Info Edge shareholders approve Rs 1,000 Cr investment in third venture fund

The Naukri.com parent announced its third venture fund in February, with a primary focus on investing in tech-driven Indian startups.

Info Edge India shareholders have approved an investment of up to Rs 1,000 crore into IE Venture Investment Fund III, as per the company’s BSE filings.

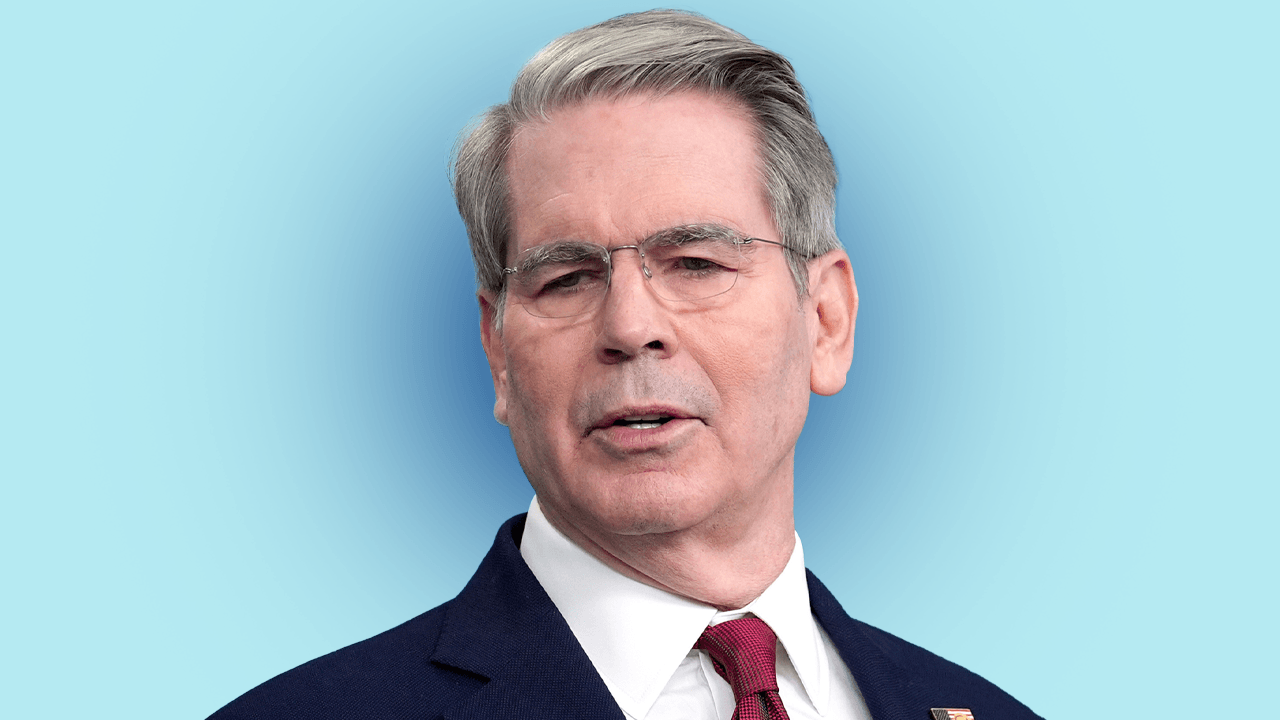

“Results of the Info Edge shareholders postal ballot are in. The proposal to invest up to Rs. 1000 crores in Info Edge Ventures Fund 3 was approved with 99.9995% of votes in favour. Thank you for the vote of confidence in our investing abilities shareholders,” Sanjeev Bikhchandani, Founder and Executive Vice Chairman of Info Edge, said in a post on X.

The Naukri.com parent announced its third venture fund in February, with a primary focus on investing in tech-driven Indian startups.

Info Edge’s venture funds are in partnership with Temasek, Singapore’s sovereign wealth fund, with the latest fund expected to surpass Rs 2,000 crore ($230 million).

Info Edge’s most notable investment is in Zomato, where it acquired a stake for around Rs 4.7 crore. Over time, Info Edge continued to invest in multiple rounds, holding around 18.6% of shares in Zomato at the time of its IPO in 2021. The stake sale during the public listing earned Info Edge over Rs 3,000 crore, making it one of the most successful startup investments in Indian venture history.

Beyond Zomato, Info Edge has funded several high-growth startups, including Policybazaar, ShopKirana, Gramophone, DotPe, Adda247, NoBroker, and Univariety. It has deployed over Rs 2,000 crore ($250 million) in various startups, often taking minority stakes while leveraging its operational expertise to support portfolio companies.

Edited by Jyoti Narayan