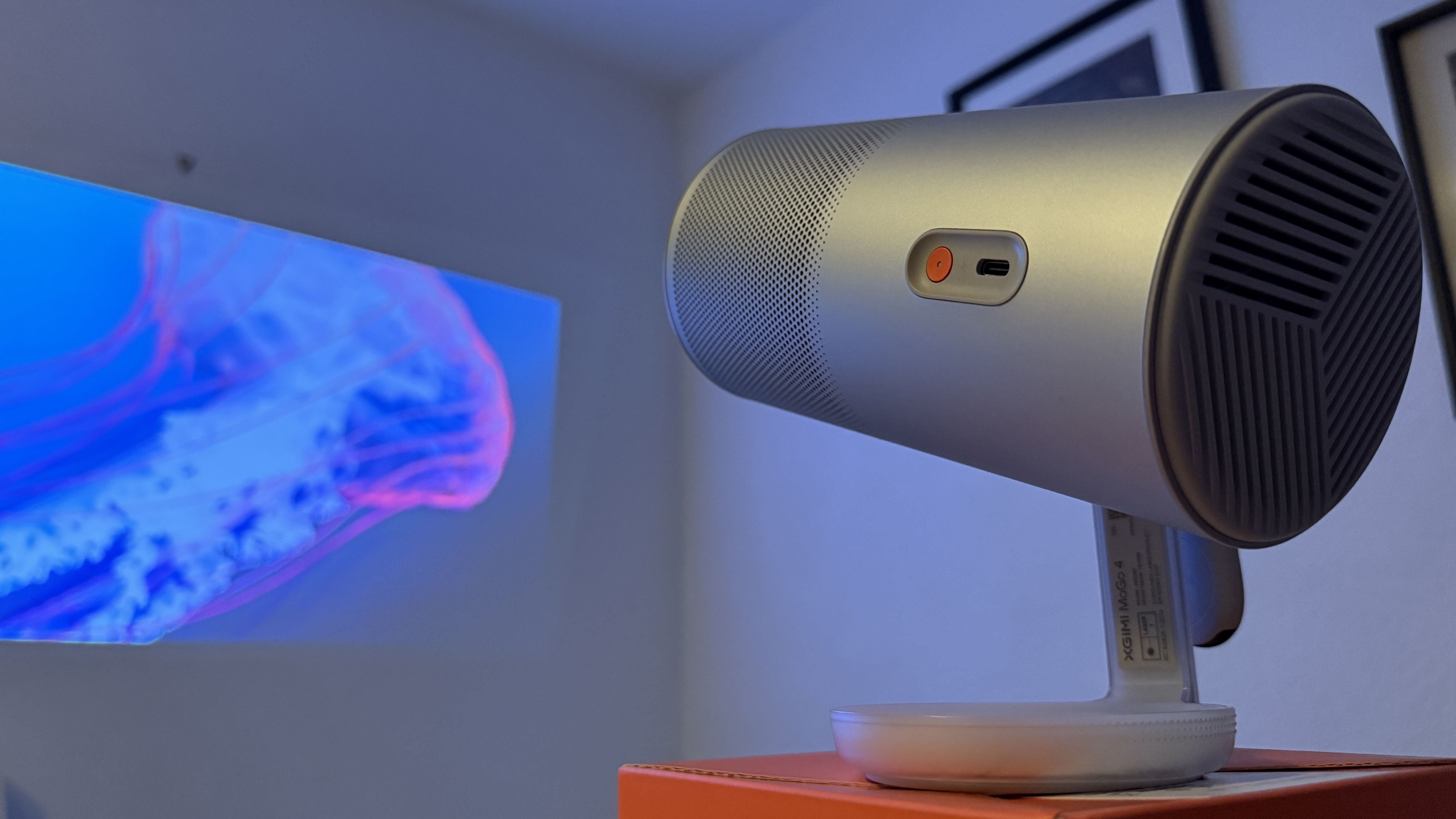

Most significantly, the OBBB guts one of the most effective energy incentives in the country: the 30% Investment Tax Credit (ITC). For homeowners, the ITC dramatically reduces the cost for going solar. As written, the OBBB would phase out certain elements of the ITC for homeowners within 180 days and the remainder of credits starting at the end of this year, with full incentive elimination for businesses at the end of 2027. To put it in perspective: Even a “simple” solar project currently takes up to six months, making a short phase-down window like this extremely disruptive.

