More Evidence That Ram Is Working On Smaller Pickup Emerges

Despite being the dedicated truck brand for Stellantis, Ram effectively only sells one full-size pickup in a myriad of flavors and configurations and the ProMaster van. Meanwhile, its rivals have correctly identified that there was a large hole in the North American market that could only be plugged with small, affordable trucks — leaving Ram to play catch up.

Despite being the dedicated truck brand for Stellantis, Ram effectively only sells one full-size pickup in a myriad of flavors and configurations and the ProMaster van. Meanwhile, its rivals have correctly identified that there was a large hole in the North American market that could only be plugged with small, affordable trucks — leaving Ram to play catch up.

Ram hasn't had a modestly sized pickup since ending production of the Dakota (top of the page) in 2010. But we’ve been hearing for years that the company was believed to be in the process of providing an answer to the Ford Ranger, Toyota Tacoma, and Chevrolet Colorado. Rumors have also been circulating that Ram has been working on a response to the successful Ford Maverick. But things have been relatively quiet since Stellantis took over, at least until the last couple of weeks.

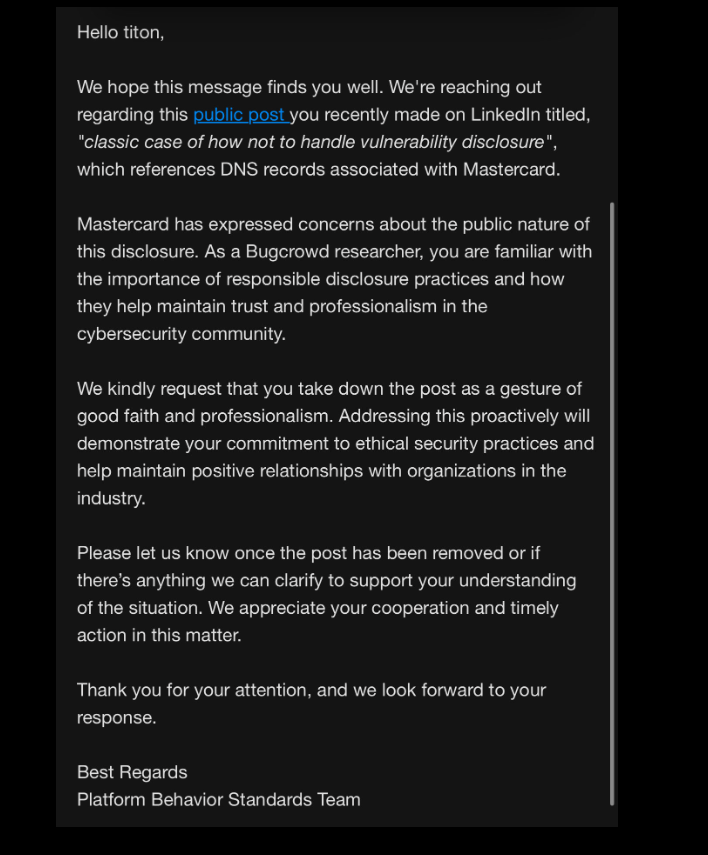

During the Detroit Auto Show, Ram CEO Tim Kuniskis dropped some incredibly direct hints to Road & Track that something is being worked on behind the scenes.

“I think we can grow more in our sub-$55,000 price point, because I used to have [the Ram Classic] and I don’t have that [truck] anymore,” Kuniskis explained. “I'm doing some interesting stuff down there with Tradesmans and Warlocks and stuff like that, but I need to do more there. I need a mid-size truck for sure."

"We’re a truck brand and we don’t have a compact, we don’t have a mid-size. Kinda disingenuous to call me a truck brand, isn’t it?” the CEO continued. "So yeah, I need that. I want that, I need that. I’m not telling you that I am going to have it in six months, but I desperately want it, and there is a market for it.”

From Road & Track:

The recently-unretired executive was quick to point to the success that competitive brands have had in the mid-size and compact truck segments, which only continues to grow in the United States. Those represent a massive number of potential conquest customers for Stellantis, if it can solidify its position.

