CFTC Might Regulate Crypto Perpetual Futures “Very Soon”: Commissioner Mersinger

Outgoing Commodity Futures Trading Commission (CFTC) Commissioner Summer Mersinger confirmed yesterday (Thursday) that the agency might “very soon” authorise the issuance and circulation of crypto perpetual contracts.It Would Be “Great to Get that Trading Back Onshore”Speaking to Bloomberg TV, Mersinger emphasised that perpetual crypto futures “can come to market now.”“We’re seeing some applications, and I believe we’ll see some of those products trading live very soon,” said Mersinger, who will leave the agency later this month. She added that it would be “great to get that trading back onshore in the United States.”Her confirmation came a month after the regulatory agency sought public comments on perpetual futures contracts. Mersinger is set to join the Blockchain Association as CEO next month, following the departure of its current CEO, Kristin Smith.You may also like: CFTC Urges Tighter Market Safeguards to Prevent Trading Chaos amid Volatility“Perps” Are Very PopularPerpetual contracts, also known as “perps,” are structured similarly to regular futures. The CFTC stated in its request for comments that the contracts’ settlement, pricing, and margin calculations are conducted on an ongoing basis, often multiple times per day. However, unlike regular futures, these contracts do not have expiration dates, meaning they can be held indefinitely.Perpetual futures contracts have gained traction outside the United States. These contracts are particularly popular in the cryptocurrency industry, as many crypto derivatives platforms offer them globally, but not within the US.The largest issuers of these perpetual contracts are crypto exchanges such as Binance, OKX, and Bybit, which offer them via offshore platforms. Binance leads the market, offering over 500 crypto perpetual pairs and handling about $95 billion in daily trading volume.Many crypto exchanges also target the European markets with such perpetual contracts. However, the European Union already enforces the Markets in Financial Instruments Directive II (MiFID II) to regulate these instruments. Coinbase, Kraken, Gemini, and Crypto.com are among the exchanges that have obtained licences to offer such contracts, along with other derivatives, to European customers.Read more: Kraken Puts Cyprus Licence to Use - Launches Crypto Derivatives in EuropeAccording to Mersinger, regulating such contracts in the US would be “a really good thing for these markets and would be really beneficial to the industry broadly.” This article was written by Arnab Shome at www.financemagnates.com.

Outgoing Commodity Futures Trading Commission (CFTC) Commissioner Summer Mersinger confirmed yesterday (Thursday) that the agency might “very soon” authorise the issuance and circulation of crypto perpetual contracts.

It Would Be “Great to Get that Trading Back Onshore”

Speaking to Bloomberg TV, Mersinger emphasised that perpetual crypto futures “can come to market now.”

“We’re seeing some applications, and I believe we’ll see some of those products trading live very soon,” said Mersinger, who will leave the agency later this month. She added that it would be “great to get that trading back onshore in the United States.”

Her confirmation came a month after the regulatory agency sought public comments on perpetual futures contracts. Mersinger is set to join the Blockchain Association as CEO next month, following the departure of its current CEO, Kristin Smith.

You may also like: CFTC Urges Tighter Market Safeguards to Prevent Trading Chaos amid Volatility

“Perps” Are Very Popular

Perpetual contracts, also known as “perps,” are structured similarly to regular futures. The CFTC stated in its request for comments that the contracts’ settlement, pricing, and margin calculations are conducted on an ongoing basis, often multiple times per day. However, unlike regular futures, these contracts do not have expiration dates, meaning they can be held indefinitely.

