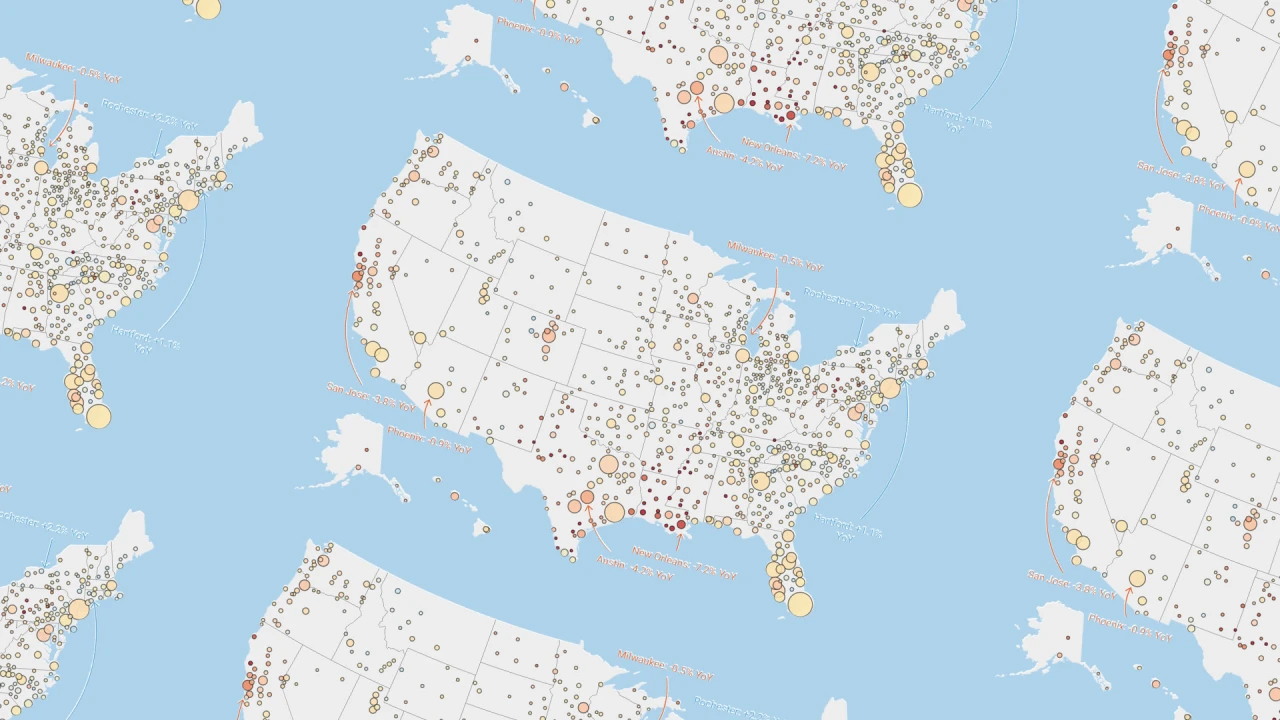

Housing market map: Zillow just released its updated home price forecast for 400-plus housing markets

