Here's Why NuScale Power Stock Is a Buy Before August

A lot of near-term catalysts could drive this little nuclear stock higher.

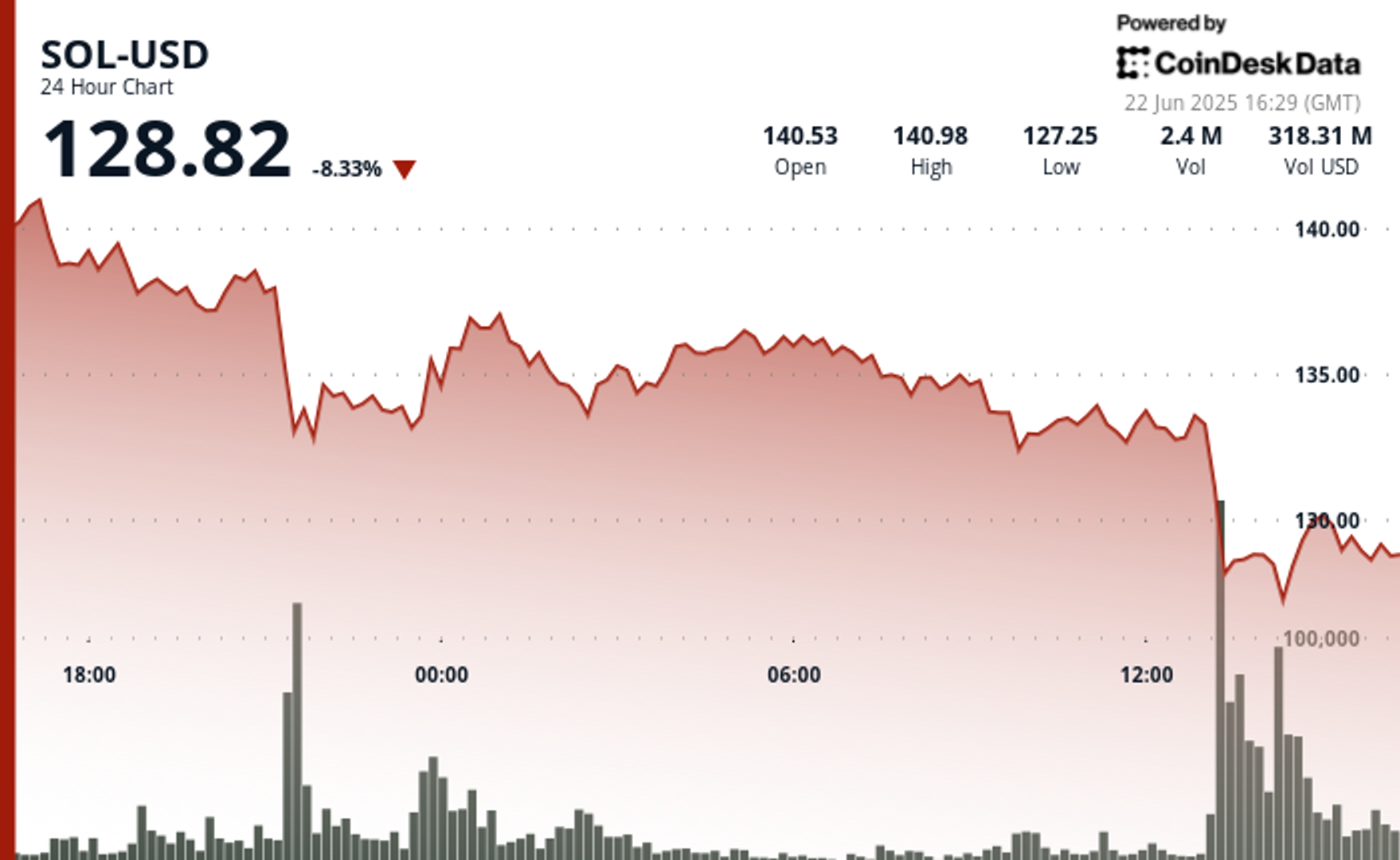

NuScale Power (NYSE: SMR) has been a volatile stock since its public debut three years ago. It initially dazzled investors with the disruptive potential of its small modular reactors (SMRs), which could reduce the costs and time required to build new nuclear power plants, but the abrupt cancellation of a major nuclear reactor project in Idaho in 2023 rattled the bulls.

But over the past 12 months, NuScale's stock price more than quadrupled as some major catalysts appeared. Let's see why its stock skyrocketed, and why it could still be worth accumulating ahead of its next earnings report in early August.

NuScale's SMRs, which can be installed in vessels that are only nine feet wide and 65 feet high, are prefabricated, delivered, and assembled on site. That modular design allows them to be installed faster and in areas that aren't suited for traditional nuclear reactors.

![The Largest Communities on Reddit [Infographic]](https://imgproxy.divecdn.com/vfTS-YsC_ZrqM6F4tAXJgV6qj3gCHSsf2dvHufDbrrQ/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9sYXJnZXN0X3JlZGRpdF9jb21tdW5pdGllczIucG5n.webp)