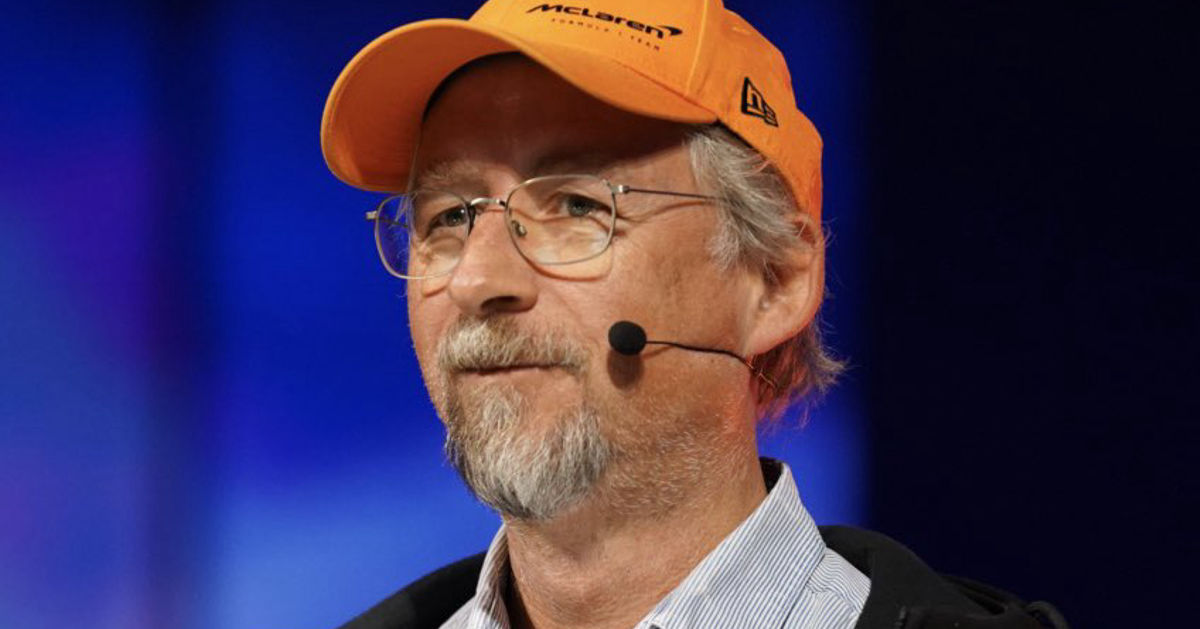

Ethereum co-founder Joe Lubin discusses new Ether treasury strategy, cites Michael Saylor’s influence

Joe Lubin, a prominent long-time advocate for cryptocurrency and a co-founder of Ethereum, has revealed that a pivotal dinner conversation with Michael Saylor, significantly influenced his decision to launch a firm dedicated to investing in Ethereum’s native currency, Ether (ETH). Saylor is the renowned proponent of corporate Bitcoin accumulation. This move, initiated approximately six months […] The post Ethereum co-founder Joe Lubin discusses new Ether treasury strategy, cites Michael Saylor’s influence appeared first on CoinJournal.

Joe Lubin, a prominent long-time advocate for cryptocurrency and a co-founder of Ethereum, has revealed that a pivotal dinner conversation with Michael Saylor, significantly influenced his decision to launch a firm dedicated to investing in Ethereum’s native currency, Ether (ETH).

Saylor is the renowned proponent of corporate Bitcoin accumulation.

This move, initiated approximately six months ago, signals a growing trend of companies adopting crypto treasury strategies, a concept largely popularized by Saylor’s MicroStrategy.

“I was at a dinner with Michael Saylor, I did a little bit of research, I started talking to my colleagues about how cool it could be,” Lubin, who is the founder and chief executive officer of Ethereum software infrastructure provider Consensys, disclosed in an interview to Bloomberg.

He explained the internal thought process at Consensys: “Nobody in our company had done a deep dive on it. We saw, hey we don’t see anything overly dangerous in the strategy.”

The remarkable financial returns achieved by MicroStrategy (now formally known as Strategy) since Saylor embarked on a strategy in 2020 to transform the software firm into a leveraged Bitcoin proxy have captured the attention of both Wall Street institutions and individual investors.

The significant premium that Strategy’s shares command over the actual value of its substantial Bitcoin holdings has ignited a surge in so-called “crypto treasury companies,” all aiming to replicate Saylor’s widely publicized success.

SharpLink gaming’s transformation

This trend gained further momentum last week when SharpLink Gaming Inc., a sports betting and gaming technology firm, announced its strategic pivot to become an Ether treasury company.

Crucially, Joe Lubin will serve as chairman of the board for this newly repurposed entity.

To fuel its Ether acquisition strategy, SharpLink has successfully closed a $425 million private placement, with New York-based Consensys leading the fundraising round.

The market’s reaction to SharpLink’s announcement on May 27 was explosive.

The company’s shares surged by approximately 400% following the news and concluded last week with an astonishing gain of around 1,000%.

This dramatic turnaround is particularly noteworthy given that the stock had experienced a more than 50% decline annually in the preceding three years.

Prudent growth and anticipated demand for Ether

Lubin indicated that he anticipates raising additional capital to fund further purchases of Ether, which currently stands as the second-largest cryptocurrency by market capitalization, trailing only Bitcoin.

“There will be ways for us to take in more capital for us to buy more Ether,” Lubin stated, referencing Saylor’s well-established strategy of issuing shares and convertible bonds to finance Bitcoin acquisitions.

He emphasized a cautious approach to this expansion: “We’ll do that in a prudent way, we’ll not take excessive risk.”

The key, Lubin stressed, is to avoid becoming over-leveraged.

“We anticipate that our actions and similar actions will drive a huge amount of demand for Ether,” Lubin projected, also noting that other firms are actively exploring Ether treasury strategies.

This suggests a potential wave of institutional interest focusing on Ethereum’s native asset.

Elevating Ether’s narrative: beyond ‘digital gold’

While Michael Saylor has successfully marketed Bitcoin as “digital gold,” Lubin acknowledged that the marketing message for Ethereum—often described as crypto’s commercial highway due to its support for thousands of gaming and decentralized finance (DeFi) lending applications—has been “more garbled.”

This has, at times, led some investors to focus solely on Bitcoin, which has gained approximately 11% year-to-date.

In contrast, Ether is down about 26% over the same period, even after a rally following its latest software upgrade.

Lubin, however, firmly believes that Ether warrants greater recognition and value.

“Essentially there’s a paradigm shift on, to a more decentralized global economy,” Lubin asserted. “It shouldn’t be hard to believe that Ether will be a big part of that paradigm shift.”

Addressing concerns that the crypto treasury strategy might be perceived as another speculative ploy to make quick profits, a phenomenon that has historically plagued the sector, Lubin was unequivocal.

“I’ve never been looking to exit anything in the Ethereum ecosystem, we are builders, not exploiters,” he stated.

We expect there will be years, possibly decades of growth in our ecosystem. We expect Ether growing enormously valuable.

A distinct advantage for companies holding Ether in their treasuries is the ability to stake their coins.

Staking involves using the Ether to help secure the Ethereum network, and in return, stakers earn yield, providing an additional avenue for returns beyond price appreciation.

Lubin concluded with an optimistic outlook: “We anticipate that there will be a number of vehicles like this that are well intentioned.”

The post Ethereum co-founder Joe Lubin discusses new Ether treasury strategy, cites Michael Saylor’s influence appeared first on CoinJournal.

.png)