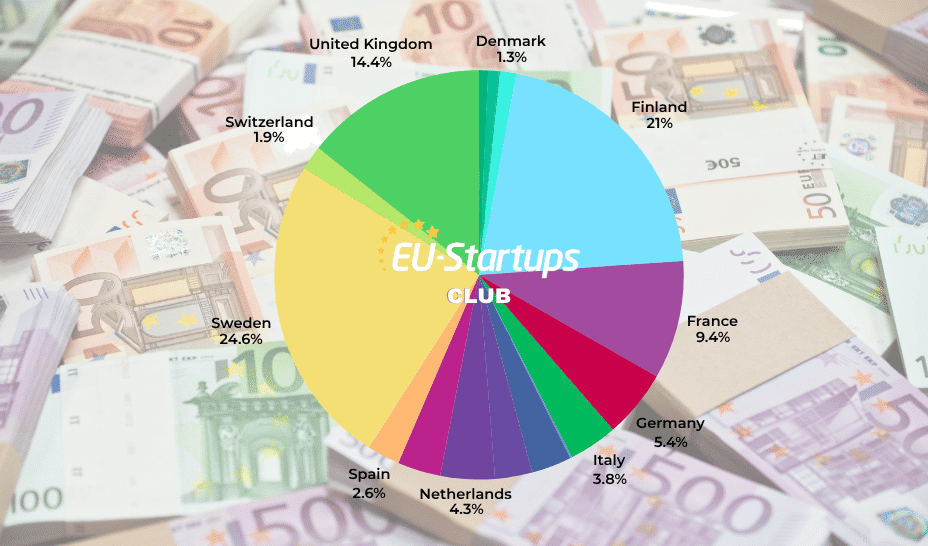

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. Heading into the year, Zillow economists forecasted that U.S. home prices were likely to rise 2.6% in 2025. However, this year, the housing market—in particular in the Sun Belt—was softer than expected and Zillow has made several downgrades to its forecast for national home prices. This week, newly released data from Zillow shows that U.S. home prices have decelerated to a year-over-year increase of just 0.4%. Zillow economists now expect U.S. home prices to decline by 0.7% between May 2025 and May 2026. “With inventory up nearly 20% over the previous year, buyers had more options in May than at any time since July 2020. Despite higher sales, sellers still outnumber buyers,” wrote Zillow economists. “This gives buyers more time to decide and more power in negotiations. Zillow’s market heat index shows a balanced market nationwide, one that’s a lot more buyer-friendly than in recent years. Competition among buyers declined to the lowest level seen in May in Zillow records, reaching back through 2018.” Not only do Zillow economists predict soft national home price growth this year, but they’re also predicting that the housing market will only see 4.1 million U.S. existing home sales in 2025. That would mark the third-straight year of suppressed existing home sales. For comparison, in pre-pandemic 2019, there were 5.3 million existing home sales in the U.S. Zillow economists added: “Home values have fallen in 22 of the 50 largest metro areas over the past year, and sellers cut prices on almost 26% of listings nationwide—another May high in Zillow records. Homes that sell typically do so in 17 days, about four more than last year and only two days fewer than pre-pandemic averages.” Among the 300 largest U.S. housing markets, Zillow expects the strongest home price appreciation between May 2025 and May 2026 to occur in these 10 areas: Atlantic City, New Jersey → 3.4% Kingston, New York → 2.7% Knoxville, Tennessee → 2.6% Pottsville, Pennsylvania → 2.5% Torrington, Connecticut → 2.4% Rochester, New York → 2.2% Syracuse, New York → 2.1% Fayetteville, Arkansas → 2.1% Rockford, Illinois → 2.1% Yuma, Arizona → 2.0% Among the 300 largest U.S. housing markets, Zillow expects the weakest home price appreciation between May 2025 and May 2026 to occur in these 10 areas: Houma, Louisiana → -9.4% Lake Charles, Louisiana → -8.9% New Orleans → -7.2% Alexandria, Louisiana → -6.7% Lafayette, Louisiana → -6.6% Shreveport, Louisiana → -6.4% Beaumont, Texas → -6.2% San Francisco → -5.5% Midland, Texas → -5.3% Odessa, Texas → -5.3% While Zillow expects home prices across most of Florida to be flat over the coming year, ResiClub remains skeptical. After all, Florida has experienced a significant increase in active inventory and months of supply over the past year, which could signal potential pricing weakness. Indeed, prices of single-family homes and condos are currently declining in most Florida housing markets.

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Heading into the year, Zillow economists forecasted that U.S. home prices were likely to rise 2.6% in 2025.

However, this year, the housing market—in particular in the Sun Belt—was softer than expected and Zillow has made several downgrades to its forecast for national home prices.

This week, newly released data from Zillow shows that U.S. home prices have decelerated to a year-over-year increase of just 0.4%. Zillow economists now expect U.S. home prices to decline by 0.7% between May 2025 and May 2026.

“With inventory up nearly 20% over the previous year, buyers had more options in May than at any time since July 2020. Despite higher sales, sellers still outnumber buyers,” wrote Zillow economists. “This gives buyers more time to decide and more power in negotiations. Zillow’s market heat index shows a balanced market nationwide, one that’s a lot more buyer-friendly than in recent years. Competition among buyers declined to the lowest level seen in May in Zillow records, reaching back through 2018.”

Not only do Zillow economists predict soft national home price growth this year, but they’re also predicting that the housing market will only see 4.1 million U.S. existing home sales in 2025. That would mark the third-straight year of suppressed existing home sales. For comparison, in pre-pandemic 2019, there were 5.3 million existing home sales in the U.S.

Zillow economists added: “Home values have fallen in 22 of the 50 largest metro areas over the past year, and sellers cut prices on almost 26% of listings nationwide—another May high in Zillow records. Homes that sell typically do so in 17 days, about four more than last year and only two days fewer than pre-pandemic averages.”

Among the 300 largest U.S. housing markets, Zillow expects the strongest home price appreciation between May 2025 and May 2026 to occur in these 10 areas:

- Atlantic City, New Jersey → 3.4%

- Kingston, New York → 2.7%

- Knoxville, Tennessee → 2.6%

- Pottsville, Pennsylvania → 2.5%

- Torrington, Connecticut → 2.4%

- Rochester, New York → 2.2%

- Syracuse, New York → 2.1%

- Fayetteville, Arkansas → 2.1%

- Rockford, Illinois → 2.1%

- Yuma, Arizona → 2.0%

Among the 300 largest U.S. housing markets, Zillow expects the weakest home price appreciation between May 2025 and May 2026 to occur in these 10 areas:

- Houma, Louisiana → -9.4%

- Lake Charles, Louisiana → -8.9%

- New Orleans → -7.2%

- Alexandria, Louisiana → -6.7%

- Lafayette, Louisiana → -6.6%

- Shreveport, Louisiana → -6.4%

- Beaumont, Texas → -6.2%

- San Francisco → -5.5%

- Midland, Texas → -5.3%

- Odessa, Texas → -5.3%

While Zillow expects home prices across most of Florida to be flat over the coming year, ResiClub remains skeptical. After all, Florida has experienced a significant increase in active inventory and months of supply over the past year, which could signal potential pricing weakness. Indeed, prices of single-family homes and condos are currently declining in most Florida housing markets.

![The Largest Communities on Reddit [Infographic]](https://imgproxy.divecdn.com/vfTS-YsC_ZrqM6F4tAXJgV6qj3gCHSsf2dvHufDbrrQ/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9sYXJnZXN0X3JlZGRpdF9jb21tdW5pdGllczIucG5n.webp)