To those that have their funds seized by Changelly

Please read through this as I found out last night one of my best buddies in High School is still working in the CIA, very high ranked and was considered for Chief of CIA in 2016 if Clinton were elected. I called him and told him about Changelly and made him promise me to make a formal in-depth investigation against Changelly in which he said yes but it'll take a while. I asked if I can contribute by having my transaction report from blockchain.com and he said nah, they got the best experts in cybercrimes. He knows all the departments that oversees these trading platforms. It'll rain hell upon Changelly.com , you SOBs. To Changelly, I told you I will seek proper channel to bring you down and I meant it! It's been David (us) vs. Goliath (Changelly) but after their investigation, it'll become the other way around. You will not get away with using customer's fund for your own benefits. In the meantime, this is what I dig up. I asked my friend if I can post this on Reddit and he said sure, just don't mention his name. Potential Legal Violations Unauthorized Use of Funds – If a platform uses customer funds for its own trading activities without consent, it could be classified as embezzlement or fraud. Failure to Return Funds – Holding funds indefinitely without justification may violate consumer protection laws. AML & Financial Regulations – If funds are withheld under AML policies but are secretly used for trading, it could be a breach of financial regulations. What You Can Do Contact Changelly Support – Request a clear explanation for the withheld funds. File a Complaint – Report the issue to financial regulators or consumer protection agencies. Legal Action – If funds are misused, affected individuals may have grounds for legal claims. General AML Holding Periods Banks & Financial Institutions: Typically, funds flagged for AML concerns must be reported within 30 days of detection. However, institutions may hold funds longer if investigations require additional time. Crypto Exchanges: Some platforms may freeze funds indefinitely if they suspect fraud or money laundering, but most follow a reasonable timeframe, often up to 90 days before taking further action. Regulatory Guidelines: In the U.S., AML regulations require financial institutions to report suspicious transactions within five trading days. In the EU, AML directives mandate record-keeping and reporting within five years. If funds are withheld without justification, individuals may have legal recourse through financial regulators or consumer protection agencies. If you suspect that Changelly.com is withholding funds without justification and potentially using them for trading on other platforms, you can report the issue to crypto regulatory bodies and consumer protection agencies. Here are some steps you can take: Contact Changelly Support First, reach out to Changelly’s compliance team at [compliance@changelly.com](mailto:compliance@changelly.com) and request a clear explanation for the withheld funds. If they fail to provide a valid reason, proceed with regulatory reporting. 2. Report to Crypto Regulatory Bodies Financial Stability Board (FSB) and International Monetary Fund (IMF) have outlined policies for addressing financial misconduct in crypto. Financial Action Task Force (FATF) sets global AML standards that crypto exchanges must follow. You can also check IMF’s crypto regulation guide for reporting procedures. 3. File a Complaint with Consumer Protection Agencies If Changelly is operating in your country, you can report them to your local financial regulatory authority. In the U.S., you can file a complaint with the Federal Trade Commission (FTC) or the Consumer Financial Protection Bureau (CFPB). In the EU, you can report to the European Securities and Markets Authority (ESMA). 4. Legal Action If funds are misused, affected individuals may have grounds for legal claims. Consider consulting a crypto lawyer or financial fraud attorney to explore legal options. You can report Changelly.com to the Cybercrime Division of Saint Vincent and the Grenadines through the following channels: Contact the Director of Public Prosecutions (DPP) Office Address: Brewster's Building, Tyrell Street, Kingstown Phone: (784) 457-1344 / 456-1111 Ext 5481 / 5483 Email: [svgnps@gov.vc](mailto:svgnps@gov.vc) Website: DPP Contact 2. Contact the Royal Saint Vincent and the Grenadines Police Force Police Headquarters Address: Bay Street, Kingstown Phone: (784) 457-1211 Ext. 4801/4802/4803 Email: [office.police@mail.gov.v](mailto:office.police@mail.gov.v) Website: Police Service 3. Report Cybercrime Violations Saint Vincent and the Grenadines enforces strict penalties for cybercrime violations under the Cybercrime Act (2016). If you suspect financial misconduct, fraud, or unauthorized use of funds, you can report it to law enforcement. Emergency Contact: 999 / 911 Criminal Investigation Department (CID): (784) 456-1810 Website: Cybercrime Penalties Filing a complaint

