The American starter home is shrinking

In 2024, for the third straight year, the median size of a new single-family home in the U.S. has shrunk, to 2,150 square feet. That’s down from nearly 2,500 square feet back in 2013, and startlingly close to the roughly 2,100 square foot average seen in 2009 at the depth of the global financial crisis. It’s a downsizing that underscores just how hard it is for most people to afford to buy a home today, and the extent to which homebuilders are adjusting their offerings to meet demand. This telling figure comes from The State of the Nation’s Housing, an annual report just released by Harvard University’s Joint Center for Housing Studies. The report finds that affordability challenges are reshaping the housing market, right down to the square footage. “Homebuilders are able to make adjustments to meet demand where it is, and what it’s showing is that there’s demand for lower-cost units,” says Daniel McCue, a senior research associate at the Joint Center for Housing Studies. “Buyers look like they’re willing to buy slightly smaller homes in order to be able to afford them, given that prices have risen so high over the past three, four, five years, and interest rates remain relatively high as well.” Since 2019, average home prices have risen more than 60%, according to the report. Historically, that average has been skewed by the cost of new homes, which tended to be more expensive than existing homes. But that gap is narrowing. In the 2010s, the typical new single-family home was about $66,000 more expensive than the median sales price of an existing home, McCue says. In 2024, the typical new home cost only about $8,000 more. “I take that as a reaction to the lack of inventory and the tightness of existing housing sales markets,” McCue says. Part of this price drop has been engineered by homebuilders themselves. McCue says many builders are trying to help buyers by offering more favorable interest rates and interest-rate buydowns through their own mortgage companies. “They’re able to make some adjustments, and in doing so, we’re seeing the price points of new homes coming down to make those sales happen,” McCue says. In addition to reducing the size of U.S. homes, these efforts have had some impact. New home sales in 2024 were up about 3% over 2023, and existing home sales have dropped to a 30-year low. “[Homebuilders] have been able to kind of buck the trend by making these hard-fought gains in affordability,” McCue says. But with interest rates hovering above 6% and a general sense of economic uncertainty tied to the Trump Administration’s trade policies, whether sales of new homes will continue to rise is unclear. “One of the themes looking forward is how much of these adjustments, and how much of these hard-fought gains will be upended by rising costs due to tariffs,” he says. Another way the shape of housing is changing is in growing numbers of townhomes on the market. The report found that in 2024, builders started 176,000 townhomes, a 59% increase compared to 2019. “It’s one example of the way in which buyers and builders are focusing on products that are relatively more affordable, given the affordability constraints,” McCue says. Those constraints don’t look to be going away any time soon, and that’s created a separate but connected boom in the housing market. According to the report, about 93,000 single-family rental homes were started in 2024, which is the highest number on record and more than double the 40,000 rental units started in 2019. As homeownership gets farther and farther out of reach for many Americans, homebuilders appear ready to build rental homes they can afford.

In 2024, for the third straight year, the median size of a new single-family home in the U.S. has shrunk, to 2,150 square feet. That’s down from nearly 2,500 square feet back in 2013, and startlingly close to the roughly 2,100 square foot average seen in 2009 at the depth of the global financial crisis. It’s a downsizing that underscores just how hard it is for most people to afford to buy a home today, and the extent to which homebuilders are adjusting their offerings to meet demand.

This telling figure comes from The State of the Nation’s Housing, an annual report just released by Harvard University’s Joint Center for Housing Studies. The report finds that affordability challenges are reshaping the housing market, right down to the square footage.

“Homebuilders are able to make adjustments to meet demand where it is, and what it’s showing is that there’s demand for lower-cost units,” says Daniel McCue, a senior research associate at the Joint Center for Housing Studies. “Buyers look like they’re willing to buy slightly smaller homes in order to be able to afford them, given that prices have risen so high over the past three, four, five years, and interest rates remain relatively high as well.”

Since 2019, average home prices have risen more than 60%, according to the report. Historically, that average has been skewed by the cost of new homes, which tended to be more expensive than existing homes. But that gap is narrowing. In the 2010s, the typical new single-family home was about $66,000 more expensive than the median sales price of an existing home, McCue says. In 2024, the typical new home cost only about $8,000 more. “I take that as a reaction to the lack of inventory and the tightness of existing housing sales markets,” McCue says.

