The Penny Is Dead — Long Live Bitcoin

It costs $3.69 cents to make a 1-cent coin. That’s not just backwards — it’s proof the system is broken. ⸻ So RIP to the U.S. penny, a coin so devalued by inflation that it now costs almost 4x its face value just to mint. The U.S. Treasury just ordered its final batch of penny blanks, marking the quiet end of a coin that’s long outlived its usefulness — and more importantly, its purchasing power. Let that sink in: It costs 3.69 cents to produce a 1-cent coin. And somehow, inflation is not considered theft. It’s just “policy.” The Wenny Was Supposed to Grow in Value — Not Become Trash In a world of sound money, where currency supply is limited and tied to real productivity, each unit of money becomes more valuable over time. Technology advances, prices fall, and your savings stretch further. But fiat money doesn’t work that way. • In the 1950s, a penny could buy you a piece of candy. • By 2025, it should've become ten times MORE valuable, but instead it became 400x less valuable The reason? The Fed prints. Value leaks. Your money's buying power dies slowly. As Saifedean Ammous argues in his book, The Bitcoin Standard, fiat currencies destroy long-term planning. They reward debt, punish savers, and inflate away real value — all under the illusion of “stimulating growth.” Jeff Booth (author of The Price of Tomorrow) makes the case that deflation is natural in a tech-driven world; More innovation should mean cheaper stuff, not rising prices. But central banks ruin it by printing more money for government benefit — diluting your dollars and distorting the economy. The penny didn’t fail. The Keynesian fiat system failed the penny. Bitcoin Fixes This Time for a return to Austrian economics with a new standard of money — one that can't be backdoor devalued by Government greed. 1. Fixed Supply – 21 million. Forever. No bailouts. No backroom deals. 2. Neutral & Global – Borderless, permissionless, immune to sanctions and manipulation. 3. Aligned Incentives – No counterparty risk. HODLing it rewards discipline. Fiat punishes it. Bitcoin is what the penny could’ve been — a real store of value. Instead, the penny is soon to be a relic, not even worthy of becoming a valued collectible. ⸻ The Bottom Line: The death of the penny is a warning. The dollar isn’t far behind. Sound money isn’t a luxury. It’s a necessity. Bitcoin is the way forward. SaveInBitcoin ⸻ Let’s Discuss: • Could a Bitcoin standard have preserved the penny’s relevance? • How long before the rest of fiat crumbles under its own weight? • If not Bitcoin… is your savings plan in gold or what’s your alternative? Links & Sources: • The Bitcoin Standard – Saifedean Ammous • The Price of Tomorrow - Jeff Booth • Treasury’s Final Penny Shipment ⸻ TL;DR: The U.S. just killed the penny. It died because fiat money is a rigged, self-destructive joke. Bitcoin is the best chance to save the working class. ⸻ submitted by /u/AutomatonRobot [link] [comments]

It costs $3.69 cents to make a 1-cent coin. That’s not just backwards — it’s proof the system is broken.

⸻

So RIP to the U.S. penny, a coin so devalued by inflation that it now costs almost 4x its face value just to mint.

The U.S. Treasury just ordered its final batch of penny blanks, marking the quiet end of a coin that’s long outlived its usefulness — and more importantly, its purchasing power.

Let that sink in: It costs 3.69 cents to produce a 1-cent coin. And somehow, inflation is not considered theft. It’s just “policy.”

The Wenny Was Supposed to Grow in Value — Not Become Trash

In a world of sound money, where currency supply is limited and tied to real productivity, each unit of money becomes more valuable over time. Technology advances, prices fall, and your savings stretch further.

But fiat money doesn’t work that way. • In the 1950s, a penny could buy you a piece of candy. • By 2025, it should've become ten times MORE valuable, but instead it became 400x less valuable

The reason? The Fed prints. Value leaks. Your money's buying power dies slowly.

As Saifedean Ammous argues in his book, The Bitcoin Standard, fiat currencies destroy long-term planning. They reward debt, punish savers, and inflate away real value — all under the illusion of “stimulating growth.”

Jeff Booth (author of The Price of Tomorrow) makes the case that deflation is natural in a tech-driven world; More innovation should mean cheaper stuff, not rising prices. But central banks ruin it by printing more money for government benefit — diluting your dollars and distorting the economy.

The penny didn’t fail. The Keynesian fiat system failed the penny.