Please read through this as I found out last night one of my best buddies in High School is still working in the CIA, very high ranked and was considered for Chief of CIA in 2016 if Clinton were elected. I called him and told him about Changelly and made him promise me to make a formal in-depth investigation against Changelly in which he said yes but it'll take a while. I asked if I can contribute by having my transaction report from blockchain.com and he said nah, they got the best experts in cybercrimes. He knows all the departments that oversees these trading platforms. It'll rain hell upon Changelly.com , you SOBs. To Changelly, I told you I will seek proper channel to bring you down and I meant it! It's been David (us) vs. Goliath (Changelly) but after their investigation, it'll become the other way around. You will not get away with using customer's fund for your own benefits. In the meantime, this is what I dig up. I asked my friend if I can post this on Reddit and he said sure, just don't mention his name.

- Potential Legal Violations

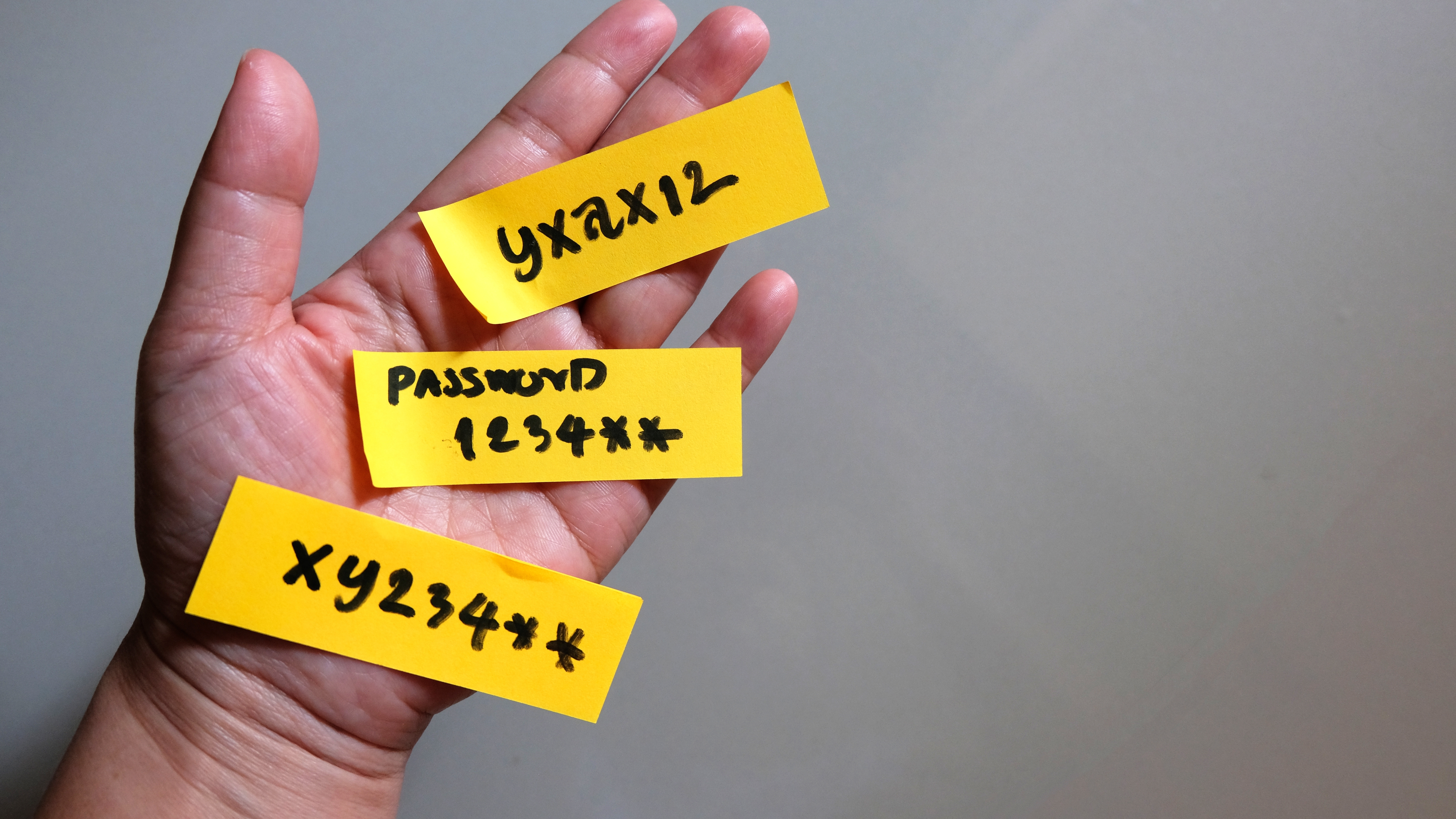

- Unauthorized Use of Funds – If a platform uses customer funds for its own trading activities without consent, it could be classified as embezzlement or fraud.

- Failure to Return Funds – Holding funds indefinitely without justification may violate consumer protection laws.

- AML & Financial Regulations – If funds are withheld under AML policies but are secretly used for trading, it could be a breach of financial regulations.

- What You Can Do

- Contact Changelly Support – Request a clear explanation for the withheld funds.

- File a Complaint – Report the issue to financial regulators or consumer protection agencies.

- Legal Action – If funds are misused, affected individuals may have grounds for legal claims.

- General AML Holding Periods

- Banks & Financial Institutions: Typically, funds flagged for AML concerns must be reported within 30 days of detection. However, institutions may hold funds longer if investigations require additional time.

- Crypto Exchanges: Some platforms may freeze funds indefinitely if they suspect fraud or money laundering, but most follow a reasonable timeframe, often up to 90 days before taking further action.

- Regulatory Guidelines: In the U.S., AML regulations require financial institutions to report suspicious transactions within five trading days. In the EU, AML directives mandate record-keeping and reporting within five years.