Make no mistake: The solar industry should not rely on federal tax credits indefinitely. This was never the intention of the initial ITC proposal enacted in the Inflation Reduction Act (IRA). However, the OBBB’s abrupt repeal would cause severe and immediate harm. It could even destabilize the entire American solar industry. Without a more structured, longer-term phase-down timeline, developers, manufacturers, and installers will scramble to meet tight deadlines and face a massive drop in demand shortly thereafter. This threatens project viability, workforce stability, and long-term investments. According to the Solar Energy Industries Association, this bill jeopardizes up to 330,000 jobs and 331 U.S. factories.

The current bill also undermines the appeal of investing in domestic energy. Many hundreds of billions of dollars have been invested in renewable energy based on policies set by Congress. This legislation will make potential investors ask: Why invest in a market governed by U.S. policy if that policy can reverse course so abruptly and completely? Such unpredictability raises serious doubts about the reliability of U.S. policy as a foundation for long-term investment.

Instead, Congress should pursue a steady phase-down of tax credits, which would allow the industry to adapt, preserve many thousands of jobs, and ensure our ever-growing energy needs are met.

The IRA also spurred investment in large-scale solar projects that connect directly to the grid and help power entire communities. These projects often rely on low-cost financing provided through federal loan programs. The OBBB would eliminate this low-cost financing, significantly undercutting the financial viability of many solar energy projects. If developers are unable to secure alternative financing, many solar projects would likely be scrapped altogether. This would inevitably increase utility costs—expenses that are often passed directly to the customer.

Homeowners are already unhappy with the current state of utilities, particularly in light of extreme weather events and widespread outages. If these solar projects are delayed or shut down due to lack of funding, other energy sources will not be able to meet demand in a timely or cost-effective manner. And while fossil fuels have historically been a flexible, reliable option, equipment backlogs now force developers to reserve gas turbines seven to eight years in advance, so new projects wouldn’t enter service until 2031 or later. Nuclear energy is pushed even further out: The U.S. Department of Energy’s Pathways to Commercial Liftoff report notes that broad deployment of next-generation reactors is unlikely to begin before 2035.

That leaves solar as the best solution to meet our energy needs, avoid blackouts, and keep energy costs under control as we enter the AI revolution. A large-scale, commercial solar project can be deployed in 12 to 18 months, and projects in recent years have been completed at 40% less than the cost of gas plants today. While interconnection remains a challenge in some regions, solar still offers the fastest, most cost-effective path to adding new capacity at scale. And now that grid-scale energy storage is commercially viable, it’s the ideal complement to solar—ensuring reliable, round-the-clock power.

Residential solar and storage can be installed even faster. This makes solar the only scalable way to add generation capacity to the grid in the timeframes we need. And there’s bipartisan support, with 82% of Democrats, 74% of Republicans, and 73% of independents indicating that solar is a good investment. That’s how we can meet energy demand, lower energy costs, and keep everyone happy.

The Senate is expected to vote this week, with President Trump pushing to pass the bill by July 4. We’re at a critical juncture, and the potential ramifications are far-reaching. The decisions made in Washington now will shape the trajectory of America’s economic and energy leadership for decades to come. The OBBB, as currently written, will effectively cede leadership of the solar industry to China. Global demand for solar isn’t slowing down, and if the U.S. steps back, others will take our place.

At a time when consumers want more control over their energy and the demand for electricity is at an all-time high, energy independence is more important than ever. This bill moves us in exactly the wrong direction. Our leaders and lawmakers have to push back, advocate for a forward-thinking energy policy, and defend the future of resilient, affordable, and accessible power for all.

Chris Hopper is cofounder and CEO of Aurora Solar, a cloud-based solar design and sales platform

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

![How Social Platforms Measure Video Views [Infographic]](https://imgproxy.divecdn.com/AncxHXS242CT-kDlEkGZi7uQ2k70-ebTAh7Lm14QKb8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9ob3dfcGxhdGZvcm1zX21lYXN1cmVfdmlld3MucG5n.webp)

![How Google’s AI Mode Compares to Traditional Search and Other LLMs [AI Mode Study]](https://static.semrush.com/blog/uploads/media/86/bc/86bc4d96d5a34c3f6b460a21004c39e2/f673b8608d38f1e4be0316c4621f2df0/how-google-s-ai-mode-compares-to-traditional-search-and-other-llms-ai-mode-study-sm.png)