BNB price prediction as hedge fund execs eye $100m for ‘Microstrategy’

Former Coral Capital executives aim to raise $100 million to acquire BNB tokens through a Nasdaq-listed company. BNB’s price could surge amid the fresh institutional interest, with this set to mirror the Bitcoin treasury trend. The token’s value could spike to above $700 amid bullish sentiment, though primary support is around $550. BNB is slightly […] The post BNB price prediction as hedge fund execs eye $100m for ‘Microstrategy’ appeared first on CoinJournal.

- Former Coral Capital executives aim to raise $100 million to acquire BNB tokens through a Nasdaq-listed company.

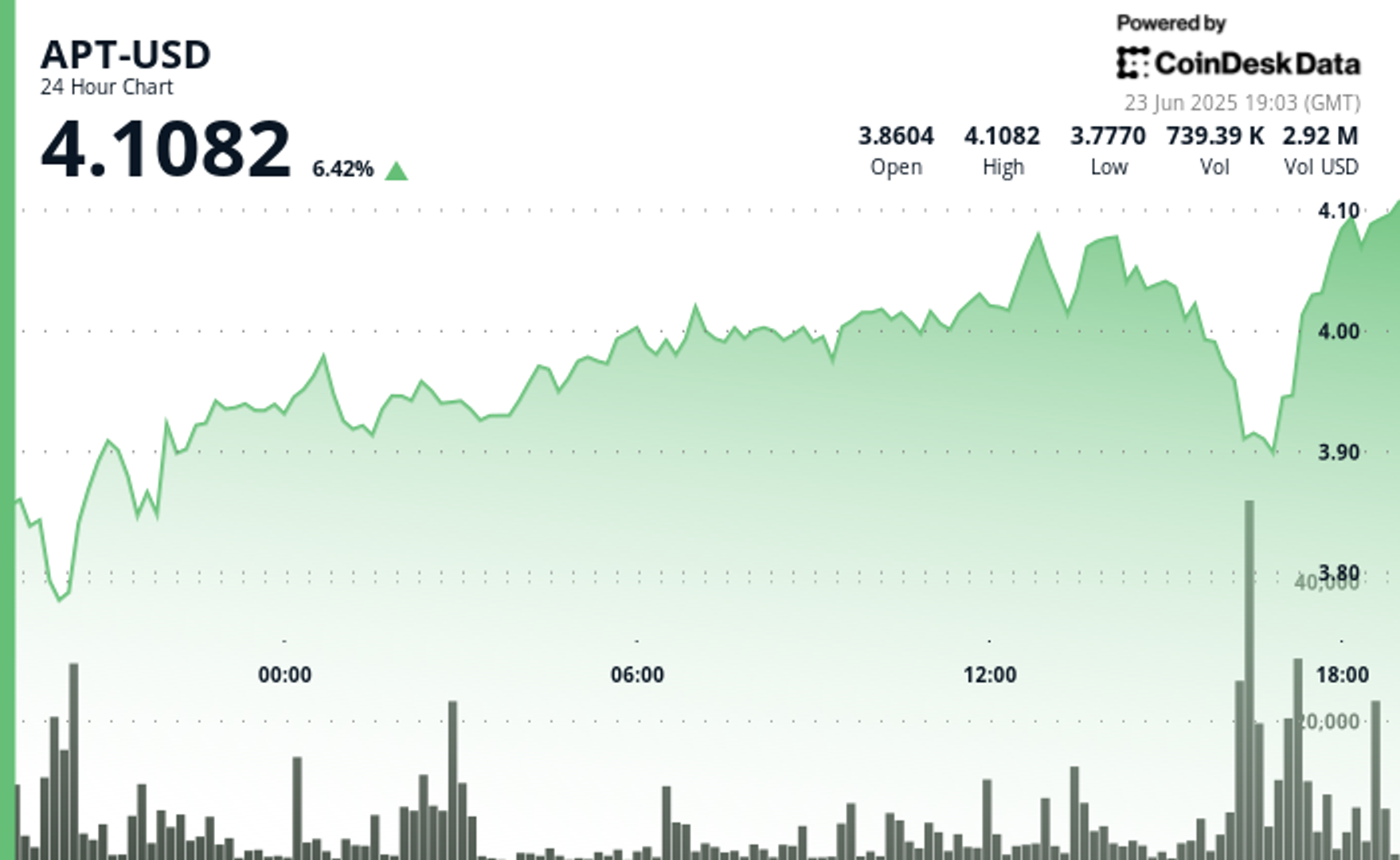

- BNB’s price could surge amid the fresh institutional interest, with this set to mirror the Bitcoin treasury trend.

- The token’s value could spike to above $700 amid bullish sentiment, though primary support is around $550.

BNB is slightly up as a group of former crypto hedge fund executives look to shake up the cryptocurrency market with a $100 million fundraising plan to invest in Binance’s BNB token.

Reports are that the hedge fund execs are eyeing the initiative via a publicly listed company.

This move, inspired by Michael Saylor’s Bitcoin treasury strategy, signals growing institutional interest in BNB, which boasts an $87 billion market cap.

Hedge Fund executives seek $100m for BNB treasury

According to a Bloomberg report, former Coral Capital Holdings executives Patrick Horsman, Joshua Kruger, and Johnathan Pasch are in advanced talks to raise $100 million for a Nasdaq-listed company they control.

The trio plans to rename the entity Build & Build Corporation and begin accumulating BNB tokens this month.

This strategy mirrors the crypto treasury trend pioneered by Saylor’s Strategy, which has built a $60 billion Bitcoin reserve since 2020.

Per the Bloomberg report, the BNB treasury play would position Build & Build as the first public company to hold BNB as its primary treasury asset, offering investors exposure to Binance’s ecosystem through regulated markets.

A spokesperson for the team declined to comment on the fundraising efforts.

BNB’s “Microstrategy”

The initiative follows a wave of public firms diversifying into cryptocurrencies. While earlier adopters focused on Bitcoin, recent efforts target altcoins like Ethereum, Solana, and now BNB.

Binance founder and former CEO Changpeng Zhao commented on the development, noting in a post on X that a “BNB ‘microstrategy’” was taking shape.

BNB "microstrategy" coming to a company near you! https://t.co/90FXknLtex

— CZ