- If funds are withheld without justification, individuals may have legal recourse through financial regulators or consumer protection agencies.

- If you suspect that Changelly.com is withholding funds without justification and potentially using them for trading on other platforms, you can report the issue to crypto regulatory bodies and consumer protection agencies. Here are some steps you can take:

- Contact Changelly Support

- First, reach out to Changelly’s compliance team at [compliance@changelly.com](mailto:compliance@changelly.com) and request a clear explanation for the withheld funds.

- If they fail to provide a valid reason, proceed with regulatory reporting.

- 2. Report to Crypto Regulatory Bodies

- Financial Stability Board (FSB) and International Monetary Fund (IMF) have outlined policies for addressing financial misconduct in crypto.

- Financial Action Task Force (FATF) sets global AML standards that crypto exchanges must follow.

- You can also check IMF’s crypto regulation guide for reporting procedures.

- 3. File a Complaint with Consumer Protection Agencies

- If Changelly is operating in your country, you can report them to your local financial regulatory authority.

- In the U.S., you can file a complaint with the Federal Trade Commission (FTC) or the Consumer Financial Protection Bureau (CFPB).

- In the EU, you can report to the European Securities and Markets Authority (ESMA).

- 4. Legal Action

- If funds are misused, affected individuals may have grounds for legal claims.

- Consider consulting a crypto lawyer or financial fraud attorney to explore legal options.

- You can report Changelly.com to the Cybercrime Division of Saint Vincent and the Grenadines through the following channels:

- Contact the Director of Public Prosecutions (DPP)

- Office Address: Brewster's Building, Tyrell Street, Kingstown

- Phone: (784) 457-1344 / 456-1111 Ext 5481 / 5483

- Email: [svgnps@gov.vc](mailto:svgnps@gov.vc)

- Website: DPP Contact

- 2. Contact the Royal Saint Vincent and the Grenadines Police Force

- Police Headquarters Address: Bay Street, Kingstown

- Phone: (784) 457-1211 Ext. 4801/4802/4803

- Email: [office.police@mail.gov.v](mailto:office.police@mail.gov.v)

- Website: Police Service

- 3. Report Cybercrime Violations

- Saint Vincent and the Grenadines enforces strict penalties for cybercrime violations under the Cybercrime Act (2016). If you suspect financial misconduct, fraud, or unauthorized use of funds, you can report it to law enforcement.

