After Nearly Dumping His Entire Portfolio and Buying Puts on Nvidia, Did Famed Investor Michael Burry Just Pull Off Another "Big Short?" It Certainly Looks That Way.

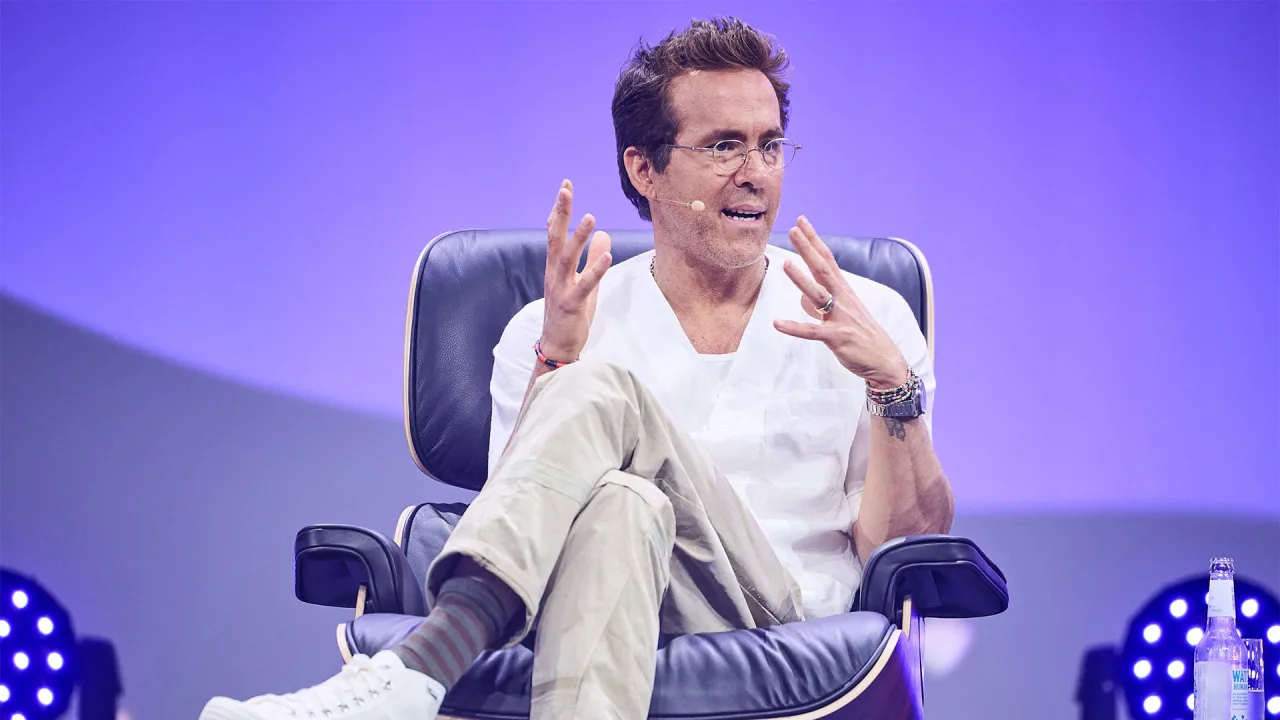

If you've seen the movie The Big Short, which is based on the novel by Michael Lewis and features acclaimed actors Steve Carrell, Christian Bale, Ryan Gosling, and Jeremy Strong, then you probably know who Michael Burry is. The former Stanford neurology resident rose to prominence while posting stock ideas online during the early days of the internet.His ideas were so good that he eventually left the medical field to launch his own fund. Prior to the Great Recession, Burry correctly bet against the housing market, making hundreds of millions in profits for his fund, Scion Capital. Now, Burry runs another fund called Scion Asset Management, which happened to sell nearly all of its stocks in the first quarter, while also buying put options. Did Burry just pull off another "big short" trade? It certainly looks that way.Burry never runs too large of a portfolio, typically holding about a dozen stocks, plus or minus a few. In the first quarter, he sold nearly all of his holdings. He had been quite bullish on China, owning large Chinese stocks like Alibaba, Baidu, JD.Com, and PDD Holdings. But after selling these stocks, he also purchased put options on these names. Put options are similar to call options but in the opposite direction, essentially betting that a stock price will decline. Burry also purchased put options on Nvidia.Continue reading

If you've seen the movie The Big Short, which is based on the novel by Michael Lewis and features acclaimed actors Steve Carrell, Christian Bale, Ryan Gosling, and Jeremy Strong, then you probably know who Michael Burry is. The former Stanford neurology resident rose to prominence while posting stock ideas online during the early days of the internet.

His ideas were so good that he eventually left the medical field to launch his own fund. Prior to the Great Recession, Burry correctly bet against the housing market, making hundreds of millions in profits for his fund, Scion Capital. Now, Burry runs another fund called Scion Asset Management, which happened to sell nearly all of its stocks in the first quarter, while also buying put options. Did Burry just pull off another "big short" trade? It certainly looks that way.

Burry never runs too large of a portfolio, typically holding about a dozen stocks, plus or minus a few. In the first quarter, he sold nearly all of his holdings. He had been quite bullish on China, owning large Chinese stocks like Alibaba, Baidu, JD.Com, and PDD Holdings. But after selling these stocks, he also purchased put options on these names. Put options are similar to call options but in the opposite direction, essentially betting that a stock price will decline. Burry also purchased put options on Nvidia.

.png)