Paytm’s gaming arm gets SC relief on Rs 5,712 Cr GST notice

The order was passed after Paytm’s gaming arm, First Games, challenged the show cause notice by filing a writ petition on May 3, 2025.

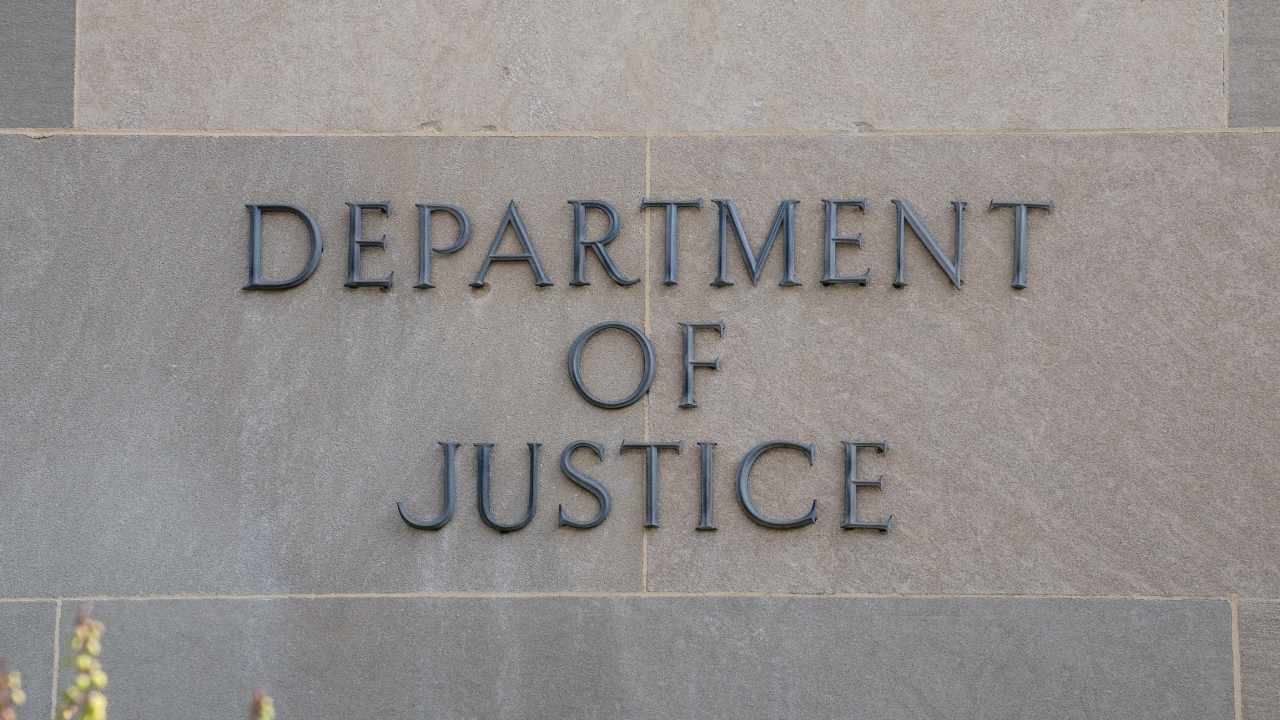

Paytm’s gaming arm, First Games Technology, got temporary relief on Friday after the Supreme Court of India put a hold on proceedings related to a tax notice from the Directorate General of GST Intelligence.

The notice had claimed a tax liability of Rs 5,712 crore, plus interest and penalties, for the period between January 2018 and March 2023.

The apex court order said, “Further proceedings of all the impugned show cause notices shall remain stayed till the final disposal of the main matter along with all the matters which are tagged.”

The order was passed after First Games challenged the show cause notice by filing a writ petition on May 3, 2025.

This is an industry-wide issue, as the GST department has issued notices to several gaming companies, including First Games. Companies such as Games24X7, Dream11, and Head Digital Works have challenged the retrospective GST notices through legal proceedings.

The notices assume that GST should be charged at 28% on the total entry amount, instead of the 18% GST that gaming companies currently pay on their platform fee or actual revenue. The companies have opposed this method, arguing that GST should be applied only to their gross gaming revenue and not on the full value of the bets placed.

The Indian gaming industry has criticised the retrospective GST notices, arguing that they would significantly increase tax burdens and could severely impact emerging startups in the sector.

Earlier this month, One97 Communications Ltd., the parent company of Paytm, reported a net loss of Rs 544.6 crore for Q4 FY25—a slight improvement of 1.08% compared to the Rs 550.5 crore loss in the same quarter of FY24.

However, revenue from operations fell by 15.68% annually to Rs 1,911.5 crore in Q4 FY25.

Edited by Suman Singh

.png)