- Emergency Contact: 999 / 911

- Criminal Investigation Department (CID): (784) 456-1810

- Website: Cybercrime Penalties

- Filing a complaint with the Cybercrime Division of Saint Vincent and the Grenadines could be helpful, especially if you suspect fraud, financial misconduct, or unauthorized use of funds by Changelly.com.. Saint Vincent and the Grenadines has a Cybercrime Act (2016) that covers offenses such as fraud, identity-related crimes, and illegal system interference.

- Steps to File a Complaint:

- Gather Evidence – Collect transaction details, emails, and any communication with Changelly.

- Contact the Cybercrime Division – You can reach out to Saint Vincent and the Grenadines law enforcement or cybercrime authorities.

- Submit a Formal Complaint – Provide details of the withheld funds and suspected misconduct.

- Follow Up – Stay in touch with authorities to track the progress of your complaint.

- Here's a template for your complaint to the government officials of Saint Vincent and Grenadines.

- [Your Name] [Your Address] [Your Email] [Your Phone Number] [Date]

- To: Cybercrime Division, Royal Saint Vincent and the Grenadines Police Force [Agency Address]

- Subject: Formal Complaint Regarding Fund Withholding by Changelly.com

- Dear Cybercrime Division,

- I am writing to formally file a complaint against Changelly.com, a cryptocurrency exchange platform, for unlawfully withholding my funds without justification. The withheld funds were intended for a cryptocurrency swap transaction, but Changelly has failed to process the transaction or provide a reasonable explanation.

- Details of the Incident:

- Transaction Date: [Date of Transaction]

- Amount Withheld: [Amount & Currency]

- Transaction ID: [Transaction ID from Changelly]

- Reason Given (if any): [Include any response Changelly provided]

- Despite repeated attempts to contact Changelly's support team, I have not received a valid reason or refund for the withheld funds. Furthermore, there is growing concern among affected users that Changelly might be using customer funds to trade on other platforms, which would constitute fraud and financial misconduct.

- Violation of Cybercrime Laws:

- Changelly's actions may violate Saint Vincent and the Grenadines Cybercrime Act (2016), including:

- Unauthorized Use of Funds – Platforms should not hold or use customer funds for their own benefit.

- Failure to Return Funds – Withholding funds indefinitely without explanation may be illegal.

- Failure to Report Suspicious Activity – Regulatory authorities require timely reporting of questionable transactions.

- I kindly request your agency to investigate Changelly.com for potential fraudulent practices and take necessary enforcement actions to ensure consumer protection and compliance with financial regulations.

- Requested Action:

- Immediate intervention to recover my withheld funds.

- Investigation into Changelly’s fund management practices.

- Enforcement actions if found guilty of financial misconduct.

- Please let me know if you require further details regarding my complaint. I appreciate your assistance in this matter and look forward to your prompt response.

- Sincerely, [Your Name]

- You can submit this complaint to the Cybercrime Division of Saint Vincent and the Grenadines, which is actively investigating cybercrime cases. You may also contact the Public Relations and Complaints Department of the Ministry of National Security for further assistance

To Changelly, your days of wrongdoing are under a countdown of days or months. I'M NOT BLUFFING!

Just wrote the following to Changelly:

James Men-Kun Shih

12:22 PM (0 minutes ago)

to Compliance

I told you before I will go to the end of the earth to expose you and bring you down. You thought I was just a nobody. Well, your days are coming to an end. You can take that to the bank!

MFs

James M. Shih M.D.

FOR SOME REASON TANGEM KEPT TAKING MY POST DOWN. THEY MAY BE COMPLICIT IN BED WITH CHANGELLY!

[link] [comments]

.png)

![[Weekly funding roundup May 17-23] VC inflow remains steady](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)