Prediction: 2 Stocks That Will Be Worth More Than Medical Properties Trust 3 Years From Now

Investors looking for attractive dividends can always find something of interest in turnaround stories. There are, however, high-risk turnarounds and low-risk turnarounds. Medical Properties Trust (NYSE: MPW) is a high-risk story, while Prologis (NYSE: PLD) and Rexford Industrial (NYSE: REXR) are both of the low-risk variety. That's why Medical Properties Trust is probably best avoided and both Prologis and Rexford deserve a deep dive.Medical Properties Trust is a real estate investment trust (REIT) that owns hospitals. Its dividend has gone from $0.29 per share per quarter in the middle of 2023 to $0.15 by the end of that year. It fell again to just $0.08 per share per quarter in the second half of 2024. It is still at that level, which is a huge 72% cut from the $0.29 per share it was at just a few years ago.Image source: Getty Images.Continue reading

Investors looking for attractive dividends can always find something of interest in turnaround stories. There are, however, high-risk turnarounds and low-risk turnarounds. Medical Properties Trust (NYSE: MPW) is a high-risk story, while Prologis (NYSE: PLD) and Rexford Industrial (NYSE: REXR) are both of the low-risk variety. That's why Medical Properties Trust is probably best avoided and both Prologis and Rexford deserve a deep dive.

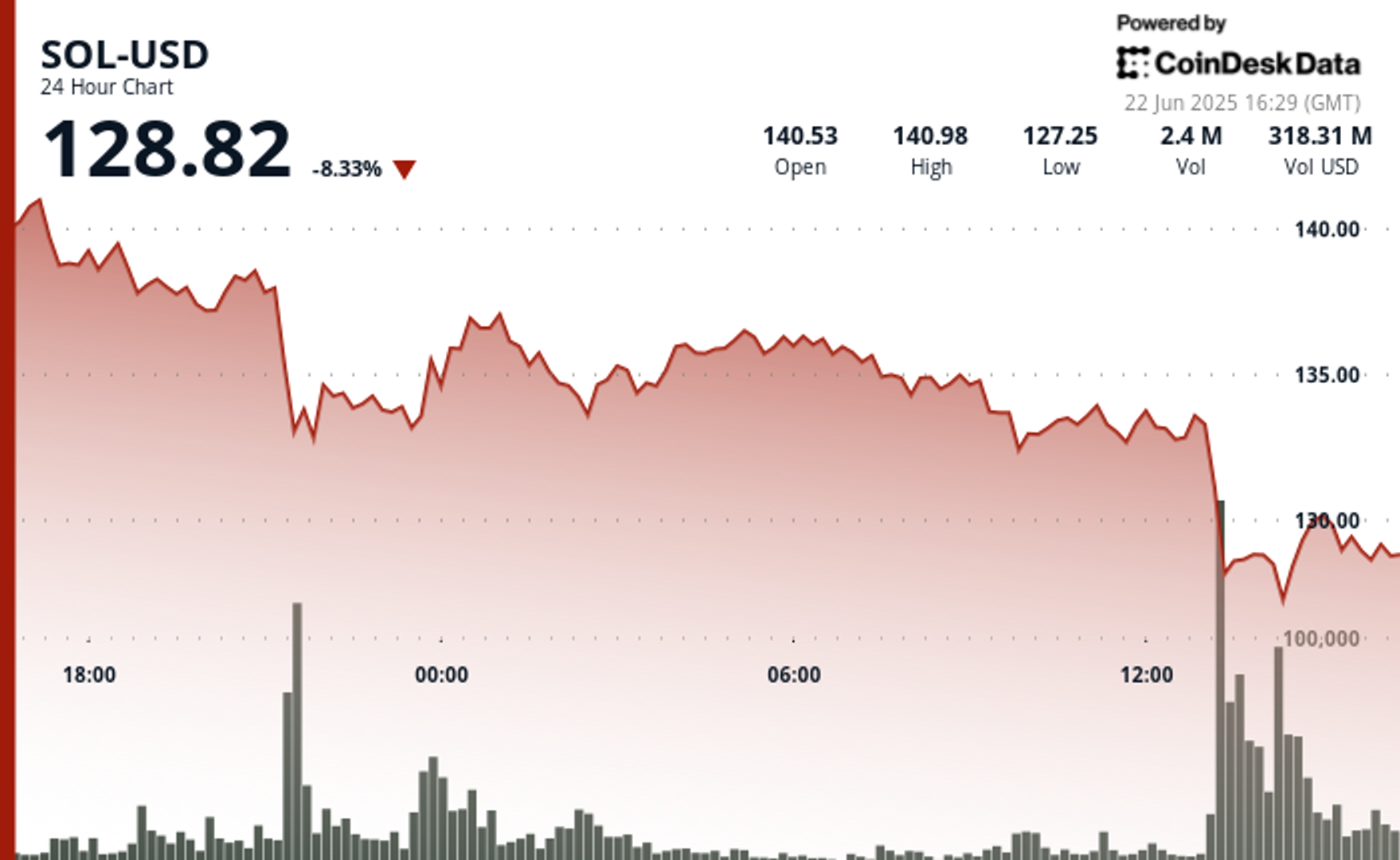

Medical Properties Trust is a real estate investment trust (REIT) that owns hospitals. Its dividend has gone from $0.29 per share per quarter in the middle of 2023 to $0.15 by the end of that year. It fell again to just $0.08 per share per quarter in the second half of 2024. It is still at that level, which is a huge 72% cut from the $0.29 per share it was at just a few years ago.

Image source: Getty Images.

![The Largest Communities on Reddit [Infographic]](https://imgproxy.divecdn.com/vfTS-YsC_ZrqM6F4tAXJgV6qj3gCHSsf2dvHufDbrrQ/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9sYXJnZXN0X3JlZGRpdF9jb21tdW5pdGllczIucG5n.webp)