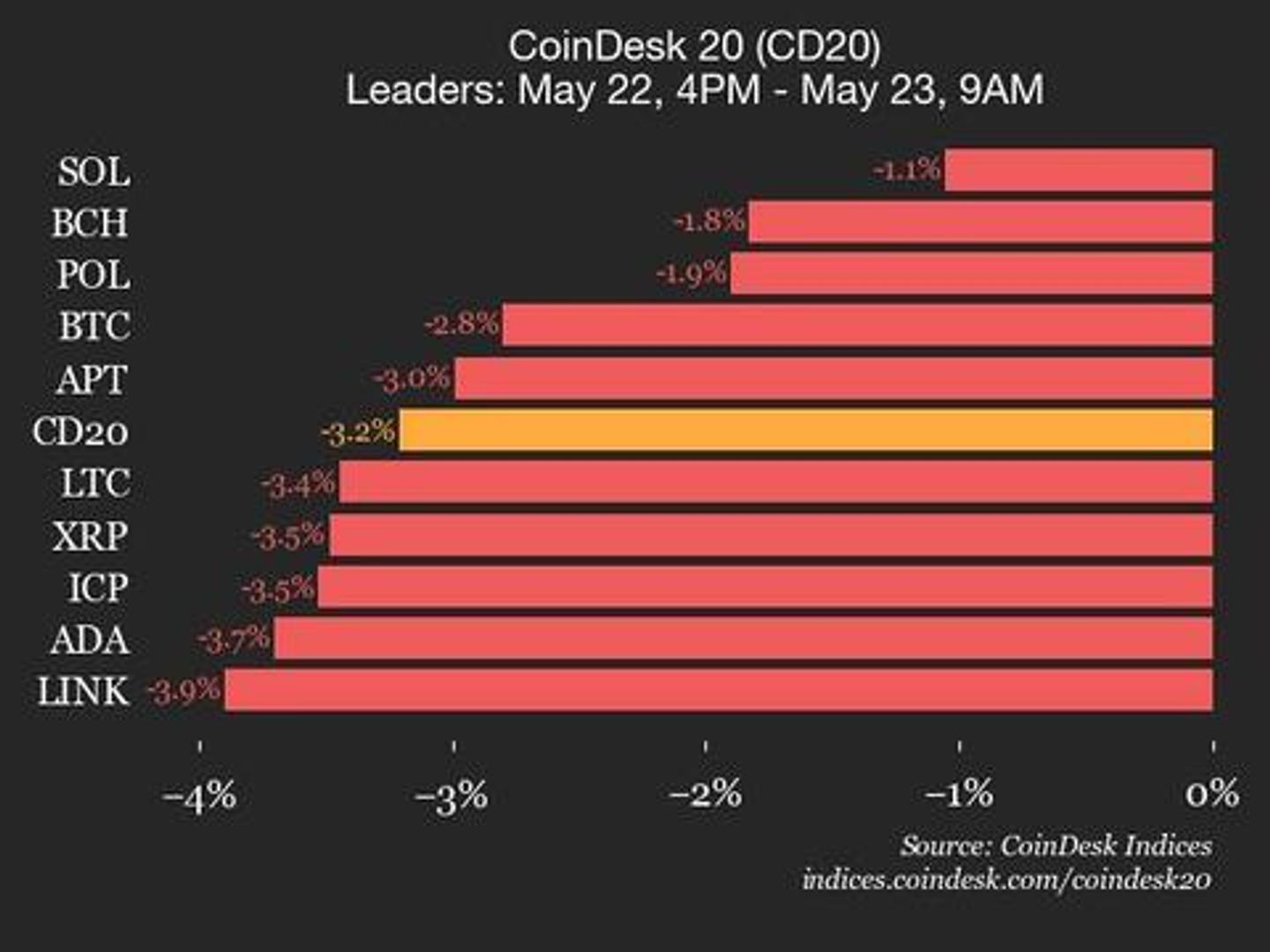

Perpetual futures contracts have gained traction outside the United States. These contracts are particularly popular in the cryptocurrency industry, as many crypto derivatives platforms offer them globally, but not within the US.

The largest issuers of these perpetual contracts are crypto exchanges such as Binance, OKX, and Bybit, which offer them via offshore platforms. Binance leads the market, offering over 500 crypto perpetual pairs and handling about $95 billion in daily trading volume.

Many crypto exchanges also target the European markets with such perpetual contracts. However, the European Union already enforces the Markets in Financial Instruments Directive II (MiFID II) to regulate these instruments. Coinbase, Kraken, Gemini, and Crypto.com are among the exchanges that have obtained licences to offer such contracts, along with other derivatives, to European customers.

Read more: Kraken Puts Cyprus Licence to Use - Launches Crypto Derivatives in Europe

According to Mersinger, regulating such contracts in the US would be “a really good thing for these markets and would be really beneficial to the industry broadly.” This article was written by Arnab Shome at www.financemagnates.com.

.png)