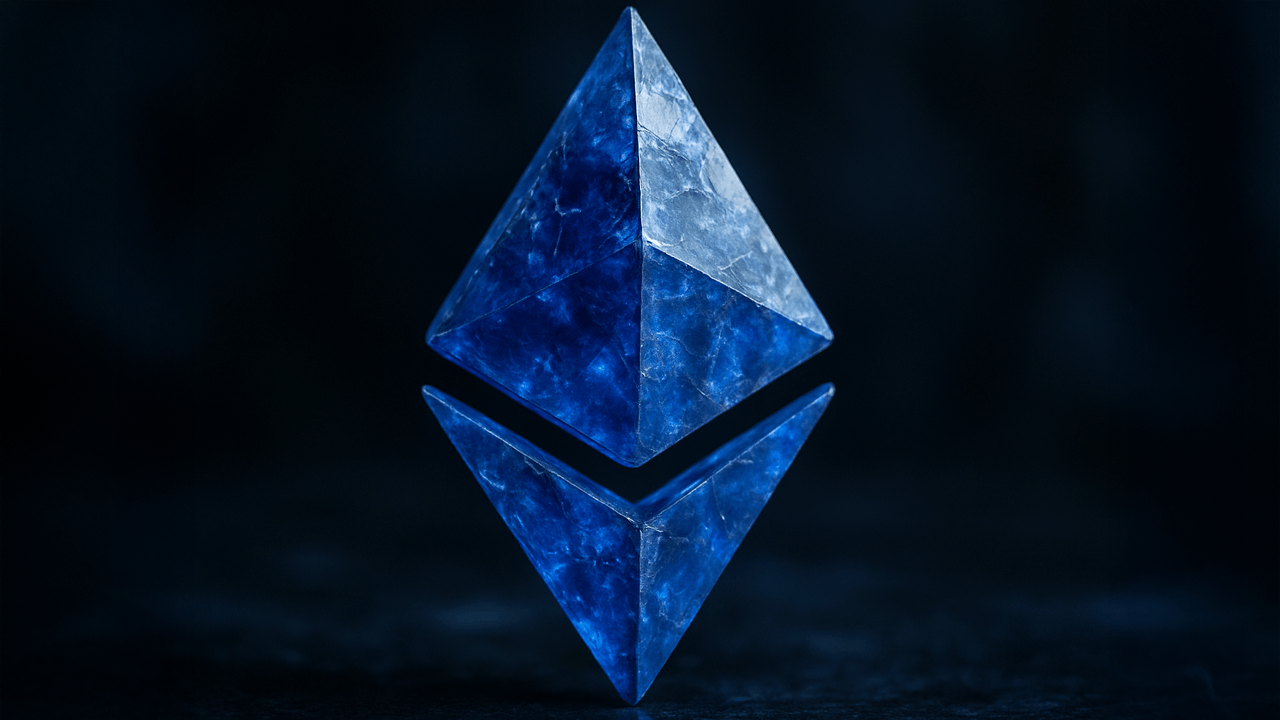

Bitcoin Fixes This

Time for a return to Austrian economics with a new standard of money — one that can't be backdoor devalued by Government greed.

1. Fixed Supply – 21 million. Forever. No bailouts. No backroom deals. 2. Neutral & Global – Borderless, permissionless, immune to sanctions and manipulation. 3. Aligned Incentives – No counterparty risk. HODLing it rewards discipline. Fiat punishes it. Bitcoin is what the penny could’ve been — a real store of value. Instead, the penny is soon to be a relic, not even worthy of becoming a valued collectible.

⸻

The Bottom Line:

The death of the penny is a warning. The dollar isn’t far behind.

Sound money isn’t a luxury. It’s a necessity. Bitcoin is the way forward.

SaveInBitcoin

⸻

Let’s Discuss: • Could a Bitcoin standard have preserved the penny’s relevance? • How long before the rest of fiat crumbles under its own weight? • If not Bitcoin… is your savings plan in gold or what’s your alternative?

Links & Sources: • The Bitcoin Standard – Saifedean Ammous • The Price of Tomorrow - Jeff Booth • Treasury’s Final Penny Shipment

⸻

TL;DR: The U.S. just killed the penny. It died because fiat money is a rigged, self-destructive joke. Bitcoin is the best chance to save the working class.

⸻

[link] [comments]