This little-known AI darling is climbing the Fortune 500 faster than any other company

Super Micro Computer skyrocketed 206 spots on the Fortune 500, thanks to its pivotal role in powering the AI boom.

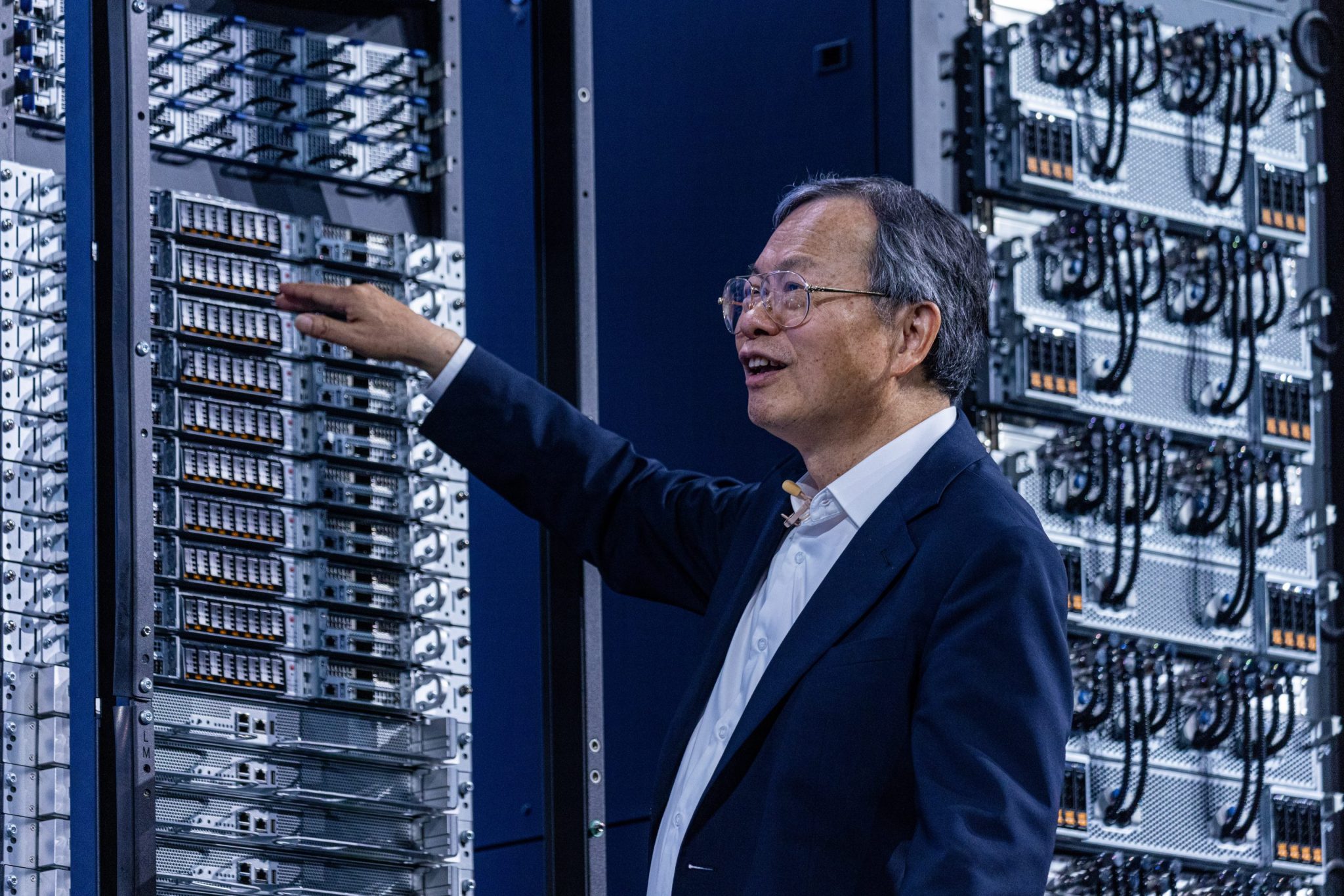

In a year when the tech sector grappled with mass layoffs, volatile chip demand, and the frenzied race to scale AI infrastructure, one company surged ahead as the Fortune 500’s biggest climber: Super Micro Computer. The San Jose-based IT hardware manufacturer posted explosive growth, jumping 206 spots to land at No. 292 more than any other company on this year’s list.

Super Micro more than doubled its revenue to $14.99 billion, a 110% year-over-year increase, and led its industry in one-year profit growth, earning $1.15 billion.

The company’s rise is largely due to its strategic position at the intersection of AI, cloud computing, and data center infrastructure, three of the fastest-growing areas in technology today.

At the center of its strategy is cofounder and CEO Charles Liang, who has emphasized vertical integration, with the company designing, testing, and assembling its products in-house. Liang says the company is laser-focused on innovation, including early-to-market compatibility with Nvidia chips and customizable server hardware built to handle diverse, high-performance workloads. That approach has positioned Super Micro to take advantage of soaring demand for AI-ready infrastructure. Super Micro has shipped more than 1.3 million server and storage nodes, which provide processing power and manage data for machines, and its systems now power many of the world’s data centers.

Through close partnerships with Nvidia and Intel, Super Micro has become a preferred vendor for companies building AI-optimized environments. Recently, it was selected by Elon Musk’s xAI team to support the development of a 750,000-square-foot data center in Memphis, a major signal of the company’s growing influence.

Liang has spoken publicly about Super Micro’s close alignment with Nvidia’s product roadmap, which allows the company to quickly integrate new technologies.

“Whatever Nvidia develops, we pretty much sync up with them,” he told CRN in 2024. “And that’s another reason why, whenever they have a new product out, we have a new product available quicker than our competitors do.”

As demand for AI accelerates, Super Micro plans to expand its server production capacity in the United States. The company is also investing in green computing, branding its systems as energy-efficient alternatives in a sector under increasing scrutiny for environmental impact.

Investors have taken notice. Super Micro’s market capitalization is approaching $24 billion, reflecting increased confidence in its trajectory. However, the company’s rise has not come without controversy.

In 2018, Nasdaq delisted the company for failing to file its financial reports on time. It was re-listed in 2020 following a settlement with the SEC. In August 2024, the company faced renewed scrutiny after Hindenburg Research published a report alleging questionable accounting practices and undisclosed third-party transactions.

Soon after, the company missed multiple regulatory filing deadlines, and audit firm EY resigned. Super Micro and Liang are now facing multiple lawsuits and active investigations by both the SEC and the Department of Justice. The company has said it is cooperating with authorities.

The company said that by February it had brought its financial reporting up to date, passed a new independent audit, and implemented leadership changes. It has hired a new general counsel and is actively searching for a new chief financial officer.

Despite reporting third-quarter revenue below expectations in early May, Super Micro reiterated its growing confidence in meeting full-year growth targets, with Liang assuring investors that demand for AI infrastructure remains strong.

“We are investing in people, processes, and systems to scale our foundation, advancing our leadership in liquid cooling technology, and delivering Data Center Building Block Solutions to achieve and surpass our revenue targets,” a company spokesperson told Fortune in an emailed statement.

This story was originally featured on Fortune.com

.png)