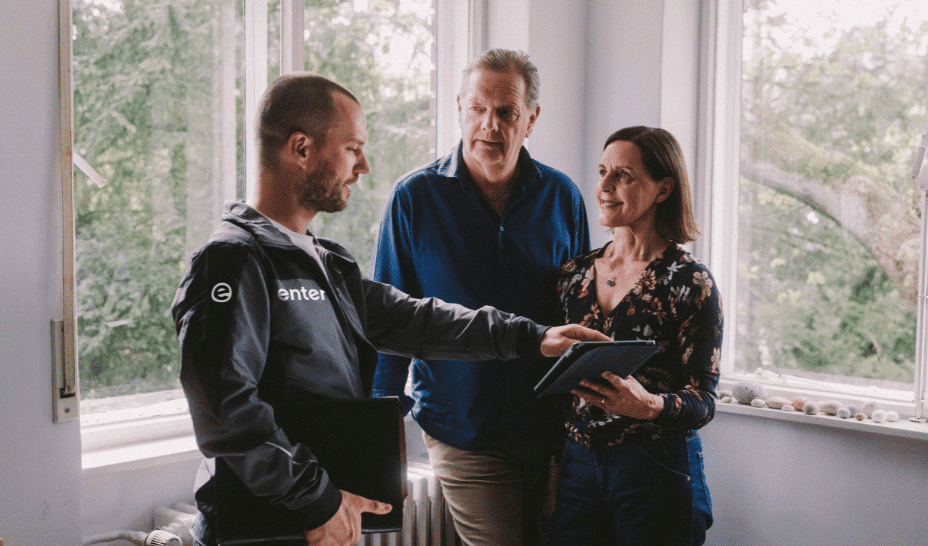

Part of this price drop has been engineered by homebuilders themselves. McCue says many builders are trying to help buyers by offering more favorable interest rates and interest-rate buydowns through their own mortgage companies. “They’re able to make some adjustments, and in doing so, we’re seeing the price points of new homes coming down to make those sales happen,” McCue says.

In addition to reducing the size of U.S. homes, these efforts have had some impact. New home sales in 2024 were up about 3% over 2023, and existing home sales have dropped to a 30-year low. “[Homebuilders] have been able to kind of buck the trend by making these hard-fought gains in affordability,” McCue says.

But with interest rates hovering above 6% and a general sense of economic uncertainty tied to the Trump Administration’s trade policies, whether sales of new homes will continue to rise is unclear. “One of the themes looking forward is how much of these adjustments, and how much of these hard-fought gains will be upended by rising costs due to tariffs,” he says.

Another way the shape of housing is changing is in growing numbers of townhomes on the market. The report found that in 2024, builders started 176,000 townhomes, a 59% increase compared to 2019. “It’s one example of the way in which buyers and builders are focusing on products that are relatively more affordable, given the affordability constraints,” McCue says.

Those constraints don’t look to be going away any time soon, and that’s created a separate but connected boom in the housing market. According to the report, about 93,000 single-family rental homes were started in 2024, which is the highest number on record and more than double the 40,000 rental units started in 2019. As homeownership gets farther and farther out of reach for many Americans, homebuilders appear ready to build rental homes they can afford.

![How Social Platforms Measure Video Views [Infographic]](https://imgproxy.divecdn.com/AncxHXS242CT-kDlEkGZi7uQ2k70-ebTAh7Lm14QKb8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9ob3dfcGxhdGZvcm1zX21lYXN1cmVfdmlld3MucG5n.webp)

![How Google’s AI Mode Compares to Traditional Search and Other LLMs [AI Mode Study]](https://static.semrush.com/blog/uploads/media/86/bc/86bc4d96d5a34c3f6b460a21004c39e2/f673b8608d38f1e4be0316c4621f2df0/how-google-s-ai-mode-compares-to-traditional-search-and-other-llms-ai-mode-study-sm.png)