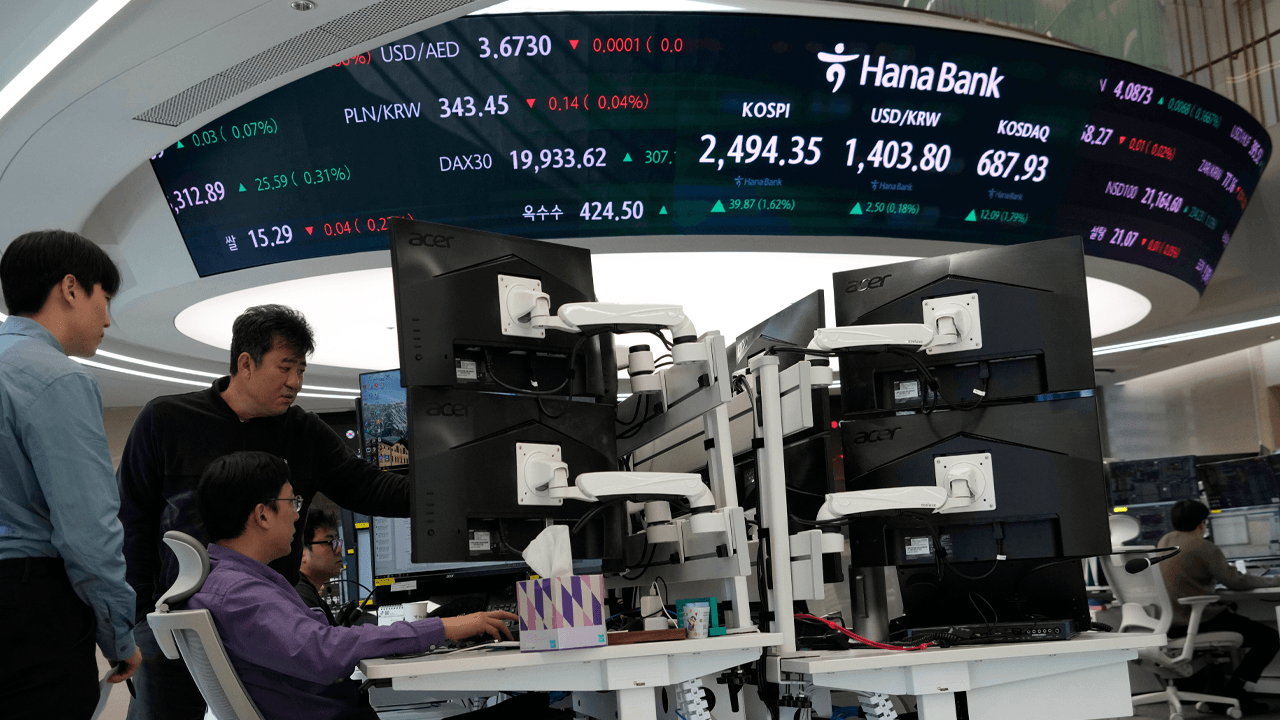

Could Central Banks Embrace Bitcoin as a Reserve Asset?

Central bankers spend their careers worrying about risks that most investors ignore. In 2024, they bought a record 1,045 tons of gold as insurance against globally swelling sovereign debt loads and growing geopolitical fractures.Those same issues might even be leading a few outliers to consider another hedge asset: Bitcoin (CRYPTO: BTC).What sounded foolish a decade ago now ticks three boxes every reserve manager studies -- specifically, the asset's limited supply, its round-the-clock liquidity, and its (partial) insulation from certain geopolitical risks. If gold hoards are a vote of no-confidence in fiat currencies, central banks holding a sliver of Bitcoin would be a vote of no-confidence in the entire monetary status quo. Let's see why they're more likely to be casting that vote right now than ever before.Continue reading

Central bankers spend their careers worrying about risks that most investors ignore. In 2024, they bought a record 1,045 tons of gold as insurance against globally swelling sovereign debt loads and growing geopolitical fractures.

Those same issues might even be leading a few outliers to consider another hedge asset: Bitcoin (CRYPTO: BTC).

What sounded foolish a decade ago now ticks three boxes every reserve manager studies -- specifically, the asset's limited supply, its round-the-clock liquidity, and its (partial) insulation from certain geopolitical risks. If gold hoards are a vote of no-confidence in fiat currencies, central banks holding a sliver of Bitcoin would be a vote of no-confidence in the entire monetary status quo. Let's see why they're more likely to be casting that vote right now than ever before.

![The Largest Communities on Reddit [Infographic]](https://imgproxy.divecdn.com/vfTS-YsC_ZrqM6F4tAXJgV6qj3gCHSsf2dvHufDbrrQ/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9sYXJnZXN0X3JlZGRpdF9jb21tdW5pdGllczIucG5n.webp)