“If I look at Toyota, they’re doing over 200,000 Tacomas a year. Ford’s doing close to 200,000 between the Maverick and the Ranger,” said Kuniskis. “GM’s doing around 140,000 between GMC and Chevy. There’s a clear, obvious market there that I want to go after. That’s just plus business to [Ram dealers] since they haven’t had that since Dakota.”

While nobody has officially confirmed that the automaker is developing something smaller than the 1500, the reality of the situation is that the company is already building them for other markets.

In Mexico, customers disinclined to purchase a full-size pickup have the option of selecting from two smaller models. The Ram 1200 (above) is a midsize that was previously based on the Mitsubishi Triton and currently exists as a rebadged Peugeot Landtrek or Fiat Titano.

Meanwhile, the pint-sized Ram 700 (below) is based on the subcompact Fiat Strada. It does a modest amount of business in Mexico and has seen increasing sales volumes. But the real success story is how well it has performed in Brazil — where the Strada can reliably expect to sell over 100,000 units annually.

Either truck could be repurposed for our market to compete in their respective segments and that seems like the likely play for Stellantis. However, the company has had mixed success in regard to this in the past. Despite being a relatively enjoyable vehicle to drive, the Dodge Hornet (AKA Alfa Romeo Tonale) hasn’t done much business for the company and is being heavily discounted in an effort to get customers interested.

That said, badge-engineering is pretty commonplace within the industry and has been for years. Sadly, even the objectively good examples have sometimes struggled with success. For example, the Pontiac Vibe was just a General Motors-Toyota NUMMI collaboration building an Americanized Corolla/Matrix in the early 2000s. But it never saw the same volumes as the original and ended up flying under the radar for the kind of shoppers that would have appreciated it. Around the same time, GM was also selling Holden performance vehicles in North America (e.g. Chevrolet SS and Pontiac GTO) that enthusiasts agreed were phenomenal. But they didn’t stay in production for very long.

The assumption is that badge-engineered vehicles (even those coming from within the same parent company) dilutes the image of a brand. Rather than building a vehicle of their own for a specific type of customer, they’re repurposing a vehicle from elsewhere. But there’s so many global market vehicles and brand consolidation in the present era, not to mention platform/component sharing and competitor collaboration, that it seems sort of silly for people to care when there’s a possibility of ending up with a better product for less money.

Kuniskis suggested that Ram needs to first focus on maintaining production of in-demand 1500 examples, specifically RHO (below) and Tungsten models. But hinted that a smaller pickup could become Ram’s priority once sport-truck allocations had been dealt with — noting that the dealerships were being pretty vocal about what they wanted to see from the company.

“That’s on us, we gotta fix it,” stated Kuniskis. “So at a base level, at an absolute step one, I gotta get back to the volume that they were at, because they’re set up for that volume. Quite frankly, we’re set up for that volume. So we gotta get back to that volume.”

As awesome as the Ram RHO is at bombing over hills and catching some air, America’s preference for modern full-size pickups seems like it could be waning. Luxury and sport trucks carrying high price tags remain popular. But some customers seeking workhorse vehicles are turning away, as larger pickups become more expensive to purchase and difficult to maintain. There’s a clear appetite for models that are easy to service and come with lower MSRPs.

But Stellantis no longer offers the older-generation Ram Classic (below) and has likewise failed to offer something that can compete with the smaller pickups of its core rivals. Practically everyone that matters is already selling midsize and compact pickups — save for Ram, which is supposed to be Stellantis’ dedicated truck brand.

Kuniskis is obviously aware of this and has historically had a handle on what the American market needs. The real question is whether or not Stellantis is willing to facilitate what’s required to make Ram competitive in regard to the smaller pickup segments it’s presently leaving for the competition. Considering how late the brand will be to offer something up, relative to its rivals, the resulting Ram product(s) will either need to trade on superior value or be so well designed that they’re effectively just better than what’s being offered elsewhere.

[Images: Stellantis]

Become a TTAC insider. Get the latest news, features, TTAC takes, and everything else that gets to the truth about cars first by subscribing to our newsletter.

What's Your Reaction?

.jpg?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)